Internal Controls & Governance: The CFO’s Foundation for Risk-Resilient Finance

Internal controls and governance form the foundation of effective risk management. While risk management identifies and assesses potential threats, internal controls and governance ensure that risks are consistently managed, monitored, and kept within acceptable limits.

In an era marked by economic volatility, geopolitical instability, and accelerating technological advancements such as artificial intelligence disruptions and escalating cyber threats, effective risk management remains paramount. Internal controls and governance frameworks provide the foundational structure for safeguarding assets, ensuring regulatory compliance, and informing strategic decision-making.

For CFOs, these are not merely compliance mechanisms, they are critical tools for protecting financial integrity, ensuring accountability, and enabling informed decision-making. They also define the CFO’s credibility as a steward of trust, resilience, and long-term value creation.

Why Internal Controls and Governance Matter for Risk Management?

Internal controls and governance are the backbone of corporate risk management. They provide the structure and discipline needed to ensure that financial reporting is accurate, operations are efficient, and compliance obligations are met. Well, designed controls and clear governance structures give CFOs confidence that financial results are dependable, assets are protected, and key risks are being managed before they become crises.

For CFOs, these frameworks are not abstract concepts, however they directly influence credibility with investors, regulators, and boards. Weak controls can lead to financial misstatements, fraud, reputational damage, and regulatory penalties. Strong governance, on the other hand, builds trust and positions the CFO as a strategic partner in guiding the company through uncertainty.

Key benefits include:

- Accuracy and reliability in financial reporting

- Fraud prevention through checks and balances

- Operational efficiency by streamlining processes

- Regulatory compliance with laws such as Sarbanes–Oxley Act (SOX), General Data Protection Regulation (GDPR), and Environmental, social, and governance (ESG) disclosure requirements

- Investor confidence through transparent governance practices

Collectively, these outcomes reduce volatility in financial performance and strengthen organizational resilience during periods of stress.

Risk Categories Relevant to CFOs

Financial, Operational, Compliance, and Emerging Risks:

CFOs operate at the nexus of multiple risk domains, each requiring tailored strategies and controls:

- Financial Risks: These include liquidity risk, market risk such as interest rate, currency, commodity price fluctuations, and credit risk. CFOs must ensure robust forecasting, hedging, and capital allocation to manage volatility and safeguard solvency.

- Operational Risks: Stemming from internal process failures, human error, system breakdowns, or external events, operational risks can disrupt business continuity and data integrity. Controls over treasury operations, Enterprise Resource Planning (ERP) systems, and transaction processing are critical.

- Compliance and Regulatory Risks: Non-adherence to laws, regulations, and accounting standards can result in financial penalties and reputational damage. CFOs are directly accountable for the completeness and accuracy of disclosures, tax compliance, and regulatory filings.

- Strategic Risks: These encompass failures in strategic planning, leadership transitions, and risks associated with mergers and acquisitions. Scenario modeling and stress testing are essential to anticipate and mitigate strategic threats.

- ESG and Emerging Risks: ESG risks including climate change, data privacy, and board effectiveness are increasingly material. CFOs must integrate ESG considerations into financial decision-making and risk management practices.

A well-defined risk taxonomy categorizing risks into strategic, operational, financial, compliance, reputational, and ESG domains enables consistent identification, aggregation, and prioritization across the enterprise.

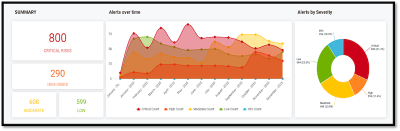

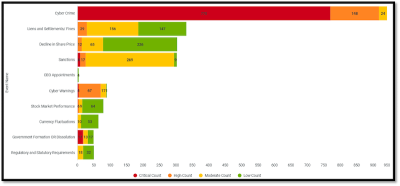

Risk Alerts as Indicators of Internal Control and Governance Effectiveness:

The dashboards are examples of the distribution of risk events identified through continuous monitoring, categorized by severity across key risk areas such as cyber incidents, legal and regulatory actions, market performance, sanctions, and governance-related changes. The concentration of critical and high-severity alerts, particularly in cyber-crime, regulatory exposure, and sanctions highlights areas of elevated risk that may require stronger internal controls, enhanced governance oversight, and timely management intervention.

Source: Supply Wisdom Share Price Decline, Stock Market Performances, Regulations, Cyber Threat, Sanctions. and Currency Fluctuations Alerts from January 01, 2025, to December 31, 2025

The CFO’s Expanding Risk Management Mandate

Traditionally, CFOs focused on financial risks of liquidity, credit, and market exposure. Today, the scope has widened dramatically. CFOs must now oversee risks that span:

- Cybersecurity and data integrity: Protecting financial systems from breaches by using automated controls and analytics, reducing manual processes and human error and gain real-time visibility into control performance.

- Regulatory shifts: Adapting to evolving tax, ESG, and reporting standards. Under laws such as Sarbanes‑Oxley (SOX), CFOs must certify the accuracy of financial statements and the effectiveness of internal controls over financial reporting.

- Operational disruptions: Supply chain breakdowns, geopolitical instability, or pandemics.

- Reputation and ethics: Ensuring ethical conduct and transparent disclosures.

Boards increasingly look to CFOs as the ‘Risk Conscience’ of the organization. This means CFOs must integrate risk management into everyday decision-making, not treat it as a separate compliance function. The modern CFO must proactively challenge assumptions, surface blind spots, and ensure risk-adjusted thinking informs strategy execution.

Building Effective Internal Controls

Internal controls are the mechanisms that help organizations achieve objectives while managing risks. For CFOs, designing and monitoring these controls is a core responsibility, they translate risk management expectations into concrete control activities and governance routines.

Key Elements of Internal Controls:

- Segregation of duties - Preventing conflicts of interest by ensuring no single individual controls all aspects of a transaction.

- Authorization and approval processes - Establishing clear thresholds for financial commitments.

- Reconciliation and monitoring - Regularly verifying accounts to detect anomalies.

- Access controls - Restricting system access to authorized personnel

- Audit trails - Maintaining records that allow for transparency and accountability.

Practical Internal Control Responsibilities for CFOs:

- Designing controls that balance operational efficiency with risk mitigation by mapping key risks across financial reporting, treasury, tax, procurement, revenue, and payroll processes to specific control activities.

- Monitoring effectiveness by assigning clear ownership for each control, with documented procedures and Key Performance Indicator (KPIs) for control performance.

- Collaborating with internal audit in testing controls and acting quickly on findings and management action plans to identify weaknesses.

- Embedding controls into digital systems to reduce manual errors using technologies such as ERP, access controls, automated checks.

- Communicating the “why” behind controls so functions see them as protecting the business, not just adding friction.

- Ensuring staff in finance and operations are trained in policies and understand their role in maintaining control integrity.

Governance as a Strategic Enabler

Governance defines who decides what, who oversees whom, and how risk and control issues are escalated. It is often misunderstood as bureaucracy, but It is a strategic enabler that ensures decisions are made responsibly and transparently.

For CFOs, governance responsibilities include:

- Board engagement: Providing clear, concise risk reports to directors.

- Policy development: Establishing financial policies aligned with corporate strategy.

- Ethics and compliance oversight: Ensuring adherence to codes of conduct.

- Stakeholder communication: Building trust with investors, regulators, and employees.

- Strong governance frameworks: Empower CFOs to function as stewards of long-term value, balancing short-term financial performance with sustainable growth.

Technology and Internal Controls

Digital transformation is reshaping internal controls and governance. CFOs must leverage technology not only to improve efficiency but also to strengthen risk management capabilities.

Tools and Innovations

- ERP systems: Automating reconciliations and approvals.

- Data analytics: Detecting anomalies in real time.

- AI-driven risk models: Predicting potential disruptions.

- Blockchain: Enhancing transparency in financial transactions.

- Technology enables CFOs to shift from reactive to initiative-taking risk management, identifying issues before they escalate.

Current Challenges CFOs Face

The financial landscape presents unique challenges that evaluate CFOs’ ability to manage risks effectively:

- Global uncertainty: Inflation, interest rate volatility, and geopolitical tensions.

- Regulatory complexity: Expanding ESG and sustainability reporting requirements.

- Talent shortages: Difficulty in building risk-aware finance teams.

- Investor scrutiny: Rising demand for transparency and ethical governance.

CFOs must balance these pressures while maintaining agility and resilience.

Conclusion

Internal controls and governance are not just compliance obligations; they are strategic assets. For CFOs, mastering these areas is essential to protecting shareholder value, enabling sustainable growth, and navigating uncertainty.

By embracing their role as risk leaders, CFOs can transform governance into a source of competitive advantage. In doing so, they not only safeguard the organization but also elevate their own position as trusted advisors to the board and strategic partners in shaping the future.

The growing complexity of global operations, regulatory change, and third-party dependencies demands more than traditional oversight. It requires continuous, real-time intelligence and proactive risk management. Third party risk monitoring enables this transformation by providing continuous external risk intelligence that complements and strengthens traditional control and governance mechanisms. By monitoring signals such as regulatory changes, compliance breaches, cyber vulnerabilities, ESG controversies, and supplier governance failures, risk intelligence equips CFOs with early visibility into risks that could undermine control effectiveness or erode governance standards. This intelligence allows finance leaders to directly link external risk signals to internal control outcomes, enhance board reporting, and embed dynamic risk awareness into assurance processes.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!