The Roles of the CFO - Past, Present and Future

Expectations associated with many C-level executives are related to their functional responsibilities. For example, the Chief Information Officer (CIO) has direct authority and responsibility over the informational needs of the organization. Similar to the CIO, the Chief Technical Officer (CTO) oversees the technical aspects of the organization while the Chief Marketing Officer provides leadership regarding marketing efforts and the results that those efforts have in promoting the organization’s outputs – all having both authority and responsibility. However, the expectations associated with the Chief Financial Officer (CFO) may not all be directly associated with their functional responsibilities – in some areas, they may have responsibility but little, if any, authority.

Given the responsibilities of the CFO suite, their role can be described in terms of the timeframes that form their responsibilities, whereby…

- PAST –The CFO is ultimately responsible for reporting historical financial and operational performance. These responsibilities are a major fiduciary duty to the stakeholders such management, investors, analysts, and governmental reporting agencies.

- PRESENT – These responsibilities pertain to administering the day-to-day financial operations such as accounting, treasury, and adherence to regulatory requirements imposed by government and trade organizations.

Clearly, the first two timeframes are extremely important and perhaps represent the major responsibilities of the CFO. The last timeframe is the subject of this course and is emerging as one of the most important with regard to the future of the organization as well as the career trajectory for the CFO…

- FUTURE – The CFO is responsible for leadership and partnership along with other C-Level peers for the financial and operational well-being of the organization. The CFO has been specifically chartered with the responsibility for identifying, from a financial perspective, where the organization is performing well along with identifying areas where enhancements are required to meet financial and other organizational objectives. To carry out their responsibilities, their role includes supporting performance improvement efforts within the organization. This role is getting more attention these days due to more global competition, economic upturns (opportunities), and downturns (crisis management).

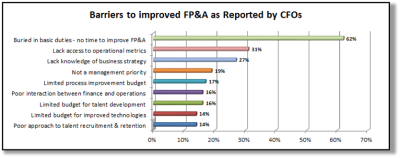

Oftentimes, the CFO’s responsibilities related to financial performance enhancements have been relegated to a Financial Planning & Analysis (FP&A) team or taken on personally. However, financial executives may neither have the expertise, tools, or the systems necessary to assess the value of what the organization does to create its products and services. A survey conducted by the American Productivity and Quality Center (APQC) – (Driscoll, M. & Kaigh, E.). Advanced Financial Planning and Analysis – A Look at the Building Blocks. APQC Financial Management Webinar) – polled a number of CFOs regarding the their most vexing issues and barriers related to improving the value contribution of FP&A to their organizations. The results of the survey are both surprising and stunning.

Used by Permission of the American Productivity and Quality Center

Breaking the “Law of Averages”

One of the first steps necessary by the CFO is to assess the financial well-being of the organization – which areas are doing well and which areas require intervention. The assessment often taken is the application of one of various cost-accounting systems designed to measure the cost and profitability of products and services.

Without accurate cost and profitability data, CFOs may come to false conclusions about financial and operational performance and the wrong conclusions often lead to the wrong solutions.

Conventional and even more advanced cost accounting systems rely on averages in their computations when distributing and/or allocating costs to products and services. By the very nature of averages, targets of such methods are either over- or under-costed. Using such cost-averaging systems can be compared to the following social situation many have experienced (Brown, 2016). When a group of people decide to “split the check” after dining, those who made less-expensive choices will be subsidizing, or covering, the cost of those whose who made more expensive selections. In business, organizations often apply overhead/indirect costs in a similar manner that “covers” some Lines of Business (LOBs) that are actually using more overhead resources than others.

Typically, such systems fall into the these three categories; Conventional Cost Accounting, Activity Based Cost Accounting and Time Driven Activity Based Costing. A general description and the shortcomings of these methods will be covered in following articles. In Activity Value Management (AVM) – A New Perspective on Costs and Performance Management you will be introduced to a new perspective on costs and performance management – Activity Value Management. In a Case Study and Applying AVM to Your Business you will find a study and the opportunity to apply AVM to your business, more AVM benefits and some conclusions.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!