Top 10 Mistakes Owners and CFOs Make When Valuing Their Company

Valuing a business is one of the most important tasks for business owners and yet, many business owners and their CFOs often have no idea of the true value of their company.

A business valuation determines the fair market value of the business, which is important for a variety of reasons including mergers and acquisitions, taxes, investment, and financing. Unfortunately, business owners and CFOs often rely on “back of the envelope” valuations that result in critical mistakes that will either under-value or over-value the business.

Fair Market Value: “the price at which the asset would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts”

Here are the top 10 mistakes that business owners and their CFOs make when valuing their company:

1. Ignoring the industry and market trends: A business’s industry and market trends influence its valuation and it’s important to rely on the right benchmarks for comparison. Getting this wrong can significantly undervalue or overvalue a business.

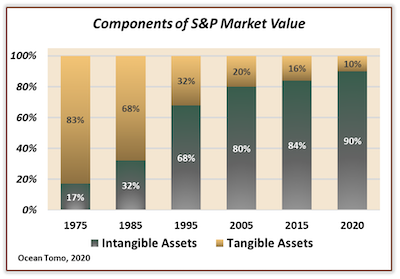

2. Overemphasizing assets: Business owners and CFOs often focus on tangible assets such as equipment, inventory, and buildings, while neglecting intangible assets such as intellectual property, brand value, customer base and most importantly, employees. These intangible assets can significantly impact the business’s valuation and, as the chart below shows, intangible assets make up the lion’s share of a company’s value today as compared to previous decades.

Learn more about intangible assets, like brand & intellectual property, and how to leverage and protect them in these two pieces:

3. Not accounting for liabilities: Business owners and CFOsoften overlook or underestimate their liabilities such as overdue creditor invoices, long-term debt, and legal disputes in the valuation of the company. These liabilities can reduce the business’s valuation.

Related: What Is My Business Worth?

4. Neglecting the future: Many business leaders have heard that valuation is done by simply using a market-based method that relies on an EBITDA multiple. However, valuation is a forward-looking exercise where future expected performance is key. The income approach values a business based on its future earnings potential and neglecting this approach can lead to an inaccurate valuation.

Related: More on EBITDA Calculations

5. Relying on outdated financial statements: A valuation is always as-of a particular date; a snapshot in time. Business owners need to use financial statements that align with the date of valuation when valuing their company. Using outdated financial statements, or the wrong financial statements, can significantly misrepresent the value of business.

Related: The CFO’s Dilemma: Speed Or Accuracy?

6. Neglecting normalizing adjustments: Certain extraordinary or non-recurring expenses may warrant adjustment. These ‘add-backs’ might demonstrate a better profitability picture and neglecting such adjustments can lead to undervaluing a business.

Related: Adjustments to EBITDA

7. A lack of objectivity: Business owners are emotionally attached to their company, and they oftentimes produce overly-optimistic forecasts which could result in overvaluing the business. Assumptions that underpin the forecast should be reasonable and well supported. The classic “hockey stick” forecast won’t pass the sniff test for investors.

8. Not consulting professionals: Valuing a business is a complex task that requires professional help that often includes disciplines like legal, accounting, and wealth management in conjunction with a valuation professional. Business owners who do not consult professionals can make critical mistakes by not considering the entirety of the circumstances or the ramifications of certain decisions from various lenses.

9. Neglecting discounts: Privately owned companies lack the liquidity that their publicly traded counterparts enjoy. Since a shareholder in a privately held business can’t sell their shares on a stock exchange whenever they choose, a discount for this lack of marketability reduces the value of their ownership position.

Related: 7 Reasons Why You Should Get a Business Valuation

10. Lack of clarity in the business plan (or no plan at all): A business plan should outline the company’s path forward with documented support for the growth and profitability assumptions. A lack of clarity in the business plan can lead to undervaluing or overvaluing a business, and the absence of a business plan could signal a red flag to potential investors.

Related: Here’s What Should Be in Your Plan

The Cost of Not Knowing The Value of Your Business

Valuing a business is a complex process that requires careful consideration of various factors – many more than what is discussed here.

Not knowing the true value of your business can also lead to unforeseen risks. For example, if you are not aware of the value of your business, you may be underinsured, which can be a major issue if your business suffers a catastrophic event such as a natural disaster or cyber-attack.

Additionally, not knowing the true value of your business can lead to operational and financial risks. You may be making decisions based on incomplete information which can ultimately harm your business. For example, if you don’t know the true value of your business, you may not be aware of the financial risks associated with taking on too much debt, which can lead to cash flow problems down the line.

It is important to know the true value of your business in order to make informed decisions, attract potential investors, and protect your business from legal and operational risks. If you’d like to discuss this topic, please feel free to reach out.

Learn more about Dave, a global leader in business valuation, by visiting his library, Dave’s Library.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!