What Are Bankers Good for Anyhow?

Enjoy this series of shorts on Cash and Bankers from Jim.

Time is the most expensive and elusive capital that businesses have. Often it’s spent on the wrong things, or wasted on big things that could have been exploited sooner and cheaper. What all businesses need is a time accelerant—and all have just that available to them but few see it.

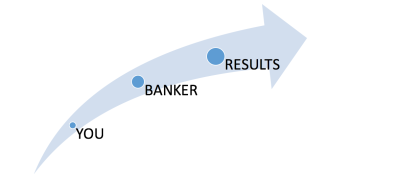

Think of your banker as a time accelerant that will help you ramp up your return on the time you invest in your business. Here’s the formula:

You x Time = Results

You x Banker x Time = Results²

Most CEOs I’ve known cite reasons like these to keep their banker at arm’s length:

• He’s only interested in whether I’ve violated the covenants.

• All he offers is rates and terms when I get a new loan.

• She’s just a salesperson, with little knowledge of how a business works.

And yes, some bankers are like that. But many are not and could happily provide services like these for FREE:

• A look farther down the road, to clarify whether the light at the end of the tunnel is the sun or a locomotive. Many business leaders are so consumed with the work of the day and the quarter that they miss problems or opportunities. The biggest ones usually are visible years ahead, for those with eyes to see. A good banker will see them.

• A financial sounding board to help clarify investment choices. Most investments include ongoing costs as well as benefits. A good banker will help you see the real risk, since he’s not as excited about the benefits as you may be. Surprisingly, what the banker sees may provide the encouragement to make the risky choices that will transform your business.

• A financial resource to find and evaluate the best sources of capital, regardless of where it comes from. Few mid-size businesses have in-house resource people who are current on capital markets and sources, since often their information is from the last salesperson who called about a leasing deal.

• An investment partner who can spot real growth opportunities that you may be missing. A common leadership error is to assume that growth must be from higher sales. Two common evils in sales growth are:

o Items or prices that don’t deliver value to both the business and the customer.

o Sales emphasis that ignores profit-building opportunities inside the business.

• Insight that connects your KPI (Key Performance Indicators) to your financials, spotting disconnects early. When KPI and financials aren’t moving in the same direction, it often indicates an opportunity or problem that you may not see as soon as you’d like. These insights are priceless.

• Valuable referrals to potential new customers complete with a positive story about your offerings, based upon a sophisticated understanding of your value proposition.

• Introductions to pre-screened high-value helpers, including accountants, attorneys, consultants, and financial planners who may fit your current needs better than your current advisory team. Just as kids’ needs change as they grow, businesses change over time, and their advisory needs change with them. Sometimes it’s hard to see that your loyal advisors are not quite keeping up.

• Assistance with mindfulness of your end game as you make leadership decisions. The “end game” is frequently a moving target, but it’s about who owns and leads the company after you. The usual suspects are employees, current executives, and outside investors. Decisions that you make about financial statement quality and non-business expenses can impact these outcomes in strikingly unexpected ways.

Look early and clearly at problems when they are small enough to be corrected. You go to the dermatologist to have pre-cancerous areas removed so you’ll avoid skin cancer. You pay the dermatologist. Why wouldn’t you use the banker for prevention like that—for free?

My favorite banker, now retired, gave me this advice: “Tell me the big chunks, good and bad. Do it in days, not weeks. Let me worry about the credit officer at the bank.” Twice she spotted problems before they were fully formed, and we fixed them easily and cheaply. Invaluable.

A simple label for a good banker: Seer of Surprises and Sounding Board for Success. If you don’t have a banker that brings this kind of help, get one. They’re out there.

Next up from Jim in this series on Cash and Bankers, The Three Rules of Cash Success.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!