Why Should M&A and Private Equity Matter to You? More on Breakfast with PitchBook.

Last week I summarized a presentation PitchBook analysts made at a Portland business event, Breakfast with PitchBook – Recap of 2019 and Predictions for 2020

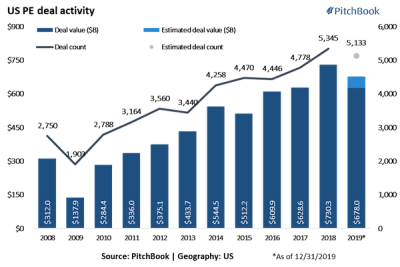

The recent 10 year explosion of activity in the private equity market, as highlighted in the graph below, has drawn the attention of many investors and Board members.

Since “Breakfast with PitchBook…” was published, a number of finance leaders within our community have asked me how they should use this information for planning and operating purposes. Here is a condensed version of my responses to them.

Why is information on M&A, Private Equity and Venture Capital important to the CFO?

Being familiar with these industries will help you develop a company that is prepared to be sold or “market ready”.

One reason being “market ready” is helpful - it gives your shareholders more liquidity than they would otherwise have. More liquidity options will drive a higher valuation for your company.

Is it still important even if shareholders have expressed no desire to sell? Yes, it’s still very valuable. The rigor required to be “market ready” will make you and your team better, a lot better. It’s the ultimate win-win-win. The stock of your company will appreciate, your team will add more value and your professional worth will go up.

Being familiar with the M&A professionals dedicated to your space (geography or industry) while understanding how Private Equity is behaving in your market is a great first step to become “market ready”. On the flip side, if your company becomes the acquirer rather the target these relationships are just as valuable.

Here is a perspective I used with one member. Visualize your company as if it is one of your products. How do you create more demand for your company? Just like your products, by providing greater value. In this case, to potential suitors for the company rather your customers. The principle is identical, only the company becomes the product the suitor is buying.

This paradigm will help you take an outside-in look at your company. Questions like this will arise:

- What industries or other companies can our company help the most?

- What is it about our company they would find most valuable today?

- Are there actions we should be taking to protect (build a moat) what others find valuable in our business?

- What can we do to make our business more valuable for them in the future?

- What steps should we take to become “market” ready?

- How do we systematically refresh the answers to these questions on a go forward basis?

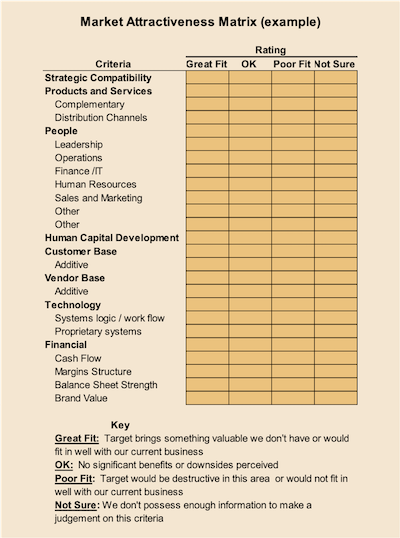

Below is a simple market attractiveness table you can use to help you through some of the questions above. Before evaluating other companies using this lens, use it internally. Rate your company on each Criteria based on how well that Criteria would “show” to a potential acquiror. This will help you determine how far you are from being “market ready”. Once you have done that, you will be ready to evaluate the Market Attractiveness other companies you choose to look at.

By learning about these markets and answering the above questions the value of your company will appreciate, your team will deliver more value, and your professional worth will increase. That is a trifecta with no downside.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!