Grasping the Financial Situation

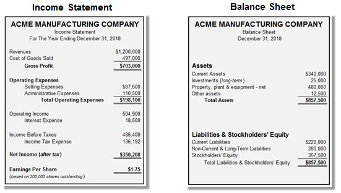

One of the first steps necessary by the CFO is to assess the financial well-being of the organization – which areas are doing well and which areas require intervention. Oftentimes, the first place to seek understanding of the financial well-being of the organization is to examine the organization’s financial statements.

GAAP accounting, supported by General Ledger systems, is designed to capture costs at the functional/department level and can be structured for P&L data at a granular level (e.g., office or branch), but that doesn’t deal with indirect/overhead costs, overlap/duplication, value creation, or activity fragmentation. Therefore GAAP accounting provides little, if any, managerial insights that can be used to identify improvement opportunities. To support improvement initiatives, more detailed managerial cost accounting systems are required.

Breaking the “Law of Averages”

Conventional and even more advanced cost accounting systems rely on averages in their computations when distributing and/or allocating costs to products and services. By the very nature of averages, targets of such methods are either over- or under-costed. Using such cost-averaging systems can be compared to the following social situation many have experienced (Brown, K. [2016], Increasing Profitability by Product: Manufacturing Business Improvement through Activity Value Management, www.EKSH.com, pg. 2.). When a group of people decide to “split the check” after dining, those who made less-expensive choices will be subsidizing, or covering, the cost of those whose who made more expensive selections. In business, organizations often apply overhead/indirect costs in a similar manner that “covers” some Lines of Business (LOBs) that are actually using more overhead resources than others.

Typically, such systems fall into the these three categories; Conventional Absorption Cost Accounting (ACA), Activity Based Cost Accounting (ABC), and Time Driven Activity Based Costing (TDABC). A general description and the shortcomings of these methods will be covered in the following 3 chapters. In chapter 7 you will be introduced to a new perspective on costs and performance management – Activity Value Management (AVM). The final 2 chapters include a case study, the opportunity to apply AVM to your business, more AVM benefits and some conclusions.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!