Finding and Maximizing the True Value of Intellectual Property.

Welcome to CFO.University’s transcript of T.J. Romano’s CFO Ed Talk. (You can find the video version here Finding and Maximizing the True Value of Intellectual Property)

TJ’s lessons focus on how finance leaders can find and maximize the value of your company’s Intellectual Property.

Enjoy, Learn, Engage.

__________________________________________________________________________________

Intellectual property: Is it important? Does it have value?

Well today, we are going to address those issues. Finding and maximizing the true value of intellectual property and how you as financial professionals fit into this universe.

Let’s start with a history lesson. The US Constitution, Article One, Section Eight, Clause Eight, grants Congress the power to promote the arts and useful science by granting to inventors and artists a right to the exclusive use of their inventions and creations. The Founding Fathers of the United States found intellectual property to be an important way to promote progress.

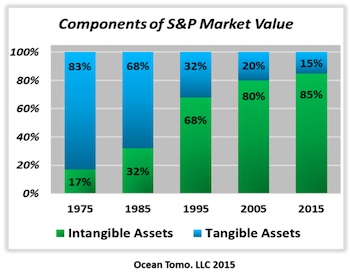

So how does that translate today? Well, if we look at the value of S&P 500 companies starting in 1975 under 20% of the value was intangible assets. Today, over 85% of the value of an S&P 500 company is intangible assets. One of those is intellectual property. Here in the real world, not just in the constitutional universe, intellectual property has a high value.

First, I will give some education, a quick primer, on the different areas of intellectual property – IP. Second, I will share some ways to create IP value, ways that you can inhibit or destroy IP value, prudent techniques for promoting intellectual property value in your company and in closing provide some creative ways financial professionals fit into this process. There are four primary areas of intellectual property; Trademarks, Patents, Copyrights, Trade Secrets.

A trademark is simply the mechanism for identifying the source of one product from another. The function of a trademark is to distinguish products between competitors.

Patents have a pretty broad range of protection. The two primary types of patents are design patents, which primarily protect the ornamental look of a product and then what we call utility patents. A utility patent protects the function and features of a product. They can protect the way a product works, manufacturing processes, business methods, the way a product is used, chemical composition, etc.

Copyrights protect works of creation. Typically and traditionally copyrights were used to protect works of authorship; books, artistic creations, dance techniques. In more recent history, copyrights have also been used to protect software code or the layout of software on your computer. For businesses, you would see copyright protection for the layout of your website or your marketing materials.

Trade Secrets are anything that has commercial value when reasonable steps are taken to protect it and keep it secret. Examples of trade secrets are customer lists, manufacturing techniques, processes and computer software code.

For perspective, I will show you an example; the Banana Bike. The Banana Bike can demonstrate all four areas of intellectual property.

- The name “Banana Bike” can be protected with a Trademark right, that’s the way that consumers are going to find this bike and identify it.

- The overall design of the bike (overlapping bananas) will be protected with a Design Patent.

- The way the bananas overlap creates an aerodynamic advantage for that design. We could get a Utility Patent to protect this aerodynamic advantage.

- The chemical composition of the paint also makes the bike more aerodynamic. We can protect the composition of the paint as a Trade Secret.

- Finally, the Banana Bike comes with a product manual. The product manual can be protected with a copyright. There are many other ways this product could be protected. This gives you a general idea.

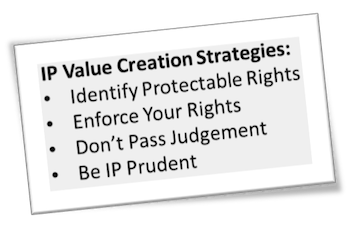

There are four strategy concepts that I’d like to communicate. First is the concept of IP value creation; basically increasing the size of the pie.

The primary way to do that is to protect your intellectual property. In many countries, including the United States, intellectual property rights can be registered with the government. Patents and trademarks can be registered with the US Patent and Trademark Office. Copyrights can be registered with the US Copyright Office. It’s not always necessary to obtain a registration to have rights but there are a number of advantages to doing so.

Another way to create value is to have your organization internally audit your rights.

- Do you have a way to determine what rights are being created by others in your company?

- Do you have a central mechanism to do that?

These are important questions to answer for value creation. Common missteps companies make include:

- Not protecting their rights or even identifying the rights that are protectable.

- Not enforcing a right you have obtained to keep others from using your ideas and technology.

IP prudence is the fourth strategy. There are certain techniques you can employ to make sure that you’re doing a decent job of IP prudence. Having a point person is very critical. Having the right point person is even more critical. Protecting IP means you have to deal with your attorneys. Intellectual property is an area that’s very rigorous and intensive and may require daily interaction with attorneys. If C level employees push the responsibility for interacting with the attorneys too far downstream - to those who are not completely in touch with the overall strategy - something gets lost. Communication is key. You have to have the right point person. If you rely on outside attorneys, communicate with them. Keep them a part of the process. Treat them like a partner. You will get better results.

Other aspects of IP prudency include clearance searching. What is clearance searching? Well, that means you’re doing something about evaluating your competitor’s rights and making sure that when you enter a marketplace, you’re not stepping on a competitor’s right. It’s very cavalier to go into a new market without doing any sort of due diligence. It’s a penny-wise, pound-foolish strategy because due diligence and clearance are forms of IP insurance. Give yourself the ability to ensure that you’re not stepping on another’s rights and stepping into an infringement issue. It will save time and money.

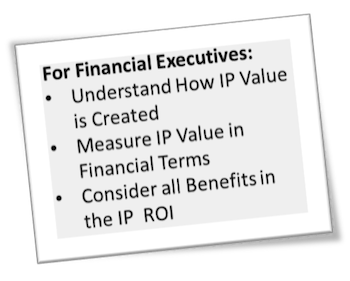

Another area where financial professionals are experts is Return on Investment. You know how to gauge return on investment, an important mechanism in determining how to protect your IP. Looking at ROI as a simply equation could be folly. For example, if I pay X to get a patent and Y to own a trademark, demanding the product this IP covers must earn more the X+Y is an oversimplification. Patents and intellectual property rights, when looked at more expansively have other features that must be considered in valuation. Having a large portfolio of intellectual property rights may discourage a competitor from entering your market. It may also discourage someone from suing you because they’re scared of your rights and also may impress investors. All of this should be captured as part of your ROI.

Now, that said, will I provide you with the ROI? No. That’s your area of expertise, not mine. So, what I say is get out there, get to it and take us to the next level in creating value from our IP.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!