For Chief Financial Officers: A Practical Approach to Using Artificial Intelligence - Part I

Part I Leveraging AI in the CFO Suite

Introduction

In their role as curator of critical information for their company, Chief Financial Officers must create processes and develop systems that filter out noise and focus only on the most important, actionable information. The plethora of data being created is growing at astronomical rates making this role much more crucial and much more difficult. In this article we’ll explore how CFOs can take a practical approach to integrating artificial intelligence (AI) into their operations.

First let’s define AI in a manner that applies to its use in finance.

AI is information derived from algorithms applied to data set(s) normally accomplished with little or no human intervention.

- Algorithm: a set of steps that are followed to solve a mathematical problem or to complete a computer process

- Information: knowledge you get about something: facts or details about a subject

In his book, The Design of Business, Roger Martin describes the stages of learning that go from mystery to heuristic to algorithmic. The financial processes at many companies are heuristic, made up of general guidelines but containing many steps, developed by trial and error, and known only to the process owner. These processes lock corporate technology in the minds of one or a few individuals; creating technology risk and a training burden when staffing transitions occur. Developing an AI system and framework to effectively select processes that should incorporate more AI is rapidly becoming a core skill required for CFO success.

Until recently, many financial applications of AI have helped uncover altogether new techniques or capabilities. For example, program trading in the financial markets came about because AI could “crunch” numbers (the price of a basket of individual stocks) fast enough to allow traders to arbitrage an index against a portfolio of individual stocks.

In addition to the speed factor, AI now is being used to replace repetitive, linear tasks and increase our information output capacity. Both uses have wide implications for the CFO, including;

- Choosing a system architecture that will capture AI most effectively for your organization

- Managing your talent in a manner that is socially responsible

- Developing and acquiring talent that captures the benefits of our AI system investment

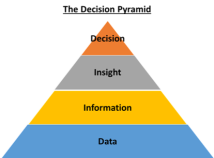

- Mastering the ability to manage the Decision Pyramid

How to Leverage AI in Finance

To date, most of the investments in AI for business have to do with specific industries; stock trading, portfolio management, banking and insurance underwriting. Customer development and customer service have also benefited from large investments in AI. The CFO responsibility areas, although ripe with automation, have not adopted AI to the extent these other industries or functions have. The opportunity is vast, but we need a methodology to identify where to start and continue our AI investment.

The main benefits to AI are derived from four aspects; speed, accuracy, volume and self learning. Logically, we should apply AI to areas where the total value (increased revenue and reduced cost) of the following four variables is greatest:

- Speed: The incremental value of time as applied to a process or delivering information

- Accuracy: The incremental cost of error or lack of precision in a process or information

- Volume: The incremental cost of each unit of volume in a process or in reports and analysis.

- Self Learning: The incremental value of the data ingested by the system to self develop new information.

Identifying the value of these different variables is the key to selecting an appropriate AI strategy and developing a work plan to implement it.

There are two main ways AI can enhance the CFO responsibility areas.

- As a Process Improvement Mechanism. In this case AI will be applied to the transactional work to complete it more quickly, more accurately and/or more of it.

- As a Decision Support Mechanism. Here AI is applied to the data used to create the information in a report or analysis to improve the decision support. This support is enhanced through quicker, more accurate and/or more information.

Illustrations of these two types of AI applications can be visualized using two examples:

- Procure to Pay (P2P): Using AI on the P2P process may yield big improvements in process effectiveness which will lead to lower costs and a reduction in errors.

- Budgeting and Forecasting: Using AI in the Forecasting process expands the scope of data that can be incorporated into the model, including the shift from exclusively using internal data to expanding the model to include external data. This use of AI will improve decision making by reducing the noise in our outputs due to using more robust input data.

We have a developed a worksheet to assist in targeting where AI will bring you the most value in the first 3 variables noted above. The worksheet is patterned after the Four Pillars of CFO Success and includes the major CFO technical competencies (i.e. CFO competencies ripe for AI application). Some critical thinking about each competency will allow you to develop a comparative scoring schedule to assist you in building an AI strategy.

Click to get your AI Identification Worksheet

Next Up: Part II The Benefits of AI and What You Will Need to Make It a Success

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!