CFO Tip for U.S. Finance Leaders: The R&D Tax Credit - A BIG HELP FOR SMALL BUSINESS!

Contributor Gerry Conroy explains how misconceptions about the R&D Tax Credit in the United States leads to many qualifying companies missing a significant opportunity to improve their bottom line.

HISTORY

In a temporary effort to boost the economy in 1981, the United States federal government passed the Research and Experimentation tax credit to reward businesses for investing in research. This credit is now referred to as the R&D tax credit.

CHANGING THE PATH

Recognizing the need to create jobs domestically and maintain global economic competitiveness, the U.S. Congress has extended the R&D tax credits more than a dozen times over subsequent years, making them permanent with the passage of the Protecting Americans from Tax Hikes Act (PATH) of 2015. In addition to becoming permanent, the PATH Act expanded R&D tax credit provisions to start-ups and small businesses.

The R&D tax credit is now available to any U.S. business that spends time and resources on new development, improvements, or technological advancements to improve upon its products or processes. The credit is available to American Businesses that have improved the performance, functionality, reliability, or quality of existing products or trade processes.

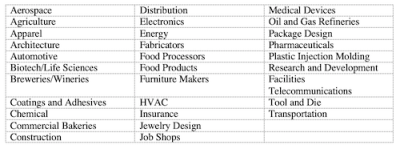

Industries ranging from software development, to aerospace, tech and biopharmaceuticals can take advantage. In fact, there are no restrictions on the type of industry that qualifies.

Qualification: A BROAD RANGE OF INDUSTRIES QUALIFY

Who Qualifies?

The R&D tax credit may apply to any taxpayer that incurs expenses for performing Qualified Research Activities (QRA) on U.S. soil. The credit is a percentage of qualified research expenses (QRE) above a base amount established by the IRS in a four-part test.

- Elimination of Uncertainty

- Process of Experimentation

- Technological in Nature

- Qualified Purpose

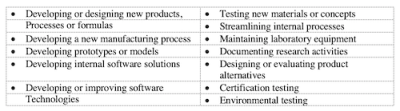

Qualified Research Activities (QRA)

Qualified Research Expenses (QRE)

- Wages paid to employees for qualified services (this includes amounts considered to be wages for federal income tax withholding purposes)

- Basic research payments made to qualified educational institutions and various scientific research organizations, allowable up to75% of the actual cost.

- Supplies (this may include any property not subject to depreciation) used and consumed in the R&D process

- Third party contract expenses for performing QRAs on behalf of the taxpayer, regardless of the success of the research, allowable up to 65% of the actual cost

The R&D Tax Credit: Big help for American businesses

About the Credit

As of January 1, 2016 Eligible Small Businesses (ESBs) can use the credit to offset the Alternative Minimum Tax (AMT). An ESB can be a non-publicly traded corporation, partnership, or sole proprietorship with annual revenues under $50 million for each of the three tax years prior to the current year and credits can be retroactively captured subject to special rules under section 448(c)(3).

Section 41 of the Internal Revenue Code lays out the rules and regulations surrounding the R&D tax credit.

Misconceptions surrounding the new regulations include:

- it is difficult to apply for the credits and

- the credits are restricted to a small group of industries.

This is not accurate. The goal of the PATH Act is to encourage innovation in business across the United States. The U.S. tax court and states alike have ruled in favor of business activities that make jobs faster and more efficient. This could be anybody from a contractor who uses new materials to create green, energy efficient improvements, to a manufacturer improving production processes through investment in new technology.

Incentive Analysis: Quick business qualification process

Industries that have qualified

How much are you entitled to?

One of the biggest reasons for small businesses not taking advantage of the R&D tax credit is self-censoring. Prior to the PATH Act, the traditional method of calculating and filing for the credit was a process that wasn’t worth the effort for small business owners and their tax advisors alike. New broadened terms and calculation methods, along with the ability to lookback 3 years and amend returns, make it less cumbersome and more beneficial for smaller companies to file for the R&D tax credit.

Studies show 95%1 of businesses are not applying for the incentives they deserve! Are you?

1 “Eight Myths That Keep Small Businesses from Claiming the R&D Tax Credit” Forbes 3/28/2013

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!