Does Your CFO View You As An Asset Or An Expense?

The rate of change impacting many of our enterprises and industries continues to escalate. Of the many jobs within our organisations, one in particular has become much more demanding. It’s the role of the CFO. The person responsible for ensuring the organisation they serve is growing both sustainably and profitably.

So then, how do CFOs decide who to hire into their finance organisations to meet and overcome these challenges?

Recently I had an interesting conversation with a CFO around this topic. And as much as I’m in no rush to become a CFO, I’m still curious to learn from them, including, how they staff their organisations.

Conundrum

It turned out that this CFO had some areas performing very well, with very positive testimonials from various general managers (GMs) on how much their finance leaders were contributing to their business success. Then there were other GMs who were giving the same CFO a hard time because their finance business partners were not meeting their expectations or doing enough to help them achieve their goals. To add to these challenges the CFO also had high-performing teams delivering incremental value creation opportunities that needed to raise their staff numbers to remain effective. Similarly the CFOs ‘headache’ or ‘heartbreak’ teams also wanted additional staff to appease their GMs and get back on track. So what should the CFO do? Where should they recruit? Or what would you do in their shoes?

Finance as an expense or asset

Well it depends on the mindset of the CFO and how they view the role and purpose of their Finance team. Let’s use our financial statements as metaphors for the three types of mindsets; profit and loss, balance sheet and cashflow.

Finance as an Expense

If profit and loss is the prevalent mindset the CFO views Finance as an overhead that must fit within a politically motivated budget, which means expenditure in one area results in less being available for another area.

Finance as an Asset

In the second perspective, a balance sheet mindset, the finance team deliver more from its existing assets, i.e. better training for under-performing teams, enhancing systems, introducing robotic process automation, in effecting improving their efficiency ratios, doing more with less to meet the requests for any additional staff expense.

What Actually Happened

The CFO ended up spending their remaining budget to plug the gap in the finance team supporting the dissatisfied GMs causing the most noise. Ultimately, organisations can be extremely political and sometimes life can easier in the short term by placating those who shout loudest. It’s easy then to see Finance as an overhead and with only so much budget to go around (an expense mindset), and being successful and meeting stakeholders’ needs alone might not fully justify winning any remaining budget.

However, the CFO did not stop there. They also leveraged the assets in their strong performing teams, their policies, controls, some systems, etc… to improve efficiencies in the under-performing teams (an asset-based approach). The CFO put in place ways of work that got the best out of the current assets in the finance team. Training them to deliver more with less.

Here are some tips on How to Inspire Success and Meaning at Work.

A Third Way

And the CFO even went on to uncover a third way. They applied the cashflow mindset, which states that the finance team’s role is to continually question are we delivering the right value for the business? So, rather than simply helping his existing finance assets realise their potential, the CFO actually increased the value creation potential of the finance organisation by hiring additional team members in the high performing teams, specialists in technology and analytics, with the mindset that the likely return to the business would outweigh any overspend in budget.

Yes! A CFO that was prepared to overspend their budget!!

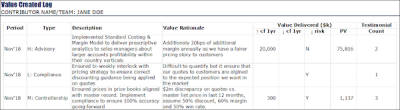

The CFO expected it would deliver more value for the business and demonstrated this by using a value log to justify the decision and the overspend. Individuals and leaders on the finance teams were tasked to track and describe what value they were delivering in the period, it’s increased present value (PV) to the business and shareholders, and how many testimonials it had received from stakeholders in the business.

This brave and more joined-up way of thinking is the future of finance. Where finance professionals are actually coming out from behind their desks to meet with stakeholders, understand how their value chain fits together, where we can apply our finance training to help solve their problems and challenges, support their decisions to reach our common goals while providing them with more certainty and peace of mind around the important decisions they make.

This is why we bring on guest mentors to our Strength in the Numbers Show. We share with you their stories and hard won lessons on figuring out how to take this third way, and create even more value in and for their organisations. Ultimately help you learn how to leverage your strengths in the numbers faster for a more rewarding, successful and fun career as a finance professional.

So what do you think, is a finance professional an expense, an asset, or a value creator?

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!