General Ledger Analysis Tool

This tool has been developed to help you determine your General Ledger structure, summarize the complexity of detail required for major accounts and where streamlining efforts may have the highest returns – providing a big boost to closing quicker with better account analysis.

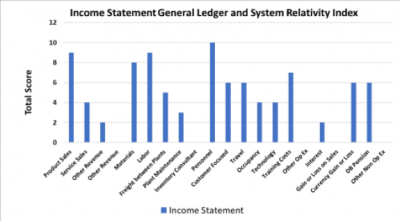

The tool uses importance (size), number of fields (amount of data required) and efficiency potential (number of transactions) for the activities reflected in each account. The Accounts with the highest scores deserve the most attention. As you select systems to support your business and evolve your general ledger for financial reporting this information will be invaluable in helping you keep the “Big Picture” in mind.

Using your chart of accounts this tool requires you to evaluate each account on a relative basis using the following criteria:

- Size: This criteria relates to the account balance. If it’s an income statement account the annual balance is the benchmark. If it’s a balance sheet account compare average balances. The bigger the account balances the higher the score.

- Number of Fields: The number of fields required for an account to be accepted helps measure the complexity of related to properly processing a transaction. This is especially true of balance sheet accounts where matching details becomes and an important step in smooth and errorless processing. We recommend you also consider the subsystems used to maintain your accounts when comparing accounts for this step and this is mandatory if the subsystem is used as the main system to keep track of specific account balances. An example of this could be in your ERP system when inventory is maintained, with summary balances delivered to your general ledger periodically.

- Number of Transactions: Even accounts with relatively small balances can create risk if they have large activity. Small errors on many transactions in an account can lead to large problems. Examples of these type of accounts include those processed near period end (credit cards charges, accounts receivable or accounts payable), so they frequently contain small balances on management reports but include significant daily activity.

The scoring system is simple. We weight each category the same, add up the scores and display the rankings on the graphs next to your inputs or the 2ndpage of your report when “print” the worksheet.

Let us know how we can improve the tool to better serve you.

Use the tool now!

Tools

- General Ledger Analysis Tool

This General Ledger Analysis Tool has been developed to help you determine your General Ledger structure, summarize the complexity of detail required for major accounts and where streamlining efforts may have the highest returns. The tool uses importance (size), number of fields (amount of data required) and efficiency potential (number of transactions) to help you determine how to improve you general ledger and account analysis.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!