What is the Human Capital Net Worth of Your Business?

Where would Amazon be without Jeff Bezos? Microsoft without Bill Gates and Paul Allen? Google without Larry Page and Sergey Brin?

For most organizations, net worth is directly linked to the talent at the company. This value is known as the human capital of the business. Investopedia defines human capital as “A measure of the economic value of an employee’s skill set . . . the education, experience and abilities of an employee that has economic value for employers and for the economy as a whole.”

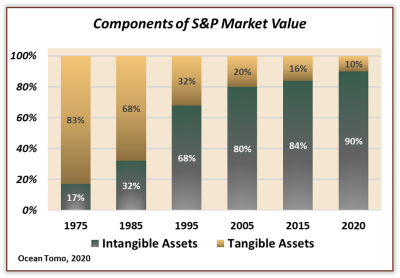

As the world evolves from the age of industry to information, human capital is becoming the benchmark of corporate success. Jobs and businesses based on intelligence are continuing to rise. The graph below was prepared several years ago by Aon and the Ponemon Institute. It divides corporate market value on the S&P 500 between tangible (brick and mortar) and intangible (human/Intellectual capital) assets.

The graph highlights a major shift that has occurred over the past 45 years. In 1975 the market value ratio of tangible to intangible assets was over 5:1, tangible:intangible. Since 1975 has more than reversed. In 2020 the ratio was 9:1, intangible:tangible.

Along with the reality that equity is no longer primarily determined by material assets; is the realization that these intangibles don’t readily conform to traditional accounting framework. It’s causing the industry to re-evaluate practices, models and assumptions, and valuations to transition from the tangible norm.

The Human Capital Management Institute has developed statements to report on human capital in formats similar to traditional financial statements. They have a taken a page out of the book Luca Pacioli wrote in 1494 about double-entry bookkeeping, to come up with the following:

Human Capital Statement

Human Capital Impact Statement

Supplementing the Income Statement, this statement measures the human capital impact on financial performance over a period of time. Some of the key items it measures include:

- Total Cost of Workforce

- Revenue, Profit and Market Capitalization per Full-Time Equivalent

- Return on Human Capital Investment

- Total Workforce Productivity Impact

Human Capital Asset Statement

Comparable to the Balance Sheet, this quantifies the total value of the workforce. It also breaks down the value contributions by job category or by key roles. The statement uses comparative periods to build information around the following concepts:

- Workforce value creation over time

- Identifying which job roles create the most value

- The value of training as an a net investment rather than simply a cost

- The value of workforce retention to a business

Human Capital Flow Statement

Comparable to the Cash Flow Statement, this statement quantifies and tracks the changes in the workforce by job class and the key steps along the talent management life cycle:

- Hiring

- Transfers

- Promotions

- Terminations

Human Capital Metrics

Assessing the actual value of human capital is determined by a defined set of metrics.

- Human Capital ROI – demonstrates the correlation between human capital investment, productivity and profitability. It is the pre-tax earnings a company generates for each dollar it invests in regular pay and benefits less non-human expenses.

- Revenue per Employee – an indication of productivity, looks at revenue generated by each employee

- Profit per Employee – pretax profit attributed to each full-time equivalent; gives an integrated picture of productivity and expense control efforts.

- Labor Cost as a Percent of Revenue – percentage of revenue allocated for compensation and benefits for regular employees; gives insight into programs and ROI over time.

- Voluntary Separation Rate – percentage of regular employees who left the company; high turnover can impact productivity, stability and profitability.

Human Capital Disclosures

The idea of human capital measurement is still being digested. The Society for Human Resource Management ascertained that “A significant portion of the value of organizations remains unaccounted for in investment communications”. The SHRM has recommended that all public companies should voluntarily disclose the following information related to their human capital management:

- Spending on human capital

- Ability to retain talent

- Leadership depth

- Leadership quality

- Employee engagement

- Human Capital Discussion & Analysis

With a highly subjective value, human capital can be difficult to measure. However, the concept continues to develop and the insights being uncovered give CFOs, CEOs and top executives a fresh perspective on how to develop talent. Using this framework with your executive team as part of resource planning will put the “human” back in your capital planning process.

The full video is available to our Member-Scholars. Please login or register to view.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!