Business partnering between Finance and Data management through driver-based modeling and data Lineage

Recently, I have encountered a lot of discussions within the FP&A community about business partnering. The challenge in such discussions is to move from the theoretical reasoning into practical execution. In this article I will highlight one area where cooperation between FP&A and Data management professionals can deliver mutually beneficial results.

This area combines two independent concepts from FP&A and Data Management: driver-based modeling and data lineage. Both concepts are rather new, and implementation may require significant resources. Seeing the commonalities and combining the resources and approaches for implementing both concepts simultaneously is what business effectiveness and partnering is really about.

In this article we will investigate:

- the origin of the common nature of the concepts of driver-based modeling and data lineage

- the essence of each concept

- the steps FP&A and data management professionals could take to create a mutually beneficial partnership

A similar value proposition of data management and FP&A in the business cycle is the foundation for pragmatic business partnering.

You can discover the common nature of driver-based modeling and data lineage by analysing the business lifecycle and value propositions of FP&A and Data management.

The strategic goal of each business is survival in the long-term. And in order to ‘survive’, a business needs to ensure a steady profit and proper asset management, data being one of these assets. The management of the business directly influences the realization of the key goal, which in its turn, relies fully on the decisions that are being made by top management of the company. To make decisions, the ones who make those decisions need to get appropriate information, which is very often expressed in performance indicators and/or KPIs. And in order to produce such information, first, you need to ensure delivery of appropriate data, key business drivers in particular. Each business function, which is a combination of business processes and people involved, participates in data processing and delivery in its own way. Technology and resources enable business functions to process and analyse data.

The key value proposition of both data management and FP&A is support and improvement of decision making on all management levels.

The ways to deliver this value proposition can differ. Data management is accountable for optimization of the data & information value chain. A data & information value chain is a set of business capabilities that enables the transformation of data into meaningful information required for decision-making on different management levels. Data lineage is the documentation of the data & information value chain.

FP&A is responsible for providing insight in information and advice on possible decisions to managers at different managerial levels. FP&A does it by applying relevant business planning and analysis techniques. Driver-based modeling is one of such techniques. It provides insights into dependencies between the key business drivers and performance indicators and forms the basis for effective financial planning and forecasting.

To deliver their value proposition, data management and FP&A would be wise to form a partnership that applies modern techniques from both disciplines, including driver-based modeling and data lineage. Let’s take a look at essence of these two techniques and find interdependencies.

Driver-based modeling

Driver-based modeling allows you to link business drivers with financial results. Consequently, we use financial results to measure our company’s success. In this context, ‘modeling’ means identification of relationships between operational business drivers and anticipated financial outcomes. These relationships are expressed in mathematical formulas. Financial outcomes and relationships between them are called ‘a driver-based model’.

Thus, a driver-based model is a simplified mathematical representation of relationships between operational business drivers and consequently generated business outcomes expressed in financial results and KPIs.

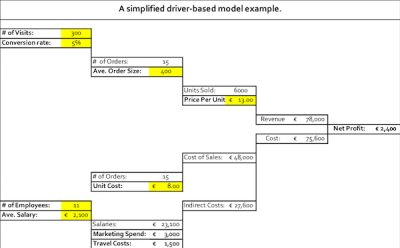

A simplified example of the driver-based model you can see in Figure 2:

The elements marked yellow are basic business drivers. Basic drivers are those that can’t be decomposed in other preceding drivers. They locate at the left edge in the Figure 2. Such drivers as ‘Number of visits’, ‘Number of employees’ are basic non-financial drivers. An ‘Average salary’ is an example’ of a basic financial (monetary) driver.

There are also some examples of derived business drivers such as Salaries. Derived drivers are drivers that are composed from other preceding drivers according some business rules.

Throughout the chain, you see which business drivers have an influence on Net Profit, which is a key KPI for almost any business.

Data lineage

Data lineage is documentation which describes how data is being transformed into information on its way from its origin to its final destination. We describe this transformation path by linking business processes, applications, and data elements. We need to know data lineage in order to:

- comply with regulations

- enable business changes

- improve the quality of data

- meet supervisor and audit requirements.

In you take another look at Figure 2, the business drivers (marked yellow) represent data elements that have been processed into meaningful information. In our case Revenue, Cost of sales and Net Profit represent the information produced as a result of data transformation.

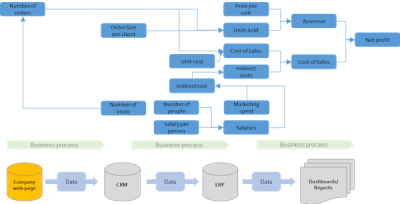

If the data lineage was built for the same data elements as in Figure 2, it would look something like this:

Those who would like to know more about data lineage, see my recent ‘Data Lineage 101-05’ article series.

If you compare Figures 2 and 3, you will see similarities between the representations of driver-based modeling and data lineage. This is some of the best evidence that coordinating the activities of finance and data management professionals will deliver mutual benefits for both functions and for the business as a whole. In the beginning I promised to show you how to take theory and convert it into practice. So here are a few practical tips for actions.

Tips for actions

1. Start the initiative: who is in charge?

It is clear that both finance (FP&A) and data management functions can profit from the initiative. But who has more power? Let’s be honest. Each company has finance as business function. Not all companies have formal data management function. Not having a formal data management function does not mean that the company does not perform data management related activities. But in any case, it would be more logical for finance to take on the sponsor role in such an initiative, considering its decision-making power within the company.

2. Scope the initiative

Find the most critical performance indicators (KPIs) used in the decision-making process. For those critical elements investigate the key business drivers by documenting data lineage. More on the subject of critical data elements you can read in my article ‘Critical Data Elements – How to Implement Them for Your Business’.

3. Specify the depth and length of data lineage.

The whole scope of data lineage starts with the original data sources and ends at the point of final usage. In large companies, especially those with many subsidiaries, such chains are rather long and complicated. That is why very often a company starts with a limited ‘length’ of data lineage, for example, at some point of data aggregation. More on the subject you can find in my article ‘Data lineage 105: Implementation guidelines’.

4. Choose the method and tooling to document driver-based model and data lineage.

One of the prerequisites for creating data-lineage it to have a formal data management framework in place. It means that finance can play a very important sponsor role in getting data in control by setting up such a framework.

The rest is simply question of finding feasible and ‘fit for purpose’ resources and tooling to document driver-based model and data lineage.

The whole company will benefit from it.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!