Taming Your Dragon – Solving the Challenges Faced by Today’s CFOs

** This article is adapted from Leading: The Modern Chief Financial Officer in Times of Constant Change, a FInEx Talk presentation Steve made at the Finance Innovation and Excellence Summit. **

As the grandfather of 4 young boys I hear a lot about Dragons. When my stories first introduce these fire breathing beasts our grandsons share a lot of skepticism. But as the stories unravel and they learn more about the Dragons they find ways to befriend them ….and almost every tale ends with the dragon flying them wherever they want to go.

Taming dragons is a lot like taming the Challenges Modern CFOs are facing in These Times of Constant Change.

Lets explore that some more.

Here are some of the dragons CFOs are facing today. Rampant inflation, supply chain woes, rising interest rates and labor shortages are all breathing fire at our businesses. And those are just some of the macroeconomic headwinds. ESG topics present a great opportunity to display leadership, but the plethora of compliance and reporting responsibilities are adding to the workload. On top of this, our discipline is going digital at an accelerating pace. While this is creating efficiencies and bridging our historical reporting role to an additional role of creating prescriptive insights – the learning curve is massive and the workload immense.

This revolution is impacting people & our technology in ways that are hard to predict. So, a wrong move or taking too much time to move is perilous. Similar to facing a fire breathing dragon.

Let’s take inflation as our first example. This summer inflation in the United States1 rose to 40-year highs while wages grew at their fastest pace in 25 years. Wage and price increases are putting pressure on both SG&A costs and gross margins. Solutions to these negative forces include the tough choice to raise prices or make further investments in technology to automate manual processes.

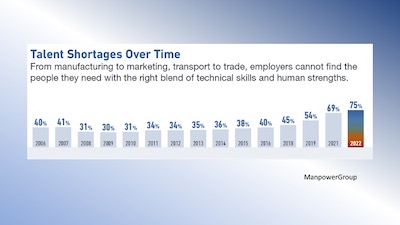

What about a shortage of Labor? A recent study by Manpower of over 40,000 companies showed that 75% of them report they have a talent shortage, the highest % in the 16 years the survey has been taken.

A CNN report in mid August highlighted the dilemma small and medium sized businesses are facing. The labor shortage is reducing their capacity while inflation is driving up costs. Companies are being forced to shut their doors.

Various reports cite this shortage to be costing our economy a minimum of $ 1 trillion US dollars annually.

Environmental, Social and Governance, or ESG, topics require great corporate leadership but they are also creating a new set of compliance and reporting standards that must be adhered to. Last November the International Sustainable Standards Board2 was created. At least 3 other ESG standard setting bodies include the Global Reporting Initiative, the Task Force on Climate-related Financial Disclosures , and the Sustainable Accounting Standards Board, a mouthful of new acronyms, a library full of new rules and a department full of new reporting requirements.

How can the CFO be successful tackling these challenges at a time when the expectation for finance is faster, better and cheaper while many trends in the economy are working against us?

Here are 4 solutions to help us tame our finance dragons

First, Build your finance infrastructure on a strong foundation

Before launching your transformation initiative in the face of pressure to be Faster, Better and Cheaper it is critical your foundation is sturdy enough to handle the weight of the dragon.

For most CFO s the foundation is held up by the four pillars of Accounting, Finance, Treasury and Leadership.

Here are four short questions to help you test how solid your foundation is:

For the Accounting Pillar: Are leaders outside your Accounting Department using or, better yet, depending on, the management reports your team prepares ?

For the Finance Pillar: Are big decisions made within the company supported by analysis from your finance team?

For the Treasury Pillar: Is your team consulted before customer or vendor payment terms are changed?

For the Leadership Pillar: Are you or your senior finance officer a key influencer on corporate Strategy?

If “Yes” doesn’t easily come to mind as a response to each of these questions, you have some foundational work to do. Sign up here to receive your free copy of CFO.University’s The Four Pillars of CFO Success!

Build your foundation to bear the Weight of the Dragon

Second, We must adjust our mindset from being a Chief Cost Officer to being a Chief Value Officer.

As the Chief Cost Officer we are comfortable with our teams analysis of SG&A costs and their expertise in understanding and explaining our cost of sales. But in today’s environment a singular focus on cost management will only lead to disgruntled suppliers and a disenfranchised employee group.

The primary focus of the Chief Value Officer lies in pricing and revenue growth. By being included in the pricing conversation finance chiefs close the loop on any mystery in our gross margin structure. Tackling the revenue growth question draws on our core competency of capital allocation. Where is our next dollar of capital best invested – in growing our current product portfolio, developing new products, investing in new geographies or to creating greater efficiencies.

By moving your mindset from Chief Cost Officer to the Chief Value Officer you’ll grow from a Dragon slayer to a Dragon tamer.

Third, Train and hire talent for Design - we are used to hiring for skills. But financial skills are just the ante. Today we need to be hiring for attributes. Attributes like curiosity, empathy, a craving to improve, interdependence, follow through, flexibility, teamwork, and sharing - are qualities our teams must possess for success.

We need the talent that can tame a dragon.

Over the past few months I have had the pleasure of coaching 15 very talented finance leaders. These professionals display a hunger for new ideas. Ideas on a large scale that cover, Strategy, Creating Influence, Building Teams and Innovation. They came into the course with the accounting and finance skills they need… now they are searching for the attributes that will help them become effective leaders.

It’s unlikely your current team has all the attributes you need the tame your dragon. The standards of performance and attributes you set for the team today are what you will be building on, or putting up with, in the future. As a leader of people, you are responsible for their growth and development – as an executive it’s your obligation to create the resource plan, including the skills required of your talent, that will advance the company’s strategic objectives. Not addressing any shortcomings today will ensure the dragon is your enemy tomorrow.

Tame you dragon by understanding, and then addressing today’s training and hiring needs.

And fourth, we need to invest in technology as an enabler to our designs. Using technology we can harness the dragon and use its energy to not only become Faster, Better and Cheaper but to answer important questions that previously went unasked, find opportunities we didn’t know existed and make choices with data driven decision making.

In the Design of Business, author Roger Martin outlines a 3-step journey in the learning process. Martin claims in phase 1 we are in the mysterious or the unknowing stage…as we learn we move into phase 2 the heuristic phase – where seat of the pants or experiential decision-making rules, where knowledge is hard to transfer and silos easy to erect – causing one of the world’s oldest problems - miscommunication. The final phase in the journey is the algorithmic phase. In this phase information flows freely and seamlessly between individuals and departments to create knowledge. This is the ultimate goal of digital transformation.

It seems ironic that we are going to use our most modern technology to tame one of the world’s oldest beasts

So don’t despair or shudder when you consider all that is front you. Your challenge is formidable but the rewards for great performance will be plenty.

So,

ONE. Build a strong foundation,

TWO. Become the Chief Value Officer,

THREE. Develop and hire talent with your design for the future in mind, and

FOUR. Embrace technology as an enabler to your design

Tame your Finance dragon.

The Finance Innovation and Excellence Summit platform is still open. Grab your Premium Access Pass here and enter the VIP Boardroom, a virtual ‘Candyland’ for finance leaders focused on professional growth.

——————————————————————————————————————————————————————————

1 U.S. Bureau of Labor Statistics https://tradingeconomics.com/united-states/inflation-cpi

2 IFRS Foundation https://www.ifrs.org/groups/international-sustainability-standards-board/

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!