Which Pillar Will Be Most Critical To CFO Success In 2024?

For the third year in a row we polled the global finance community to determine if there have been shifts in what Pillar is most important to CFO Success.

A little background on the Four Pillars before we dig into this year’s poll results.

The Four Pillars of CFO Success

CFO.University identifies four primary proficiencies that drive the success of Chief Financial Officers. We call these the Four Pillars. The following is a brief explanation of each pillar and each pillar’s core competencies.

Accounting is the foundation on which the other three pillars of the Chief Financial officer role are built upon. Double entry book-keeping was developed over 500 years ago. Its key principles are still in practice today. Accounting is both an art and a science; a common language for business whose evolution improves the understanding and speed of commerce. Accounting’s core competencies include Controls/Governance, Recording and Reporting.

Finance uses the discipline and data from a strong Accounting team as the launching pad for planning and creating their company’s future. A seamless handoff between the Accounting and Finance departments is critical in creating and executing an effective strategy. The Finance function is about creating the optimum analytical framework to make strategic decisions. Finance’s core competencies include Planning/Budgeting, Forecasting and Investment Analysis.

Treasury is the pillar of the CFO function that provides the discipline and fuel to manage and grow a company’s capital base. Treasury encompasses three critical competencies for long term business success; Cash Management, Capital Raising and Risk Management. A successful CFO has the capabilities to effectively lead each one.

Leadership is the act of inspiring others to engage in achieving a goal. At CFO.University we view leadership along a spectrum that begins with self-awareness, grows through building teamwork skills with strategic leadership being honed after these first two building blocks are firmly in place.

Learn more about the four pillars from our e-book, The Four Pillars of CFO Success.

The Poll

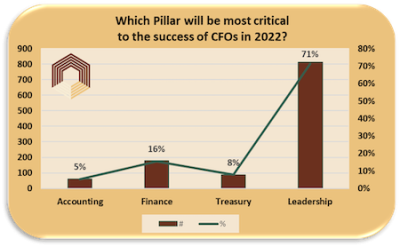

Our poll asked, “Which Pillar will be most critical to the success of CFOs in 2024?”

The Leadership Pillar garnered 71.3% of the vote, 1% more than last year and similar to the % vote received in 2021. Defined as the ability of an individual, group, or organization to “lead”, influence, or guide other individuals, teams, or entire organizations, this pillar dwarfs all others. Technical competency may still be valuable in small and medium sized companies but success in any CFO role is now dependent on leadership capabilities.

Here are some leadership resources you can tap into.

Select any number of Leadership Courses on CFO.University to improve your self-awareness, team building and strategic & planning skills.

Our Coaching program offers the rigors of all of our resources with an experienced finance leader to help shepherd your way. Learn more about it here, CFO.University Coaching Program

For more on leadership type “Leadership’ into the Keywords search bar on this page, CFO.University Library Search and hit the submit button

It’s ironic because in a world where everything is being left to the machines the human element has never been more important.”

One of the interesting shifts that has taken place has been the growing importance of the Treasury Pillar in the survey.

The Treasury Pillar collected 11.8% of the vote, 53% higher than in 2021. Managing cash, raising capital and risk management seem to be more critical when the economy is stressed with higher interest rates, inflationary pressure, including wage pressure from low unemployment and supply chain woes. The economy seems to be recovering from these pressures. We are curious to see where the Treasury Pillar will fit in if the economy continues to improve.

Stay on top of the Treasury Pillar with these resources.

One of the best ways to stay on top of your business is by planning for your cash needs before a crisis hits. Preparing a 13 Week Cash Flow Forecast is a great discipline that creates transparency in your near term cash requirements while growing your understanding of the business. Businesses start and end with cash.

As your growth plans accelerate it’s likely more funds will be needed to finance that growth. Tap into our CFO Success Series on Capital Planning and Financing if you find your business at this stage.

Select any number of Treasury Courses on CFO.University to improve your cash management, funding and risk management skills.

The Finance Pillar

The Finance Pillar with its forward looking focus CFOs are expected to center their attention on surprisingly declined in the polls by 23% over the past two years, from nearly 16% in 2021 to 12% today. As we come out of hunkering down from the recent economic scare and return to growth minded strategies we expect the Finance Pillar to grow in importance.

To help you grow with it, consider these resources.

Our Finance Pillar tools include the Simple Price, Gross Margin and Unit Variance Analysis, a great place to begin when breaking your business down to its component parts. It’s broad concepts can be used to create a common understanding among Board and Executive team members, employees and trusted advisors to the key moving parts in your organization.

Choose from our Finance Courses to develop your business planning, financial forecasting and investment analysis skills.

A growing discipline for CFOs is in top line growth. Learning from our CFO Talk Series on pricing is an excellent way to develop your skills in this area.

o CFO Talk: The CFO Pricing Pyramid with Anne Warren

o CFO Talk: Pricing Excellence and the CFO with Lynn Guinn

o CFO TALK - The Role of Finance in Pricing with Paul Barnhurst

o CFO Talk: The CFO as a Key Player in Pricing

The foundational role of the Accounting Pillar doesn’t get much love in our poll, finishing with barely 5% of the vote in each year of the poll. As a profession, we take this key pillar for granted. Without a strong Accounting Pillar the other Pillars are built on sand.

The Accounting Pillar

We believe the Accounting Pillar gets its bad reputation, primarily from these three reasons:

A historical (backward looking) perspective,

A control oriented nature and,

The perception of the masses that “Everything in accounting can be automated”

Contrary to these arguments against accounting, strong historical reporting provides business leaders the confidence to invest in finance, the forward looking aspect of the CFO role.

Similarly, controls provide the infrastructure that allows businesses to grow. Like breaks on a car, they allow you to go fast, but with confidence you can stop in time to avoid a collision.

Many roles in accounting can be augmented with automation and improved with AI. However, technology can not compensate for the complexity and ambiguity found in the activities of control, governance, recording and reporting that a well trained accountant delivers.

To keep or develop a strong Accounting foundation consider utilizing these resources

If you don’t think your accounting processes are keeping up with the times use the Process Redesign Workbook to create efficiencies and build a state of the art accounting function.

Here are some tools to help you in that process,

* General Ledger Analysis Tool

* Managerial Reporting Scorecard

Visit our Accounting Courses to shore up your accounting foundations, including controls & governance, recording and reporting.

And here is a fun training video to help build the accounting acumen of your non accounting teammates, Accounting and Finance for Non Accounting and Finance Professionals.

Leadership still takes the cake, by a long shot, but without the other Pillars to prop it up, Leadership can’t stand on its own.

Thank you to all 567 CFOs, FDs, accounting, finance and treasury leaders who participated in this years poll and especially to those who took the time to leave us with their thoughts in addition to filling out the survey. Here are some of your comments:

“I’m sure it won’t surprise you, my vote is for Leadership! At the CFO level this is the critical differentiator, as all the others can/should be handled by others in the team!”

- Sue Rosen, Sue Rosen Executive Coaching

“ Much of my career was spent in smaller organizations Steve, and I still believe that the components of leadership are critical because we must start with self-leadership. We still need to find a way to step out of the detail, even when that is part of our remit, and see the big picture around strategy and culture, or we will drown in the detail and never grow.”

- Sue Rosen

“Depending on generative AI for these fundamentally hard skills… (but also requiring macro-level sensitivities, so they also have some soft skill aspects, as well), except for accounting, which is always backward looking and more objective if its governing rules are sincerely followed,… is an interesting idea given these models well-known limitations and poor training sets. I am not even alluding to the tail-risk events happening from 2007 to today. As opposed to what many voters think, I believe that leadership would be among the least important pillars. Considering the current conditions and future expectations, I expect maintaining a strong treasury, as well as managing both cash and the risk, to be extremely hard.”

- Selim Hasagasioglu, Aringo MBA Admissions Consulting

“Steve Rosvold I love reading your posts. The deeper I get into my career the more I realize that as you move up the ladder you have to learn to let go. Most of us started in this field because we are deeply analytical people who want to do everything precisely and by the book. We were often very good with computers and not great with people. But in the 20 years I have now practiced in accounting much has changed. The days where just getting the numbers right and looking crisp off the printer are gone. Being fast on a 10 key is largely meaningless in a world where machine learning and OCR have automated away most of our processes and reduced our team size from entire departments down to a room full of people. The importance of our role is now communicating the “why” behind our mission often alongside our founders and CEO to our entire team and then we have to turn around and wear a different hat as we communicate the “why” to our boards and investors as to why our funds are being used in the most ruthlessly efficient way possible. It’s ironic because in a world where everything is being left to the machines the human element has never been more important.”

- Nicholas Rutledge , Financial Controller, Arc & Naya

“Sales is not an option?”

- Rocky LaGrone, Founder/CEO

“Steve Rosvold agreed. The ones that don’t are part of the Sales Prevention Dept.”

- Rocky LaGrone

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!