Is EBITDA The Silver Bullet of Business Valuation?

“Valuations are up.”

“Multiples are very attractive now.”

These are comments that get business owners and shareholders excited, but what does it really mean for you?

If you’re at a publicly traded company, you can check your firm’s stock price and generally know what those comments mean for you, but if you’re at a privately held company you don’t have that real-time feedback.

Private-company leaders will regularly tell me about the “back of the envelope” valuation that they performed by using an EBITDA multiple that they got from a broker… or from somebody’s brother-in-law “who works in M&A.”

The multiple is usually 5x or 6x in this conversation.

Although widely used, The Back of the Envelope Method and the Back of the Napkin Method are not accepted valuation techniques.

Remember the expression: “He who acts as his own lawyer has a fool for a client?”

It’s kind of like that with doing your own valuation - especially when the stakes are high.

EBITDA - What it is and Why it Matters

EBITDA is an acronym for “Earnings Before Interest, Taxes, Depreciation and Amortization.”

This is just one measure of financial performance and unlike net income, EBITDA removes the cost of debt capital, income tax and non-cash expenses related to long term assets. EBITDA is used as a simple proxy for cash flows adjusted for capital structure and tax jurisdiction. .

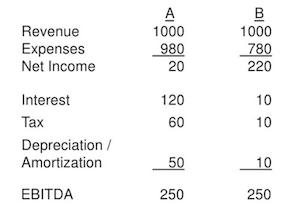

Let’s consider a quick example where two companies have identical revenues but different expense profiles. As you can see from the chart below, when comparing two companies with different capital structures and levels of investment, the “I, T, D and A” components can have a material impact on net income. Adding these elements back to arrive at EBITDA helps to level the playing field in the comparison.

Although Company B shows more net income than Company A, on an EBITDA basis these two companies have comparable adjusted cash flows. For this reason, EBITDA is an extremely valuable financial metric to consider when valuing a business.

Where do EBITDA Multiples Come From?

EBITDA multiples are derived from two possible sources: (i) multiples paid in the sale of comparable businesses; and (ii) the trading multiples of comparable public companies. It’s critical to properly identify the right set of comparables from which to derive these multiples, just like you would when identifying market ‘comps’ when buying or selling a house.

Note there are differences between trading multiples and transaction multiples, but that’s a subject for another time.

Multiplying a company’s EBITDA by an appropriate EBITDA multiple results in what is called the Enterprise Value conclusion.

Enterprise Value

Because EBITDA reflects the financial performance of a company before the deduction of interest, EBITDA less the T, taxes, is considered to be available for distribution to both debt and equity holders. Accordingly, the application of EBITDA multiples results in an estimated value of the enterprise in its entirety. The use of EBITDA multiples and enterprise value is a convenient way to think about the value of a company because it allows for the separation of the investment decision from the financing decision.

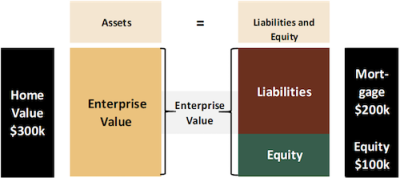

For example, let’s think about this with the analogy of buying a house. The house is listed at $300,000 and you would like to buy it.

You now have two key decisions to make.

First, are you willing to pay $300,000 to buy the house (the investment decision) and what amount of money are you going to borrow to make the purchase? (the financing decision).

Equity Value

In this example, if you are a cash buyer, you’d write a check for $300,000 and have $300,000 equity in the house. If you can’t pay cash or would prefer to take advantage of leverage, perhaps you would borrow $200,000 and write a check for $100,000. In that scenario it’s the bank holds a mortgage that must be paid off when the house is sold while your investment in the house, $100,000, is your initial equity.

The same concepts are true with regard to a business. If the business has no debt, the enterprise value and the total equity value are essentially equal. If the business has debt, just like in the house / mortgage scenario, the debt would be subtracted to arrive at the equity (ownership) value.

The Downside of the EBITDA Multiple

The EBITDA multiple is often thought of as a reasonable heuristic or rule of thumb for valuing a business. And while EBITDA multiples are certainly a valuable tool in the context of valuing a business, and generally a key metric in any market-based valuation methodology, it’s important to understand that it is not the silver bullet of valuation techniques.

Silver bullet: something that acts as a magical weapon; especially one that instantly solves a long-standing problem.

Here are a few shortcomings to keep in mind when relying on an EBITDA multiple:

- Valuation is a forward-looking exercise as described here, In The Shark Tank It’s All About Valuation. Sure, past performance matters, but what the future holds is more important. Even forward-looking EBITDA multiples can’t capture the entire growth picture.

- Speaking of forward-looking EBITDA, is next year’s performance going to be better or worse than last year? Which metric and which multiple are most-applicable?

- EBITDA is often thought to be representative of cash flow, but it isn’t really cash flow. Working capital needs, capital spending and cash taxes are not captured in EBITDA and investors will want to understand these aspects of the business.

- Although EBITDA helps in assessing companies with differing capital structures, be mindful that it can also be the proverbial “lipstick on a pig.” Companies with large amounts of debt, especially expensive debt, may look a lot more attractive through an EBITDA lens. These companies don’t always warrant the same multiple as their debt-free peers, however.

Pulling it all Together

As a business leader, employee or shareholder it can be exciting to hear that companies are selling at large multiples. But before you begin to imagine “What is My Business Worth?” and what that math might mean for your retirement planning, it’s important to remember that valuation is a forward-looking exercise, and the use of historic financial metrics don’t tell the whole story.

Furthermore, relying on a single methodology, let alone a single metric, will likely yield unreliable results.

A robust valuation analysis would consider several methodologies, utilizing those that are most appropriate, with results being correlated and synthesized into a meaningful conclusion.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!