What Area of the Income Statement is Top of Mind for You in 2022?

To help CFOs and other finance leaders navigate the uncertainty and change looming in the economy we started our series, What is Top of Mind for You. Part I dealt with the balance sheet, What Area of The Balance Sheet Is Top of Mind For You?

In Part II, we tackle the income statement.

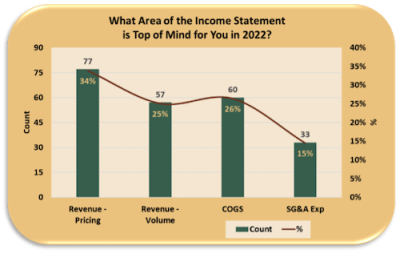

We polled finance leaders with this question “What area of the Income Statement is top of mind for you in 2022?”

We gave these four choices. Each is followed by an example of what that choice could look like.

1. Revenue – Pricing : Trying to recover increased material costs…. or earn value for extra features we are adding to our products.

2. Revenue - Volume: As volumes grow, economies of scale really improves our bottom line….. or new markets are blue oceans for our products.

3. Cost of Sales: Supply chain and raw material costs have been out of control – we need to find a way to tame ours.

4. Selling General and Administrative Expenses: Our margin environment is stable so SG&A Expenses are the best area to work on to improve the P&L… or our growth engine is running so fast we need to add resources faster than a speeding bullet.

Clearly the above the margin activities won out with only 15% of finance leaders indicating SG&A expenses are top of mind in 2022.

Pricing stood out with just over 1/3 of respondents indicating that is top of mind for them. Sales volume improvements and cost of goods sold were basically tied, each garnering about 1 of every 4 votes.

We set out to study why using our network and tapping into the work of other firms who closely serve the Chief Financial Officer.

1. PWC: CFO and finance leaders: Latest findings from PwC’s Pulse Survey1

Although hiring and retention were first on the list of CFO’s keys to growth, Reevaluating pricing strategies (e.g., exploring price increases to make up for rising input costs) was next on the list. The survey reports,

“ Pricing to protect profitability: Accelerated by a triple threat of Omicron, rising inflation and changing customer demand, (59% of the CFOs PWC surveyed indicate) finding ways to quickly address the converging economics of these challenges has become more urgent for CFOs looking to maintain or increase margin.

To keep …costs low, 48% of CFOs plan to double down on digital transformation efforts to deliver both near-term operating efficiencies and long-term top-line growth. Forty-three percent plan to invest in automation as a strategic solution to offset increased labor costs and supply chain constraints,”

2. Strategic Finance Magazine: What’s Keeping CFOs Up At Night In 2022?2

The first CFO concern on the Strategic Finance’s list is supply disruptions. This implies a focus on controlling cost of goods and managing pricing carefully in an environment where volume could drop due to supply constraints. This triple financial whammy of the disruption – higher costs, lower volume with no extra value for price increases - we are seeing in the supply chain is a significant challenge to overcome.

An interesting observation on supply chain issues is how important it is to stay in front of the wave. Top tier FP&A professionals working with the business units can make the future less murky. Employee retention and talent development were the 2nd and 3rd listed CFO concerns in SF’s article. CFOs need more of them and pay more to retain the ones they have, which from our CFO.University poll’s perspective would check the SG&A box.

3. CFO: 2022 Outlook: CFOs’ 4 realms of risk3

“The inflation rate may ultimately ease in 2022, but higher materials and transportation costs will linger as companies’ product prices catch up with operating expenses.

Some manufacturers have faced enormous inflation in costs of goods sold and other areas. Conagra Brands suffered gross inflation as high as 16%. The good news is companies including Conagra and 3M are increasing prices without much pushback. Others are lowering or eliminating discounts or introducing smaller product sizes.”

One way to fight higher cost of goods is to charge higher prices. This may not be sustainable over time, but never in my business career have I seen customers more willing to accept a price increase without receiving substantial value in return. If your product is good and your service admirable – join the 34% group in CFO.University’s poll and raise your prices.

4. Gartner: These Are the Top CFO Priorities for 20224

Gartner, granted a firm that makes it bread and butter testing and opining on technology, puts a digital spin on our question about the top concerns of the income statement. They have long term view, which gives them more clout related to the balance sheet than the 2022 income statement. But we thought their ideas worthy to help us remember we are in a long game that doesn’t end in 7 months.

Gartner’s advice is a reminder to continue investing in our future, not simply the here and now. Their focus is on digital autonomous finance operations and they highlight three initiatives:

- Budget/forecast for speed and relevance

- Build digital competencies

- Drive enterprise digital growth

5. FEI - Planning For 2022: Three Things Every CFO Should Prioritize Now5

The Financial Executives International ‘Three Things…” are heavily focused on below the margin activities and investment rather than generating current year returns.

- Top Talent Is Hard to Come By - And Harder to Keep!

- Continued C-Suite Collaboration

- Investing in Digital Transformation Strategies

So where does that leave us?

It wasn’t a big surprise to us to find limited content on how finance and the CFO can influence pricing or volume or, even the cost of sales. The purview of the traditional CFO has been on cost control and asset protection. What we find fascinating is that finance leaders working in the field are indicating their influence is shifting. SG&A costs are no longer the only section on the income statement where they are having an impact.

Price * Volume - COGS – SG&A – where is your strongest lever today? – increasing the plusses or reducing the minuses?

Read part III in our series, What Area of the Cash Flow Statement is Top of Mind for You in 2022?

Specific articles from our Contributors on this topic include:

- Pricing and the P&L – Gross Margin, Variable Costs and Overhead by Mark Stiving, Ph.D. Chief Pricing Officer Impact Pricing LLC

- The Role of Finance in Pricing by Paul Barnhurst Founder of @The FP&A Guy

- CFOs can be a Change Agent to the Supply Chain by CFO.University and Jason Lockard of BlueGrace Logistics

- It is Possible to do More with Less and Create Greater Value by Archetype Consulting

1 CFO and finance leaders: Latest findings from PwC’s Pulse Survey

2 What’s Keeping CFOs Up At Night In 2022?

3 2022 Outlook: CFOs’ 4 realms of risk

4 These Are the Top CFO Priorities for 2022

5 Planning For 2022: Three Things Every CFO Should Prioritize Now

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!