What Type of Variance Analysis Creates the Most Potential for Insights

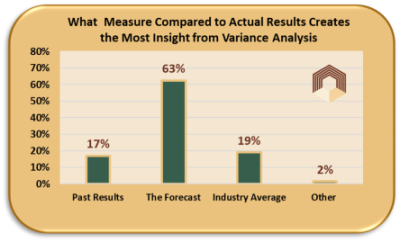

We polled our community to determine, What Type of Variance Analysis Creates the Most Potential for Insight. The results weren’t surprising but the margin was. By a wide margin, 63% to less than 20% for other choices, comparing Actuals to Forecasts came out on top as variance analysis most likely to reveal insights.

This begs the questions;

1. Are you doing a forecast?

2. Is your variance analysis being used as a strategic tool to improve the business and future forecast?

If you are searching for a resource to kick off or improve your forecasting capabilities,

- Look into our course, Financial Forecasting I: Introduction to Forecasting

- See this edition of our Future of Finance Leadership newsletter to turn your variance analysis into a strategic weapon, How to Acquire Strategic Insights from Variance Analysis

=========================================================================================================================

The comments of finance leaders who participated in the poll are more helpful than the poll itself. Here they are:

The comments of finance leaders who participated in the poll are more helpful than the poll itself. Here they are:Syed Nadeem: “Actual to Forecast. Forecast is the most realistic tool, developed based on current economic situation. if the variance is high from Actual to Forecast, it is alarming.”

Dave Tinio: ” Forecasts reflect the organization’s view on the future. How close they end up being to reality is a measure of the effectiveness and accuracy of its analysis. If forecasting is reasonably accurate, it can be an effective tool in driving plans and budgets, which ultimately drive results.”

Stephan Carnesi: “Actual to forecast for sure. Good forecast should already have taken care of PY (past year) trends. To be clear a good manager you should look at both along with budget which is interestingly enough not part of the options ” …. ( Like Stephan, if you noticed we used forecast rather than budget in the 2nd response to our poll, there is a good chance you will enjoy this article by Dr Steve Morlidge, How Do Forecasts Differ From Budgets? )

Murray Macmillan: “All of the above”.

BJ Weil: “Murray Macmillan, Yes! This one! While the forecast should incorporate the past results, it also includes inherent bias. Variances should triangulate actuals to past results to forecasts to identify actual trends vs expected.”

Neenyi Ayirebi-Acquah: “Actuals to forecast because it’s readily available within the organization. If used well it exposes biases and wrong assumptions. But aa much as possible, it will be good to compare actuals to industry averages when that information becomes available. Very useful.”

G.M. Manoj: “Actuals to Forecast since the rolling forecasts are based on current trends and any material variance to that would be due to prominent unavoidable business condition which needs analyzing and adjusting our rolling forecast further to an evolved situation.”

G Mahesh Nair: “I would always stick to Actuals to Past Results if the comparison is MOM basis. Any variance in the this should call for an explanation or ring bells.”

Here is another resource to help you improve or kick off your forecasting process, so your business gets the most insightful variance analysis, Step up your FP&A game with rolling forecasts.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!