Cash Velocity Calculator

The Cash Velocity Calculator estimates how long it takes on average to convert a dollar paid for inventory into a dollar received on sales. Using some basic figures from your financial statements you’ll have a transparent view of where your working capital is invested and how improvements in terms or operations will impact cash. Use this tool to teach your executive team and staff about working capital and cash management.

This tool uses the beginning and ending balances for you working capital accounts to calculate an estimate for the average “days” outstanding. This includes the average number of days to collect accounts receivable, the average number of days materials stay in inventory and the average number of days we use to pay vendors (payables). Receivables and Inventory use cash while Payables are a source of cash.

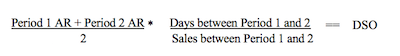

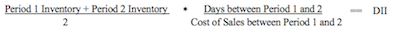

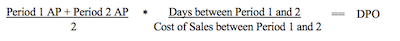

All the calculations in the Cash Velocity Calculator are done for you based on your inputs. Here are the formulas for those interested in digging in a little deeper.

Accounts Receivable: The days sales outstanding (DSO) calculation is:

Inventory: The days in inventory (DII) calculation is:

Accounts Payable: The days payables outstanding (DPO) calculation is:

We can improve our cash velocity through 1) reducing uses of cash by decreasing the days outstanding for our uses of cash, receivables and inventory or 2) increasing sources of cash by expanding the days outstanding payables.

Cash Velocity Days = DSO + DII – DPO

It may seem counterintuitive but the lower the cash velocity days the quicker sales are being converted to cash.

A nice feature of the Cash Velocity Calculator is it calculates the working capital changes you can expect from any percentage change you anticipate in your collection or payment terms or changes in production or logistics that will impact inventory.

The example on the Cash Velocity tab in the tool shows just how simple it is to get started and predict the result of meeting an improvement goal.

The article Can your business grow too fast? by Contributor Bryan Ducharme provides a cautionary note on managing working capital in a growing business. It offers an important lesson for companies with robust growth strategies.

Use the tool now!

Let us know how we can improve our tools to better serve you.

If you have any questions or stumble along the way, please reach out to us at CFO.University. You wouldn’t be here if you didn’t believe professional growth was critical to your success. We wouldn’t be here if we couldn’t help you accomplish that.

Tools

- Cash Velocity Calculator

The Cash Velocity Calculator estimates how long it takes on average to convert a dollar paid for inventory into a dollar received on sales.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!