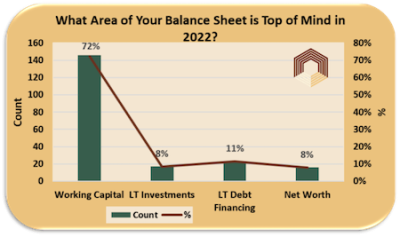

With a Faltering Economy, What Area of The Balance Sheet Is Top of Mind For You?

With uncertainty and change looming in the economy we polled finance leaders on this question, “Which area of the balance sheet is top of mind for you?”

We gave these four choices. Each is followed by an example of what that choice could look like.

1. Working Capital: We are preparing for continued supply chain disruptions, higher inflation, rising interest rates. Generally preparing for some short-term business volatility.

2. Long Term Investments: We believe strategic investments are plentiful and want to take advantage of them. Conversely, a key part of our 2022 plan includes harvesting some of our long term investments.

3. Long Term Debt Financing: We want to recapitalize to improve shareholders returns, fund strategic investments or create strength to withstand a prolonged economic retraction.

4. Strengthen/Right Size Equity: We believe its time to strengthen our balance sheet to weather a long term economic storm or return capital to shareholders after a strong run.

Overwhelmingly - nearly 3 out of every 4 - finance leaders targeted working capital as being top of mind.

We set out to study why.

Deloitte polled¹ executives earlier in the year and attributed the high priority given to working capital as companies being in ‘growth mode’, after nearly two years of managing through the pandemic they are ready to break bunker and make a charge for growth. Deloitte’s report also provides a tip from its survey.

- Companies that proactively analyze customers’ payment behaviors and use that analysis to make process improvements can significantly improve collection time, reducing their DSO.

A recent PWC report² summarizes three key findings in working capital improvement, providing further support why it’s a top priority for finance leaders in 2022.

- Digitalization and analytics - ‘Easy’ cash wins are possible through a top-down approach allowing immediate remedies which can realize up to ~40% of cash potential.

- Supply chain resilience and agility - A resilient and agile supply chain is made possible with the use of digital working capital levers

- ESG and sustainable Supply Chain Finance - Integrating sustainability into Supply Chain Finance (SCF) can improve both the financial health of the supply chain and ESG performance

In a McKinsey report last fall, Unlocking Cash from Your Balance Sheet³, the consultants point their finger directly at the CFO,

“Many companies treat working capital simply as the cost of doing business. In our experience, few consider the negative impact of extended customer terms, tight payment cycles, and high inventory levels on true economic value.”

If true, this makes working capital an easy target for improvement and a great place to focus your balance sheet attention.

Minimally, we suggest you discuss this topic with your executive teammates. You may be doing all the right things regarding working capital, but if those efforts aren’t well understood or communicated, they could be unwittingly taking the same position McKinsey states in their paper. Our jobs are tough enough without that kind of misguided publicity.

This tool, the Cash Velocity Calculator, is a great way to kick off your discussion. The tool quickly and simply highlights where and why you are consuming working capital. It presents the information in a way that makes it easy to have a thoughtful, productive discussion.

Fortunately, the McKinsey team takes this conversation a step further, suggesting other aspects of the balance sheet, besides working capital, to harvest cash from. We especially enjoy the descriptions they use for each heading:

- Reimagine or divest underperforming long-term assets

- Recover ‘trapped’ cash and accelerate returns from partnerships

- Manage credit support strategically

- Reduce long-term operating liabilities

- Identify alternatives for funding of pension obligations

With severe supply chain disruptions, rapid inflation growth and rising interest rates we find ourselves playing a game with rules we haven’t had to play by for 25 years or more. It’s time to dust off the old playbook and manage working capital like it’s a precious commodity again.

Stronger Balance Sheets, Make Stronger Companies.

Read part II in our series, What Area of the Income Statement is Top of Mind for You in 2022?

Other reference material related to this topic,

- Working Capital and Creating a Culture That Respects Cash Haroldo Monteiro

- Capital Investment Analysis and Request Form

- CFO Success Series: Treasury Part 2 - Debt Financing

- CFO Success Series: Treasury Part 3 - Equity

¹ Working Capital Management A Top Priority for Many Executives in Year Ahead

² Working capital management: Emerging topics and trends

³ Unlocking Cash From Your Balance Sheet