The Case of the Mistaken Measures

Recently, a company asked for my help in solving a mystery. Their revenue was growing but their profitability had declined over the past couple of years and they couldn’t figure out why. They thought it might have to do with operations and supply chain, but they weren’t sure.

As I investigated, it soon became apparent that most of their key performance indicators (KPIs) were activity oriented. They measured output per hour, number of purchase orders received, number of lines shipped, number of orders processed, total headcount, etc. One day they received 100 purchase orders and the next day they received 120. Which is better?

When I started to ask questions about average order size, dollars shipped per labor dollar and other elements of economic value, they said, “That’s not the way we measure things.” And that’s why their profit was declining.

Another company engaged me to improve operations and to coach their operations team. As we reviewed their practices, I discovered that what they measured was mostly economic driven. Their accounting department created KPIs with a heavy cost perspective. They didn’t measure number of orders shipped, number received, or orders per day, which left them in the dark on whether things were getting busier, whether warehouses were properly staffed, or even whether they had the right number of warehouses in the right locations.

What could these two companies have done differently?

The Importance of Balance

Useful KPIs strike a balance between economic and activity measurements. Economic measures help drive profitability, while activity measures manage capacity. Both are key elements of the Executive Command Center, along with speed, cash flow, and agility. Because measurements drive behavior, only measuring things from one perspective means missed opportunities for improvement.

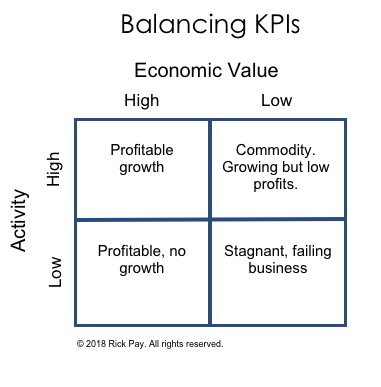

If you measure economic value but not activity, you may be profitable, but your growth will slow down due to lack of capacity. If you measure activity without economic value, your company will become a commodity, possibly growing with low profits. Measuring both economic value and activity drives profitability and growth. Measuring neither leaves you with a stagnant, dying business.

When to Measure What

Both companies measured monthly. While that makes sense for some measures, others should be produced weekly and some daily. For example, many of my clients run a daily flash report that includes dollars shipped per day, so they can tell if they’re ahead or behind forecast for the month, then take action to hit their target. Measuring daily also helps to plan for labor and any overtime that might be needed to reach monthly goals.

One company started producing the daily flash report and almost immediately improved customer service (shipped on time) and reduced overtime. They could see the backlog on a daily basis, whether they were on target or not, and how much overtime was being reported. Just showing those numbers to the management team changed behaviors right away. The result was a quick 2% of revenue to the bottom line and increased sales.

Another company found that the activity in the warehouse was steadily increasing. Accounting was pressuring operations to stop using overtime, but operations couldn’t deal with the increased volume without it, or without hiring. Once the proper measures were put in place, labor management became much more intentional, customer service improved, and variable cost per dollar shipped went down. Profitability increased and revenues grew.

Here is a step by step process to creating your KPIs, The Magic of Metrics: What Gets Measured, Gets Managed

The Take-Away

The concept of the balanced scorecard has been around for a long time, yet many companies measure only one facet of their business model. Balancing KPIs to measure economic value (including cash flow) and activity to help manage capacity is essential for accelerating profit and growth.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!