Innovation Can’t Thrive Without These Fundamentals in Place

Sound business systems precede innovation.

Before innovation can be a catalyst to business growth a culture of strong business practices must exist.

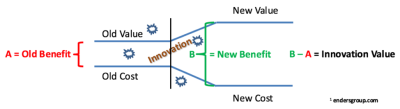

Innovation, the process by which an idea or invention is translated into a good or service, is a critical component of growth in many businesses. It occurs when the value of the product or service increases while the cost to deliver the product or service decreases; or when the new value/cost ratio¹ is significantly higher than the old ratio. The value of innovation is illustrated with the following diagram:

The diagram starts with the old state, Old Value – Old Cost = Old Benefit (A). True innovation tackles both the value of the product or service and the cost to deliver it; creating a step function improvement in the new state, New Value – New Cost = New Benefit (B). The Innovation Value = New Benefit (B) – Old Benefit (A)

Innovation relies on creativity, exploration and freedom. Frequently these characteristics are regarded as the opposite of discipline, control and structured process. However, without strong business practices that recognize and nurture advancement in good business systems, innovative practices are unlikely to make it to commercialization.How can a company know if its business systems are ready for innovative growth plans?

“Innovation readiness” can be measured by assessing six key areas in a business. These areas indicate how prepared the business is to evaluate and absorb new activities.

The building blocks for growth-oriented business are:

1. Transactional Processing: This area is the foundation of any business. It is a mundane skill but especially important in preventing delays and errors as new activities are launched. Transactional processing that is timely, error free and cost effective will free up resources to focus on innovation.The fundamentals of transaction processing include; purchasing, payments, inventory, order processing, invoicing and collections. These processes should be efficient, scalable and flexible enough to handle new business.

2. Information Reporting: Understanding financial positions and other key business metrics allows companies to:

- recognize innovation successes and failures quickly;

- improve the innovation cycle time;

- implement successful innovations faster;

- be confident and agile regarding innovation decisions

Developing and communicating key performance measures, such as return on investment or minimum margin requirements will help guide the innovation process toward products or projects that drive sustainable growth. Albrecht Enders, a principal at endersgroup, a local innovation consulting company, uses the value/cost ratio in the early phase of projects to measure the potential of an innovation. Without solid financial systems in place to provide key metrics like the value/cost ratio Enders says companies can waste valuable resources on projects that have poor return potential.

3. Governance: Clear boundaries around authorities and responsibilities add to the innovation foundation by focusing resources, preventing duplication and eliminating gaps that exist in the governance framework. Too often these “controls” are viewed as inhibiting innovation when good governance actually streamlines the process of resource allocation, eliminates uncertainty around approvals and hastens the decision to move forward with or terminate work on an innovation.

4. Planning and Forecasting: Having strong tools and skill sets in planning is critical to “feeding innovation”. Leveraging the cross functional groups required to develop, launch and support new products requires a well thought out roadmap and navigation system. The process of looking ahead, or forecasting, to help create the future is a necessary step in the evolution of innovation.Good forecasting models that incorporate an innovation strategy provide context to the R&D and other upfront investments required for successful innovation. When these expenditures are viewed as unrecoverable costs and not as investments in the future, spending on innovation is reduced. This action can lead a business to “death by a thousand cuts”.

5. Financing: Successful innovations often require capital to move into the commercial stage of development. Financing can come in many forms and from many sources. Funds can be internally generated, originated from bank loans or, for higher risk projects, equity issuance. Depending upon the project, vendor or customer financing may also be available. The key here is to have a funding origination plan that fits each innovation being developed.

6. Growth Capabilities: Scalable systems and processes combined with access to human resources capable of commercializing an innovation is the last building block of the innovation foundation. For example, Enders noted that distribution systems and order processing are critical to launching new products successfully. Without scalability or available people new growth derived from innovation can overwhelm a well functioning operation and sabotage the success of the product.

Conducting an assessment of these areas, either internally or by an independent firm, will help identify where a company’s innovation foundation needs strengthening. Often a small but targeted investment can significantly strengthen a foundational area and put a company in a much better position to capture the benefits of its innovation strategy. An added benefit to these investments is the overall operation will improve in performance whether or not an innovation is adopted.

Learn more about innovating, A Process for Disrupting Your Own Business Model

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!