What Area of the Cash Flow Statement is Top of Mind for You in 2022?

To help CFOs and other finance leaders navigate the uncertainty and change looming in the economy we started our series, What is Top of Mind for You?

Part I dealt with the balance sheet, What Area of The Balance Sheet Is Top of Mind For You?

Part II dealt with the Income Statement What Area of the Income Statement is Top of Mind for You in 2022?

In Part III, we tackle the Cash Flow Statement.

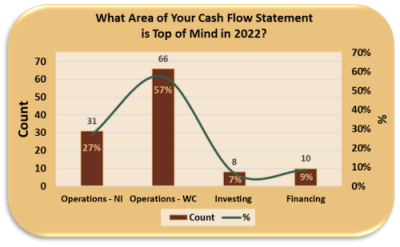

We polled finance leaders with this question “What area of the Cash Flow Statement is top of mind for you in 2022?”

We gave these four choices. Each is followed by an example of what that choice could look like.

1. Operations – Net Income: Increasing cash by growing operating income is driving our business today.

2. Operations – Working Capital: Supply chain woes and inflation have stressed our working capital – it is top of mind for us right now.

3. Investing: We have significant growth opportunities in front of us that require long term investment. This long-range thinking is on the top of our list.

4. Financing: New Opportunities and/or cash pressure created by the economy are making funding a top priority for our team.

Cash flow from operations dominated what is top of mind in 2022 for finance leaders garnering 84% of the votes. 2/3 of those ballots were cast for generating cash from working capital rather than earnings.

This suggests supply chain issues and inflation are dominating discussions taking place in the CFO suite.

While operations took the front seat in the cash flow cab, investment opportunities and financing took the back seat, neither garnering double digit support. Combined they make up only 16% of the ballots cast.

As we did in Parts I and II, we then set out to study and better understand this result by researching some recent reports on the topic.

1. Positive Vision: Where Manufacturing CFOs Are Focusing in 20221

“…managing working capital (vs. investments), cash flow, and rising inventory costs rank as the second-highest CFO priority for 2022 [following Increased Investing in eCommerce and Digital Transformation Initiatives]. With logistical pressures currently placed upon supply chains, companies have noted that the costs of inventory management have the potential to rise to unforeseeable levels. Managing cash flow and margins remains a key objective for US finance leaders, based on our survey in 2020, 2021, and now into 2022.”

2. IR Magazine: Inflation and pandemic batter CFO confidence for 20222

“ (of) the three biggest challenges facing their business, ‘supply chain’ jumped 16 percentage points from 24 percent to 40 percent, taking over from cyber-security risks as CFOs’ top concern. Asked which business issue was most likely to have a negative impact on their business, CFOs cite ‘supply chain’ and ‘workforce shortages’, both at 53 percent.

Asked what actions they plan to manage disruption, the majority (52 percent) of CFOs say they intend to step up their focus on cash flow and liquidity to bolster cash reserves.”

3. Cashflow Keeping Business Leaders Awake at Night As SMEs ‘Extremely Concerned’ For 2022 3 (United Kingdom specific)

In a poll of Small and Medium Size Enterprises “The majority (52%) said they were worried about their company’s cashflow over the next 12 months, with 23% saying it is keeping them awake at night.

Over a third (37%) of UK SMEs responding to the survey also reported that they currently have less than £50,000 in the bank.”

On the bright side, part of these cash flow concerns appear to be the result of expected growth as “SMEs answering the survey struck a positive tone about turnover and profit.

“Over half (56%) grew their turnover over the past 12 months – 27% of which was by 10% or more, while 46% increased their profits.

Additionally, 60% of businesses expect to grow their turnover in 2022 – with 15% aiming for growth of 20% or more”

4. McKinsey & Company: In conversation: The New CFO Mandate4

“ Jørn Jensen: I imagine that inventory management will be critically important in the next eight to 12 months given all the supply chain disruptions we see globally. Volume and demand forecasting, scenario management, inventory management, and risk management are all very important in the shorter term.”

Our conclusions at CFO.University include:

1. Many companies are still fighting through supply chain issues that are putting stress on cash flow, either by stretching out the whole cash conversion cycle or simply delaying sales.

The solution CFOs are implementing to fight through this situation is to apply resources to the improve their cash conversion cycle and meet their sales targets.

2. The rapid rise in prices has created a working capital crunch as requirements from higher input prices and wages are increasing working capital needs by 10-25% even before the supply chain issues are factored in.

The solution CFOs are implementing is ditto above. However, this dynamic is also creating margin compression that must be addressed. Never in this millennium has product pricing and communicating our products value proposition to our customers been more important. Many customers understand the short term need for price increases in today’s environment.

Eventually, however, they will expect value from these increases.

Finance leaders should not get complacent when they see customers accepting price increases. As customers work to protect their margin, they will be searching for alternatives to the solutions current suppliers are providing.

3. Interest rate increases and the expected future rate increases will not only create higher working capital carrying costs, but they will also stress the borrowing capacity and coverage ratios frequently found in revolving debt agreements.

Borrowing capacity on a per unit basis will shrink while the costs to carry per unit will rise.

Fighting the triple threat of inflation, higher interest rates and supply chain issue requires rethinking all aspects of our cash conversion cycles, working capital financing concurrent with rethinking pricing and staying on top of margins.

At no time since the mid-1980s has it been more important for finance, supply chain, marketing and pricing professionals to be linked at the hip. For profitable growth to occur in this environment companies will need:

- The capability to fund their working capital needs for both unit volume increases and to cover inflationary pressure.

- Understand how margins are being impacted by changes in supply costs and wage pressure in nearly real time. (If you are selling one-year fixed price contracts, are you also procuring your inputs with one-year fixed contracts?)

We are keenly interested in learning how you are dealing with these challenges. If you can, please share your solutions with us and we’ll give you credit for helping us all get better.

Operations dominate focus on Cash Flow

Here are some specific articles and tools from our Contributors on this topic that will help you manage:

- For Operations – Net Income

Simple Price, Gross Margin and Unit Variance Analysis, an article from CFO.University to help you analyze the impact of Pricing, Gross Margin and Units Sold. It includes a tool to help you manage these components.

- For Operations – Working Capital

Cash Velocity Calculator, a cash conversion cycle analysis tool. Simple, yet powerful

Where’s the cash? Check your Balance Sheet, an article by John Lafferty to help explain ‘where is the cash?” that also includes a helpful tool.

- Investment

Capital Investment Analysis and Request Form, an article with a tool to help you evaluate different options to invest in.

- Financing

CFO Success Series: Treasury Part 1- Capital Planning, this material focuses on creating an optimum funding plan for your business.

To catch up on what is top of mind on all three financial statements read our reports on the:

- Balance Sheet, What Area of The Balance Sheet Is Top of Mind For You In 2022?

- Income Statement, What Area of the Income Statement is Top of Mind for You in 2022?

1. Positive Vision: Where Manufacturing CFOs Are Focusing in 2022

2. IR Magazine: Inflation and pandemic batter CFO confidence for 2022

3. Financial IT Cashflow Keeping Business Leaders Awake at Night As SMEs ‘Extremely Concerned’ For 2022

4. McKinsey & Company: In conversation: The New CFO Mandate

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!