Are You Ready For Robotic Process Automation?

Robotics Process Automation (RPA ) is not new, but it is still not well understand. This is especially true when applying RPA to finance systems. We appreciate Anders sharing some of his do’s and don’ts regarding RPA that will help you use it more effectively in your finance operations.

What is Robotics Process Automation?

Let’s start with the basic question and demystify any odd perceptions of the concept. All it is, is an automated work flow where you use a piece of software to carry out a specific task. One vendor showed how they had 1,000s of standard robots that could be plugged straight into your ERP system and perform a specific task. If you have a process which they were yet to cover with one of their robots they would simply create it for you. The robot will execute the task for you without fail and around 99,95% uptime which is excellent for any given system uptime. You can run with fully automated tasks or you could build in manual checks should you wish so whereby you would confirm that a given part of the work flow had been performed before the robot would move on to the next one. Some of the tasks to be performed could be data pulls, sending e-mails, processing payments etc. but even some FP&A tasks and other more complex tasks could be automated.

What are some of the do’s and dont’s?

The robot can do repetitive tasks for you fast and efficient with no downtime and no breaks – I’ll show you the economics later. However, if you have a broken process it doesn’t make sense to plug a robot into it. You need first fix your processes and then plug your robot in. The good news is that you don’t have to redesign your full process landscape as you can plug robots into individual processes where than fully automating an end-to-end process. Ideally, of course, you would like to aim a full end-to-end automation but for many companies this is unattainable now in my opinion.

Another thing to get right is to code the robot right from the beginning. Yes, it can do a lot of tasks for you fast and efficient but it could also be doing a lot of tasks wrongly fast and efficiently if you haven’t covered all the necessary steps in your process. In addition, you should have a clear plan with what to use the freed-up resources for. Do you let them go, retrain them or assign them to different tasks yet to be automated?

Tell me what the robot costs then?

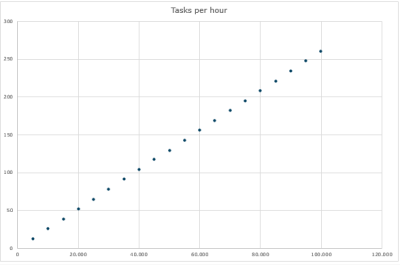

To build a business case you need to know what to automate and the cost of said automation. The price point mentioned at the conference was 20¢ per task. If you then consider a worker who works 40 hours a week for 48 weeks a year (without any breaks which is unrealistic, of course, but arguments sake) then depending on the fully loaded FTE cost of said worker here are how many tasks the worker needs to perform per hour to compete with the robot.

So, it’s just above 50 tasks per hour per $20,000 annual fully loaded FTE cost. Now try for yourself with a simple task such as sending 50 e-mails to different people with slightly different content. How many can you do an hour? How many can you do a day? Now compare that with your own fully loaded cost and see where you stack up against the robot. Seems like a simple business case, doesn’t it?

Take a few minutes to ponder these three questions:

1. Where are you on the journey with Robotics Process Automation in your company or specifically in the finance function?

2. Are there any learnings you can share from working with the robots?

3. Finally, how far are you from being able to automate end-to-end processes such as Order to Cash (OtC), Procure to Pay (PtP) or Accounting to Reporting (AtR)?

Anders and CFO.University are curious to learn about your RPA journey!

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!