Top Priorities for Senior Financial Officers

Over the past few weeks we polled senior financial officers to determine their current top three priorities.

We offered these choices:

- Raising capital to grow our business

- Leveraging analytics for business success

- Leading the modern finance function

- Creating a Finance Business Partner culture

- Coaching that will help me manage the critical success factors of my job

- Building a solid foundation (accounting, finance, treasury and leadership)

- Attracting, retaining and developing talent

- Selecting the right technology to improve our business

- Write In: If yours is missing add it (them) here

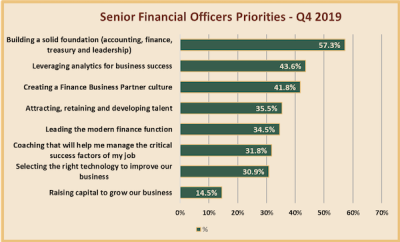

The following graph indicates the % of senior financial offices who selected each option as one of their top three priorities.

The top two results highlight the struggle CFOs are facing today. Juggling the need to build solid footings for our platforms with the need to be leading edge in analytics to deliver more insight to our stakeholders. This struggle is being played out in CFO suites globally. How much do we invest in maintaining a solid infrastructure vs. how much do we invest in technologies that will help our business thrive? Finding the right balance in our businesses today is an important ingredient to CFO success.

Even with the right balance, if we are only able to procure 50% of the funds required for investment, we are destined to fail reaching our goals. To be effective the mindset of CFOs must shift from cost control and frugality to resource enabling and value added.

Do you have the right narrative to procure enough resources in the form of people and capital to run an effective operation?

Rounding out the top three priorities is one of today’s hottest topics in the CFO Suite, Finance Business Partnering1 , which was included in 40% of the respondents top three choices. An FBP mindset must only be embraced by the finance team, it must also be adopted by the commercial partners they serve. It’s encouraging to see the importance finance executives are putting on this paradigm shift.

In what we interpret as good news from the survey, not many CFOs view a capital raise as a top priority. We assume this means most company’s have enough capital readily available to meet their operating and growth needs. One challenge CFOs may face is capturing their fair share of the capex/opex for their human resource and technology needs. As noted above this will take homework and excellent communication skills. Read this four part series, For Chief Financial Officers: A Practical Approach to Using Artificial Intelligence, to get started.

Talent management and being coached fell in the mid range of priorities, scoring barely 60% of the top priority votes.

Talent management is a surprising result to us but could be explained by advancements being made in automating transactional work, creating capacity that is being directed to higher value finance activities. We worry for CFOs who are leading cost cutting initiatives while using their team as an example. There is a high risk this will leave them void of the talent and skills needed to be competitive in the future.

Formal coaching is gaining popularity but is still a relatively new technique for CFO development. As the cost of a CFO failure grows we expect this professional development method to grow in abundance and priority.

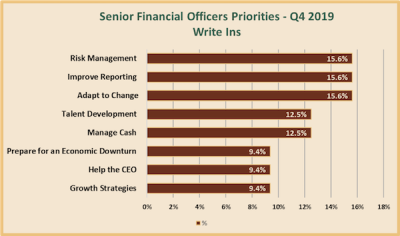

Survey participants were given the option to “write in” their priorities that were missing from the list. 15% of participants included at least one priority that wasn’t listed.

We grouped the “write in” priorities into the following themes:

- Improve Reporting

- Manage through Brexit

- Commercial focus

- Manage Cash

- Help the CEO

- Risk Management

- Prepare for an Economic Downturn

The following graph indicates the % of senior financial offices who wrote in these themes as a top priority.

The main write in concern revolved around managing through a downturn in the economy. In a similar vein managing company cash was noted as critical by a number of senior financial officers. Here are couple of examples of what these executives had to say.

Respondent 1

“My priorities are “Optimizing profits in potential downturn or recession. My two biggest Customers announced this week that sales will decrease by 20% starting now, October; one through March the other said through entire 2020.”

“When there is a slowdown in economic growth, it automatically affects supply chain and current account, which results in market sluggishness. Indeed, this situation is not easy to deal with, but in order to continue to maintain a positive current account, there is still a market gap that can be utilized to obtain a little income, so that the business continues without the need to reduce resources.

Respondent 2

So my main priorities at this time are:

- Get an alternative source of income for operational financing and business continuity.

- Maintaining the company’s liquidity capability remains solid.”

—————————————————————————————————————————————————————————————————————————————————————

Risk management, an expanding role for CFOs, is also on the minds of these executives. The days of risk management being primarily an annual project with insurance brokers has grown to include the year around management of uninsurable risks and even margin management. Boards of Directors are more commonly depending, if not demanding, the senior financial officer wear the hat of Chief Risk Officer when that role doesn’t exist formally within the company.

Assisting the CEO, implementing growth strategies, improvements in reporting, managing Brexit and creating a commercial focus were all other “write in” priorities.

Thank you for investing your valuable time sharing your priorities with our community and I encourage you to benchmark the summary results with your priorities to help guide you on your path to CFO and business success.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!