How to Acquire Strategic Insights from Variance Analysis

As economic turbulence rumbles through our businesses more resources are being committed to understanding how to mitigate, or even, take advantage of this chaos. Recognizing what is changing on the horizon has multiple components. One of those key components is the variance analysis.

Dwight D. Eisenhower is given credit for the quote, “...plans are worthless; planning is everything.” As our access to data grows and our capacity to mine data increases planning can become even more valuable if we invest in the resources necessary to effectively analyze our performance to plan.

A well developed plan will identify what areas of the business your variance analysis should focus on.

For example, if you are a SasS company SaaS metrics should rise to the top: if you are a manufacturer of luxury goods, quality and customer intimacy will dominate your measures; while Chartered Accountant and CPA firms are likely to measure the efficiency of attestations and the growth of their advisory practice. Capital intensive companies will focus on asset utilization and leverage.

The Plan must include measurable results in areas identified as strategic to the business. If you have strategic measures that can’t be calculated with your current systems and processes, don’t ignore the measure! Fix your processes and systems or, minimally, develop a proxy for these measure while you fix your processes and systems.

The best measures are simple and broad with enough supporting detail to find the ‘why’ behind significant variances. A significant variance is any variance worth looking into with the resources available.

This definition leads us to an important area of discussion. What resources in terms of talent and technology are you willing to commit toward discovering and analyzing variances? It’s unlikely you will find great insights having your accounts payable intern as your committed resource to variance analysis, while having a flock of data scientists on staff may be overkill. Ultimately, the cost of your variance analysis must be less than the value created from business changes resulting from the analysis. Being intentional in this investment is a critical step in making it sustainable.

Mindset: Moving past the Mysterious, through the Heuristic to the Algorithmic

Moving the mindset of your business from heuristic decision making to algorithmic decision making is a key step in growing your variance analysis capabilities. Accepting analytics as an aid to your analysis seems logical enough, but emotion and logic often create a stalemate. To get over this hurdle agree that heuristics, or experience-based decisions, are a hypothesis that must be supported by facts for all key decisions. Roger Martin’s, The Design of Business, is an excellent resource to learn more on this topic.

Here are some statements or questions to identify you are in still in the heuristic mode of decision making.

- This worked for us in the past.

- We have been doing it this way since ________ (fill in the blank)

- Why change a good thing?

- That sounds hard to get.

- Our customers (vendors, employees, investors, etc) will never accept it.

For more on how data and analytics can support your business visit Dr. Prashanth Southekal’s library on CFO.University, Prashanth’s Library or type in “data and analytics” in the Keywords bar and click submit here, Find it on CFO.University

The bounty from your plan can only be harvested when three activities occur;

- The plan is executed

- Deviations are measured

- Positive variances are magnified, while negative variances are mitigated

This rest of this article will focus on making the 2nd activity above, Deviations are measured, strategic.

Deviations from plans reveal themselves in financial variances. These variances are very important. They help us recognize the financial impact of where we are overperforming and underperforming.

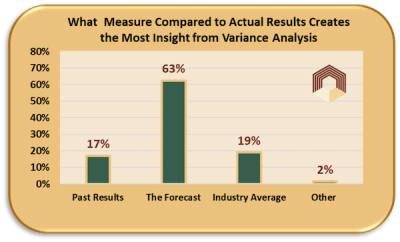

Footnote: I am not a big fan of spending time on comparing last year’s anything to this year’s results. It might be convenient, but last year’s results are like reading yesterday’s newspaper. The only time it makes sense to use last year in your variance analysis is if don’t have confidence in your Plan (or better yet your most current forecast. For clarity on the difference between a forecast and plan read this article by Steve Morlidge, How do forecasts differ from budgets?). Even then, you would be better off spending time improving your Plan than on analyzing last year’s to current year’s variances. The graph below summarizes the results of a survey we recently took. We asked, What Type of Variance Analysis Creates the Most Potential for Insights? Find more details, including comments from the finance leaders taking the poll here, Forecasts Win.

(Commentators include: Syed Nadeem , Dave Tinio, Stephan Carnesi, Murray Macmillan , BJ Weil , Neenyi Ayirebi-Acquah, G.M. Mano, G Mahesh Nair )

Here are examples of key account variances that will help make your variance analysis more strategic.

Income Statement:

- Revenue (both unit pricing and volumes)

- Product or service costs (both unit costing and volumes)

- Overheads

Cash Flow Statement

- Operations

- Investments

- Financing

Balance Sheet

- Cash

- Working Capital

- Equity

Financial variance analysis reveals the canary in the coal mine. The next step to insight requires identifying and analyzing what is causing the variances.

As noted in the opening paragraphs, a good planning process will identify the drivers of all significant financial statement accounts. If your planning process is weak, there is a good chance much of your variance analysis is comparing actuals to last year’s results. Stop that! Use the time you save to develop a driver focused Plan.

The next step is where strategic variance analysis enters the picture. Innovation and creativity must replace the linear thinking that has been used up to this point. The challenge most executives confront at this stage; getting comfortable only having a variance analysis done on drivers of accounts with significant variations. No more standard reporting that includes 90% of insignificant variances. Be laser focused on garnering insights on important changes. This requires a number of changes at most companies:

· A mindset shift from the urgent to the important. The team must accept that your variance report will longer include every aspect of the business. It will include only those variances identified as being significantly deviating from the plan. Here is a piece with some tips on how to stay focused on the important, 9 Tips to Keep You Operating at a Strategic Level.

· The team must agree on what thresholds are critical. A simple method would be a reporting hurdle that includes both variance as a % difference and variance of some minimum cash amount.

For example, assume the team agreed to + or - 5% deviation and $350k minimum as the variance reporting threshold. If our Plan for revenue for the period is $10 million and the actual revenue is 10.4m no variance analysis would be reported (less than 5%). If revenue was $10.6m (over 5%) a driver-based analysis would be included.

· For each variance analysis reported an action plan should be created to address the shortcomings or leverage the unexpected windfall.

o What is the scope of the opportunity?

o Who and what department(s) is (are) in charge of the action plan?

o What is the time frame for the action to be realized?

o What resources are required to create the innovation or change required?

· Incorporate the expected results from your actions and make sure they are included in your forecast…so variances and insights can be derived on them as well.

Follow the above steps to make your Variance Analysis exercise strategic.

To get started take a look at our Simple Price, Gross Margin and Unit Variance Analysis. This tool summarizes three key variables that drive earnings for most companies; Price, Gross Margin and Units Sold. The output, tables and graphs, will assist you in driving discussion around these key business drivers with your Executive Team.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!