Sales Analysis: The Incredible Opportunity For Finance!

Depending upon what¹ study² you look at, most of the time in sales is spent on administrative tasks instead of being in front of customers. Given that the lifeblood of a company is the revenue that our customers so generously give to us, it is amazing that so little time is spent on helping sales teams be more efficient at generating revenue. CRMs are fantastic tools for gathering data on customer and sales rep activities, but organizations spend very little time in providing meaningful information to help sales teams be more effective.

Finance teams share part of the blame for not helping this key function perform better. Month end reports that highlight high level price and volume variances rarely help sales teams be more effective. Financial reporting focuses on the big gains and losses when we know the detail is where we improve profitability. And believe it or not, sales reps don’t like to spend time with non value adding accountants and their spreadsheets! To be an effective finance business partner, put yourself in the shoes of a salesperson: their most limited resource is time and to be efficient they need to have as much productive time with clients as possible. We have tons of data about our customers and if we analyze and present it correctly it can be a very powerful tool to increase profitable sales.

My biggest recommendation to truly get to know your client in sales: go on sales calls. Don’t walk away from the meetings simply saying “I’m glad I’m an accountant, I could never do that.” Appreciate the level of preparation it takes to get in front of the client, have a productive meeting, and to ask for the business. It will shape what data you provide the sales team, how often, and in what format to help maximize their time.

A good sales rep knows that stories are far more effective at selling than using facts alone. So, to get you to “buy” what I am offering in in terms of analytics, the rest of the article is written as a story. Step away from your life as an accountant! You are, through the magic of the internet, being magically transformed in to a sales rep. Here is your first meeting with your sales manager.

“Know Your Client”

Welcome to the sales team, kid. These are some of the cold hard facts of being on our sales team:

- Over 90% of customer contact is done over the phone

- About 80% of sales are closed after five follow ups with the customer

- Retaining an existing customer is at least five times less expensive than finding a new customer

- An average company loses between 10 and 30 percent of their customers every year

- Referrals are 4 to 5 times more efficient in generating new sales than cold calling

- In some industries 5% conversion rate is awesome…or put another way, 95% of client responses will be “no”

- A new sales rep takes about a year to become productive

- An effective sales rep will want to find ways to add value to their customers…or someone else will!

You’ve heard it from people who aren’t in sales…”we just need to sell more.” If they only knew that we do want to sell more, but we don’t know how we can be more productive to do that!

Anyway, let’s go through all the things you need to know as a sales rep here:

Sales Issue #1 – “They Stopped Buying From Us!”

Not sure if you heard yet, but Atomic Company stopped ordering from us. While we are blaming production for this one, the reality is customers rarely stop buying completely unless something catastrophic happens (which I have some stories). Most often, customers slowly start buying less from us because they start experiencing problems with quality, service, or delivery. Unfortunately, customers rarely tell us their problems as they either want to avoid conflict or the problem doesn’t seem serious enough until another sales rep shows up and takes the business from us.

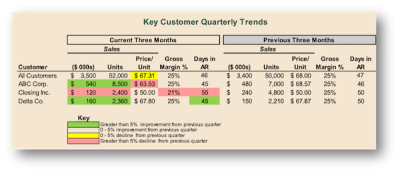

We know as customers if we have our concerns resolved, we will be incredibly loyal to our sales rep. If we don’t’ have the tools to identify our customers concerns how can we help them get solved? Today we are going to go through a report that our finance team prepared for us on customers that may need a check in. Everything is the average of the last three months versus the previous three months – short enough for us to action but doesn’t make us jump from month to month changes. The report has some simple data:

- Sales dollars

- Sales volume (units)

- Average realized price

- Average margin

- Average days in accounts receivable

See how they made it easy for us to use by:

- Condensing the list of customers we should focus on instead of an overwhelming list of our 100 plus customers.

- Using highlighting numbers in red/yellow/green to help us know which customers to call.

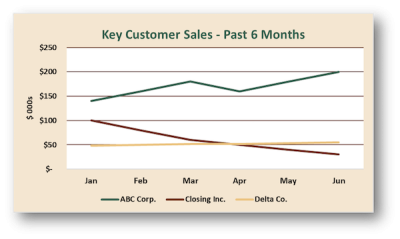

They made it easy for us to understand the sales trends by using graphs for each customer. You might run into “Pat” once in awhile. Pat is the type of salesperson who trusts their gut more than numbers. We need to have our “Pats” spend more time with our finance business partners to help them learn the how developing insight from data and information play an important role in value creation at our company.

Go through your list and call the customers to check in. Our finance person is going to sit down with us next month go through the next list. And while you are out there, ask if they need anything new from us or can refer us to another client!

Sales Issue #2 – “They Aren’t Paying Their Bills!”

Here is the list of customers who haven’t paid their bills. We get calls from the accounts receivable department when customers are sixty days overdue. I hate these calls as it seems like firefighting – doesn’t everyone pay their bills eventually? He said something about ROIC and DSO, but I don’t get that accounting lingo – why can’t the finance department just tell us why it is so important that everyone pay by 30 days?

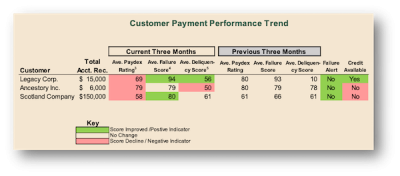

While the accounts receivable department is going to call every customer on day 25 to make sure the client has the invoice, will pay on day 30, or tell us if they have any issues with the invoice, the report above lets us see if our customers are taking longer to pay than they have in the past. As we know, in sales we are looking for ways to help clients or a reason to talk to them about their business. If our customer is taking longer to pay, get out to see them and talk about it. You may find out they have a big job coming that they have been too busy to deal with their bills in a timely manner. Or if they are having problems, you can work on solutions that allow them to continue to buy from us while reducing our credit exposure to them. This type of win-win serves our customer and protects our company!

Sales Issue #3 – “That Sales Rep”

Here is the list of sales reps that aren’t hitting their targets. The reps at the bottom are nervous…and I feel for the one who has only been here for six months. How can anyone expect them to hit those sales targets six months in? Don’t they know how long a sales cycle is? Or how many times you hear “no” before you get to a “yes”?

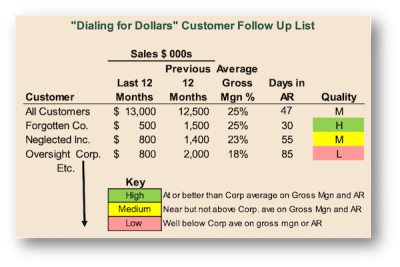

I really like the new person in finance – see what they did? They prepared this report on your accounts and summarized it as follows:

- What each account bought over the last year

- What they bought the year before

- Highlighted where they went down (or disappeared) from the prior year!

This gives you as a new sales rep a prioritized list of customers with helpful information you use for calling them right out of the gate. Our existing sales reps like this as well – it clearly shows which customer to call and start a conversation about why volume has gone down and start the discussion on how we can help them out of this slump.

For me as the sales manager, they turned this data in to sales by rep; comparing the average of the last three months versus the three months before. It lets me see which rep is moving in the right/wrong direction. Last month it led me to talk to a rep who was thinking about leaving the company because they weren’t getting the support they needed. We addressed that and they landed a couple new accounts. Just like customers, sometimes people don’t talk about stuff until it is too late… Practice identifying issues and bringing them to the table early. You’ll be surprised how many problems are really just great opportunities.

Okay, those are examples of some key reports finance provides for us on the day to day stuff. Here is what we talk about where the business really happens – selling!

Sell More to Existing Customers

If you’re a seasoned sales rep you know the easiest sale to make is to sell more to a happy customer! I don’t know about you, but I can only keep track of a limited amount of things at once. I know when I was selling, I could only keep track of ten or twenty customers in my head…and help me if I had one of those clients who needed to hear from me everyday.

So, here is the list of the hundred customers that are assigned to you, I call this “Dialing For Dollars.” What I really like is they tell me I should focus on customers who are #20 through #40 on the list. They are good margin customers and they pay on time. Based on our past experience these type of customers yield the best results from this follow up program. They are highlighted in green iunder Quality in the table below. I honestly had forgotten to call many of these good customers to see if I could sell them more. This isn’t the only company I have worked at where we focused on the top tier customers, neglecting our good customers!

Referrals Are Golden

We know in sales that we love it when a customer tells a potential customer “you should buy from them” – it is almost a slam dunk. But finding the time to ask for a referral or which customer to ask for the referral is tough to do with so many other things going on.

Our finance team can help make referrals too. Here is an example. Our finance person was saying our Dun and Bradstreet subscription allow us to tag customers by a variety of filters – business unit, geography, customer type, etc. Now, the finance department is looking at customers who may be tagged across different divisions and bringing that to the sales team so they can present a more fulsome offer to the customer. Customers love a deal…and we are smart enough to know how to package it so both of us are better off!

The finance department added in the change in D&B scores from three months ago to see if it has gone up or down – if the scores have gone up it means the company is doing better. If it is going down, others are starting to see problems and it allows our sales team to talk to customer or change the way in which we are selling to them. Pretty powerful stuff!

Here is how the finance team summarizes our Customers Payment Performance Trend

Anyway, enough talk for one day – take a look at the CRM and start calling!

Making Finance Repeat Business

Welcome back from your life as a sales rep! I trust you have found more than a couple places where some well summarized analytics along with some insight can help support improved sales performance.

Finance business partners can leverage the life in sales to make their analytics more effective. Here are some sales tips you can apply to finance business partner role:

- Over 90% of customer contact is done over the phone: spend time in person with your sales rep. Don’t just email the report.

- About 80% of sales are closed after five follow ups with the customer: don’t meet once and then assume they will read the report. Markets and customers are always changing and so should your analysis and approach.

- An effective sales rep will want to find ways to add value to their customers: sales is a critical function. Finance needs to spend time here.

- A new sales rep takes about a year to become productive. This is new data and processes. It will take time and persistence from you to get them to leverage the information. Make the reports simple!

- Anticipate your customer: a good sales person knows what a customer will need and find a solution for it. A good business partner will be able to look at the be more forward looking

Spend time with the sales team and look to add value – they are at the front line of the company. Who knows, you might find that you enjoy selling…and being equipped with some “Moneyball” techniques may make you exceptional at it….

—————————————————————————————————————————————————————————————————————

¹Sales Reps Spend Less Than 36% of their time selling, https://www.forbes.com/sites/kenkrogue/2018/01/10/why-sales-reps-spend-less-than-36-of-time-selling-and-less-than-18-in-crm/#5e1125a9b998

²The Reason Why Sales Reps Spend Little Time Selling and in the CRM, https://www.nasp.com/article/560AB49F-B0B1/the-reasons-why-sales-reps-spend-little-time-selling-and-in-crm.html

³The PAYDEX Score is a dollar-weighted indicator intended to reflect a business’s past payment performance. Companies receive a score between 1 and 100, where a higher number represents a greater likelihood that a business will pay its debts on time

⁴The Failure Score is a relative measure of risk, whereby 1 represents organisations that have the highest probability of failure and 100 the lowest.

⁵The Delinquency Score is a relative measure of risk, whereby 1 represents organisations that have the highest probability of delinquency and 100 the lowest.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!