Conventional Absorption Cost Accounting

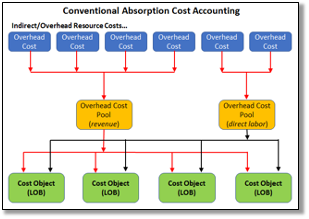

Having it roots in the 1800’s where factories made a single product and total operating costs were divided by total production volume to arrive at fully-burdened unit costs, conventional costing techniques assign indirect and/or overhead costs through the application of overhead rates. These rates are “allocated” to the outputs of the organization. The manner in which overhead costs are spread across the various Lines of Business (LOB) is to attach such costs to an operational metric associated with LOBs, such as direct labor cost, machine hours, number of employees, floor space, revenues, etc. Such costs are pooled, then the pools are then allocated to cost objects based on the amount of those metrics associated with each product and service.

However, as the number of LOBs expand, indirect and/or overhead costs grew and were “pooled” then allocated to the various LOBs based on those elaborate allocation methods. The fallacy of this approach is that non-direct costs are allocated to products and services irrespective if the various cost objects actually consume or utilize those costs. In essence, some cost objects, or LOBs, are subsidizing other LOBs simply because of the magnitude of the metric used.

The conventional cost-accounting systems developed in the late nineteenth century are still used today by at least 75% of businesses and it’s not unusual, especially in high-tech organizations, to see overhead and indirect costs represent more than 50% of total spending. Therefore, significant errors will be encountered if using conventional cost-accounting systems.

Limitations/shortcomings of conventional accounting systems.

The following represents the most significant issues related to absorption-type cost accounting:

- Based on faulty assumptions. It is highly dependent on accurate understanding of the consumption of overhead resources by individual lines of business. Conventional approaches assume that there is a linear relationship between the use of direct resources and overhead expenditures – the more direct labor or machine hours used, the greater the indirect costs. This assumption is the root cause of distortions as there is no cause-and-effect relationship between the consumption of direct resources and indirect spending.

- Inaccurate product/service costs. When overhead spending represents a significant portion of total expenditures, conventional systems unfairly “burden” products and services by allocating such costs on the basis of direct resource consumption. Also, service industries are most negatively impacted by such practices as the distinction between direct and indirect spending is often a blurred. Inaccurate cost of outputs will lead to poor, or uninformed, management decisions, pricing, product mix, profit projections and literally all management decisions that rely on an accurate understanding of costs.

- Under- and over-costing. Pooling, aggregation, then allocating average costs distorts product and service outcomes. By definition, the use of averages will over- and under-cost outputs. LOBs are assigned an average cost regardless of the actual overhead expenses required by each line of business. Under-costing may lead to lower pricing that reduces profitability while over-costing may contribute to higher pricing that sacrifice revenues.

- Lack of stakeholder input and engagement. The foundation for success is derived from the organization’s value proposition. Conventional cost accounting systems are numerically based and typically void of information necessary to determine value as perceived by customers and employees.

- Little help to service organizations. Unlike manufacturing, service organizations typically have not identified the factors necessary to assign overhead costs to their service offerings. Since services are “manufactured” at the time of delivery they often require different levels of resource investment depending on the needs of the customer. Kaplan and Cooper (Kaplan, R.S. & Cooper, R. (1998). Cost and Effect – Using Integrated Cost Systems to Drive Profitability and Performance. Harvard Business School Press. Boston, Massachusetts.) stated:

Service companies, lacking tangible products, have no financial reporting requirements at all for allocating indirect and support expenses to the services they produce or the customers they serve. Consequently, most service companies do not suffer from distorted cost numbers; they have no cost numbers at all since they do not measure the costs of producing their individual products, delivering their individual services, and serving their individual customers…nor do they know anything about the costs of the activities and processes they perform.

- ·Limited measurement of resource consumption. Traditional cost accounting systems are numerically based and results are expressed in terms of dollars. Such systems offer little information regarding other forms of resource consumption such as work hours and/or Full-Time-Equivalents (FTE). Such non-financial measures are useful for measuring and projecting staff requirements or computing the cost per FTE necessary to assess whether personnel resource compensation fits the requirements of the job.

In conclusion, conventional cost accounting systems are void of credible information necessary for informed management decisions regarding financial and operational performance.

Read about a solution Brian has developed to overcome the conventional cost accounting shortcomings noted above, Activity Value Management (AVM) – A New Perspective on Costs and Performance Management

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!