Quality vs Speed: Why Chasing Perfection to the Penny Holds You Back

With Guest Contributor Zach Kritikos, financial analyst at Quantro

Accuracy Matters, But Not Everywhere

Before discussing speed versus precision, it is important to separate historical reporting from forward looking analysis. Historical financial data such as the performance P&L and balance sheet must always be accurate. These numbers represent facts and are the basis for trust, accountability and decision making. There is no flexibility here and no trade off between speed and quality.

Forecasts serve a different purpose. They are not designed to be right, but to be useful. A forecast is a tool that helps management understand direction, risk and potential outcomes under uncertainty. By definition, it will always be wrong to some degree. The value of a forecast lies in how it informs decisions, not in how closely it matches eventual results.

Variance analysis should therefore be treated as a learning mechanism rather than a scoring exercise. The objective is to understand why reality differed from expectation and whether that difference requires action. When teams focus too heavily on reconciling every forecast variance instead of interpreting what the variance actually means, the analysis loses its strategic value.

Recognizing that accuracy in historical reporting is very important, while also acknowledging historical information has a very short half life, CFO.University prepared this article, Innovate: How to Speed Up Your Financial Processes, to help CFOs and accounting leaders bridge that gap created by late reporting.

Why Forecast Precision Can Become a Distraction

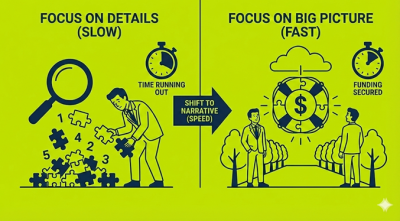

We often see this most clearly in businesses under pressure. In one recent client situation, the company was facing a serious cashflow issue and urgently needed funding. At that point, the forecast was not an academic exercise. It was a tool to unlock a lifeline. Speed and clarity mattered far more than reconciling every assumption to the last penny.

Internally, there was tension. Some team members wanted forecast models to tie perfectly, even where the variances were small and immaterial. A significant amount of energy went into debating minor differences rather than asking the more important question of whether the forecast was credible enough to support a funding conversation. At that moment, precision did not increase confidence. It slowed momentum.

This is where materiality becomes critical in forecast and variance analysis. Differences within a five to ten percent range rarely change decisions, particularly when founders are focused on survival and liquidity. The value of the forecast came from stepping back, looking at the overall cash trajectory and acting quickly. Once funding was secured, the business gained the breathing room needed to move beyond firefighting and towards strategic planning.

Using Variance Analysis to Learn, Not to Police

Variance analysis is often misunderstood. Instead of being used as a tool to improve future forecasts, it can turn into a mechanism for control. Forecasts are compared to actuals line by line, and teams are expected to explain every deviation, regardless of whether it had any real impact on the business.

This becomes even more important in the environments our clients operate in. Startups and SMEs move fast by nature. Their priorities shift, hiring plans change, customers behave unpredictably and strategy evolves throughout the year. As a result, actuals changing versus forecast is not a failure of planning. In most cases, it is a sign that the business is responding to reality.

In practice, over analysing these movements creates the wrong incentives. People become focused on defending assumptions rather than challenging them. In the client situation we described, the most valuable insight did not come from explaining why individual costs moved slightly. It came from understanding the broader cashflow timing and whether the business was burning faster or slower than expected.

At Quantro, we treat variance analysis as a directional exercise. We look for patterns that indicate structural change, not noise. When variances sit within a reasonable materiality threshold, we do not force explanations for their own sake. Instead, we focus on what the variance is telling us about customer behaviour, cost scalability and the assumptions that actually drive future performance.

Materiality as the Anchor in Forecast Reviews

Materiality is what allows forecast and variance analysis to remain useful rather than overwhelming. Without a clear view of what actually matters, every variance can feel urgent and every deviation can demand explanation. In fast moving businesses, this quickly becomes unsustainable.

As a rule of thumb, we operate within a five to ten percent materiality range when reviewing forecasts. Variances within that range rarely change strategic decisions, particularly for startups and SMEs where the direction of travel matters more than exact timing. Founders under pressure care about whether cash will run out, whether funding is achievable and whether growth assumptions are holding, not whether a line item moved slightly month to month.

This does not mean ignoring data. It means prioritising it. When variances exceed material thresholds or signal a structural shift, they demand attention. When they do not, our focus stays on speed, clarity and decision making. By anchoring forecast reviews in materiality, we help clients stay focused on the drivers that actually shape outcomes rather than getting lost in immaterial detail.

Speed in Forecasting Is About Decision Timing

Speed in forecasting does not mean rushing numbers out without thought. It means delivering insight in time for it to be useful. A perfectly refined forecast that arrives too late rarely adds value, particularly in high pressure situations where decisions cannot wait.

We see this most clearly when businesses are facing cash constraints or funding discussions. In those moments, the forecast is a decision tool, not a reporting artefact. What matters is whether it provides a clear view of runway, funding requirements and downside risk. Refining small assumptions rarely changes these conclusions, but delaying the forecast often does.

For many of our clients, speed in forecasting creates optionality. It allows founders to react early, explore funding routes and adjust strategy before pressure becomes critical. By focusing on timely, directionally correct forecasts rather than perfect ones, businesses gain the ability to act while they still have choices.

When Precision in Forecasting Truly Matters

There are situations where precision in forecasting and variance analysis becomes essential. This is typically when decisions are irreversible, when external stakeholders rely heavily on the numbers, or when the business has reached a level of stability where small movements can meaningfully affect outcomes. In these cases, a higher level of scrutiny is not only justified but required.

The key is context. Early stage companies, fast growing startups and SMEs in transition rarely benefit from treating every forecast with the same level of rigidity. Their operating reality is fluid and their numbers will evolve as the year unfolds. Applying enterprise level precision to an environment that is inherently dynamic often creates friction rather than clarity.

Our role is to recognise when the balance shifts. As businesses mature, forecasts become more stable and variance analysis becomes more granular. Until then, the objective is not to eliminate variance but to understand it. Precision should be applied where it improves decisions, not where it simply creates the appearance of control.

The Role of Finance in High Speed Environments

In high speed environments, the role of finance is often misunderstood. It is not to slow the business down by questioning every movement, nor is it to provide false certainty in an uncertain world. The role of finance is to bring structure, perspective and calm to decision making.

For startups and SMEs, this means helping founders navigate change without becoming overwhelmed by noise. Forecasts and variance analysis should reduce anxiety, not amplify it. When founders are under pressure, small deviations can feel significant even when they are not. Finance teams must help filter what matters from what does not.

By focusing on materiality, timing and direction, finance becomes a strategic partner rather than a reporting function. It enables founders to move quickly with confidence, knowing that the numbers support decisions rather than hinder them. That is where forecasting and variance analysis create real value.

This article, The CFO’s Dilemma: Speed Or Accuracy? includes steps you can take to speed up your financial processes to meet the growing demands being made by customers served by the CFO and their team in high speed environments.

Forecasts as Tools for Progress

Forecasts and variance analysis are not about being right. They are about being useful. When treated as decision tools rather than scoring mechanisms, they help businesses navigate uncertainty with clarity and confidence. The danger lies in applying the same standards of precision everywhere, regardless of context.

For startups and SMEs operating in fast moving environments, change is expected. Actuals will shift, assumptions will evolve and forecasts will move. That does not mean the process has failed. It means the business is responding to reality. The role of finance is to interpret those movements, not to resist them.

Progress comes from judgement, materiality and timing. Historical numbers must be accurate. Forecasts must be timely and directional. Variance analysis must inform action. When those principles are applied together, finance becomes an enabler of growth rather than a constraint on it.

A Final Thought for Founders, CFOs and Leadership Teams

If forecasting and variance analysis feel heavy or frustrating, it is often because they are being used in the wrong way. When every deviation requires justification and every forecast is expected to behave like a historical report, the process loses its value. Instead of supporting decisions, it becomes a source of friction.

The most effective finance functions understand context. They know when precision improves outcomes and when speed and judgement matter more. They help founders focus on runway, risk and opportunity rather than getting lost in immaterial movement that does not change the direction of travel.

If you are operating in a fast moving environment and feel that forecasting is slowing you down rather than helping you move forward, it may be time to rethink the approach. With the right framework, forecasts can become a source of clarity and confidence rather than another problem to manage.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!