Performance Risk in Financial Markets: A CFO’s Guide to Proactive Management

Overview:

Performance risk in financial markets refers to the potential for investments or portfolios to underperform due to market-wide fluctuations such as changes in interest rates, equity prices, or currency values. For CFOs, this risk directly impacts capital allocation, funding strategies, and overall corporate financial health. Understanding it enables better decision-making to safeguard shareholder value.

Financial markets are inherently volatile. For CFOs, the challenge is not only to manage exposure to price fluctuations but also to ensure that investments, funding strategies, and operational decisions perform as expected. Performance risk arises when actual outcomes deviate from projected financial or operational benchmarks.

Unlike operational risks, performance risk is often externally driven and fast-moving, requiring continuous monitoring and proactive response. Beyond traditional market movements, performance risk increasingly reflects the gap between speed of market change and the organization’s ability to respond. In an era of algorithmic trading, instantaneous capital flows, and policy-driven volatility, even well-constructed financial strategies can underperform if response mechanisms lag market signals.

Understanding Performance Risk

Performance risk, commonly aligned with market risk, stems from systemic factors that affect entire asset classes rather than isolated company events. These include fluctuations in interest rates, stock indices, commodity prices, and foreign exchange rates, all of which can diminish asset values overnight. Unlike credit or operational risks, performance risk cannot be fully eliminated through diversification within a single market, however, requires a broader enterprise perspective.

CFOs encounter this risk daily when overseeing pension funds, cash equivalents, or hedging programs. For instance, a sudden equity market correction can slash the funded status of defined-benefit plans, forcing unexpected cash infusions. Similarly, rising rates compress bond portfolios, straining liquidity just when borrowing needs peak. Historical events such as the 2008 financial crisis or the 2022 inflation surge illustrate how quickly performance shortfalls cascade into balance-sheet stress.

Additionally, performance risk increasingly originates outside traditional financial markets. Climate events, cyber incidents, and geopolitical shocks can rapidly reprice assets across multiple classes, blurring the boundary between market risk and operational or strategic risk. CFOs must therefore adopt a cross-risk lens rather than treating performance risk as a standalone category.

This risk’s non-diversifiable nature demands CFOs shift from reactive fixes to proactive frameworks. By viewing performance risk as a core element of financial strategy, CFOs can better forecast impacts on earnings volatility and communicate risks transparently to stakeholders.

Market Performance Risks Identified Through Ongoing Monitoring:

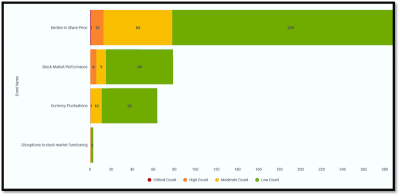

This chart illustrates the number of performance-related risk events identified through continuous monitoring, categorized by severity. The events reflect market-driven risks such as share price declines, stock market performance issues, currency fluctuations, and disruptions in market functioning. The distribution by severity provides insight into the frequency and intensity of performance risks, supporting early identification of potential financial impact and informed risk oversight.

Source: Supply Wisdom Share Price Decline, Stock Market Performances, and Currency Fluctuations Alerts from January 01, 2025, to December 31, 2025

Primary Market Drivers

Performance risk in financial markets is driven by a convergence of macroeconomic, financial, and regulatory forces that can rapidly alter funding costs, asset valuations, and cash flow expectations. For CFOs, understanding these primary drivers is essential to anticipate pressure points before financial performance deteriorates.

- Interest rate fluctuations dominate, as central bank actions reshape borrowing landscapes and investment yields; rising rates compress fixed income returns and elevate refinancing hurdles.

- Equity market volatility erodes portfolio values, particularly for firms reliant on market-tied compensation or treasury investments; downturns amplify during fear-driven selloffs.

- Foreign exchange movements challenge global players, where a strengthening home currency inflates import expenses and shrinks foreign subsidiary contributions.

- Commodity price shocks, fueled by supply disruptions or demand surges, ripple through sectors like manufacturing and energy, magnifying baseline exposures.

- Tightening credit spreads, downgrades, or counterparty stress that raise funding costs or disrupt risk-transfer arrangements.

- New capital, disclosure, or market rules that alter the economics of funding, hedging, or investment vehicles

Inflation acts as a multiplier, eroding purchasing power and prompting policy responses that intensify other drivers. Geopolitical events trade disputes, conflicts, or elections, add layers of unpredictability, and shorten decision horizons. CFOs must employ sensitivity analyses to map these interconnections, quantifying how a combined 2% rate increase and 15% equity drop might slash debt service coverage ratios or free cash flow projections by double digits.

Strategic Implications for CFOs

Performance risk reshapes the CFO’s role from financial steward to enterprise shock absorber. The modern CFO is expected not only to report outcomes but to anticipate variance, explain deviation drivers, and actively rebalance strategy under pressure. Performance risk has direct consequences for CFOs in several areas:

1. Capital Allocation

CFOs must ensure that capital investments generate returns consistent with forecasts. Underperformance can erode shareholder confidence and limit future funding flexibility.

2. Investor Relations

Performance risk affects how CFOs communicate with investors. Missing performance targets can damage credibility, while proactive risk disclosure builds trust.

3. Strategic Planning

Performance risk forces CFOs to stress-test strategies against multiple scenarios. This includes evaluating downside risks and identifying contingency plans.

4. Regulatory Compliance

Underperforming financial instruments may trigger disclosure obligations or compliance reviews, especially in regulated industries.

5. Operational Resilience

Performance risk highlights the need for robust systems, processes, and talent to ensure execution aligns with financial strategy.

Case Examples:

Each case illustrates how performance risk can undermine CFO objectives.

- Currency Hedging Gone Wrong: A multinational CFO implements a hedging strategy to protect against currency swings. However, unexpected policy changes render the hedge ineffective, leading to losses.

- Supply Chain Disruption: A CFO approves a capital investment in a new plant. Global supply chain bottlenecks delay production, causing performance shortfalls.

- Benchmark Underperformance: An institutional portfolio managed by the CFO fails to track its benchmark index due to poor diversification.

Practical Mitigation Tactics

CFOs do not control markets; however, they control exposure, preparedness, and transparency. Practical mitigation tactics include:

- Define how much earnings volatility, foreign exchange (FX) exposure, or variable-rate debt the company is willing to tolerate, approved by the board. Translate this into concrete limits (e.g., percentage of floating-rate debt, unhedged FX revenue, commodity exposure).

- Establish early-warning performance thresholds (soft and hard limits) that trigger predefined actions such as incremental hedging, liquidity drawdowns, or capex deferrals before financial stress becomes visible in earnings.

- Deploy hedging instruments strategically with interest rate swaps fix floating obligations, equity options limit downside, and FX forwards stabilize remittances.

- Build diversified portfolios spanning equities, bonds, alternatives, and geographies to temper isolated shocks, prioritizing asset-liability matching duration alignment.

- Leverage quantitative metrics such as Value at Risk (VaR) to estimate daily loss potentials at 95% or 99% confidence, paired with stress tests mimicking past crises (Ex:

1987 Black Monday or 2020 COVID-19 plunge).

- Ensure treasury, financial planning and analysis (FP&A), and business units follow coherent policies for funding, hedging, and pricing, overseen by a risk or finance committee.

- Embed risk‑adjusted metrics (e.g., risk‑adjusted return, volatility-aware targets) into incentives so teams are rewarded for resilient performance, not just upside.

Scenario planning extends foresight, simulating black swan events such as prolonged trade wars or cyber-induced market halts. Treasury technology streamlines this: automated platforms track exposures in real-time, trigger hedges within predefined bands, and visualize risk-adjusted performance via interactive dashboards. Regular model validation guards against flawed assumptions, especially amid regime changes such as zero-to-positive rate environments.

Enterprise risk management (ERM) integration ensures alignment, with CFOs chairing committees that cascade market insights into operations and strategy teams. This holistic tack complies with Sarbanes-Oxley Act (SOX) reporting while cultivating a culture where risk informs every capital decision.

Embedding Risk in CFO Leadership

Forward-thinking CFOs elevate performance risk from compliance chores to strategic lever. Integrate it into Enterprise Resource Planning (ERP) systems for holistic views linking treasury, FP&A, and investor relations. This visibility flags emerging threats, such as yield curve inversions signaling slowdowns.

CFOs should foster enterprise risk management (ERM) frameworks where performance metrics inform capex gating and dividend policies. Close collaboration with CEOs is essential to embed scenario-based planning into long-term strategies. Stress-testing five-year plans against adverse macroeconomic and market conditions ensure strategic decisions remain viable under pressure.

Investor communications benefit immensely: transparent risk disclosures build trust, narrowing cost-of-capital premium.

Technology accelerates this evolution, AI-driven analytics predict cascades from macro signals, while blockchain streamlines collateral for derivatives. CFOs leveraging gain foresight, positioning firms as market stabilizers.

Building internal capabilities is critical. Targeted training such as value at risk (VaR) and stress-testing sessions for non-finance leaders helps align incentives with risk-adjusted performance and ensures performance risk awareness is embedded across the organization.

Emerging Horizons and Adaptations

Markets evolve rapidly, with digitization compressing reaction times and climate factors introducing novel volatilities such as carbon pricing fluctuations. ESG integration currently rivals traditional drivers, as regulators penalize unaccounted transition risks. Legacy transitions, such as London Interbank Offered Rate (LIBOR) to Secured Overnight Financing Rate (SOFR), test operational resilience.

Climate-related financial risk is emerging as a structural performance drive, influencing insurance costs, asset valuations, and access to capital. Carbon pricing volatility, climate stress testing, and transition-risk disclosures are increasingly influencing investor behavior and credit assessments.

At the same time, AI-driven trading and automated risk reactions increase the speed at which market dislocations propagate, compressing decision windows for CFOs. This elevates the importance of pre-approved action frameworks over ad-hoc judgment during crises.

CFOs must evolve accordingly, incorporating machine learning for correlation detection and blockchain for efficient derivatives settlement. Forward-looking stress tests should blend quantitative rigor with qualitative judgment, preparing for hybrid threats like AI-driven flash crashes.

Conclusion

Performance risk in financial markets ultimately determines whether a company delivers the earnings, cash flow, and balance sheet strength that boards and investors expect, especially when conditions turn volatile. For CFOs, managing performance risk is not about predicting every market move, managing this risk is about more than avoiding losses, but about designing funding, hedging, and investment decisions. Performance risk management by CFOs is about ensuring that strategies deliver on their promises, maintaining investor confidence, and safeguarding organizational resilience. By adopting proactive risk management practices, CFOs can transform performance risk from a threat into a source of strategic advantage.

Third party risk monitoring can help manage this performance risk by providing continuous, external intelligence on financial, macroeconomic, geopolitical, and counterparty developments that may affect market conditions and your extended ecosystem. By integrating near real-time signals on supplier health, country and sector risk, regulatory changes, and emerging disruptions into finance and risk dashboards, CFOs can link external risk indicators to internal KPIs such as earnings before interest, taxes, depreciation, and amortization (EBITDA), free cash flow, covenants, and liquidity buffers, enabling earlier action. This outside-in visibility allows treasury, FP&A, and risk teams to adjust hedging, funding, and capital allocation before external shocks fully hit results, turning performance risk from a surprise into a managed variable within the CFO’s strategic toolkit.

Employing a third-party risk monitoring solution, such as Supply Wisdom, can transform performance risk from an unexpected financial outcome into a monitored, measurable, and actively managed variable, thereby equipping CFOs with greater foresight, stronger investor confidence, and enhanced financial resilience in volatile markets.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!