How Much Is Your Business Worth?

Understanding multiple of EBITDA calculations.

There are many techniques used to estimate business value, but the technique most familiar to small business owners is the multiple of EBITDA represented by this basic formula:

EBITDA x Multiple = Business value

The formula is simple, but widely misunderstood. We often hear business owners say things like “My competitor just sold her company for 6 times EBITDA, so my company must be worth 6 times EBITDA also.” Or “Companies in my industry typically sell for 4 - 8 times EBITDA.” The owner then does a mental calculation of their business’s value, and “the number” becomes the presumed sale price. And it’s almost always wrong.

We’ve worked with scores of business owners to plan or execute their exit and one of the first things we do is establish a realistic current business value. The valuation we develop is often quite different from what our clients have calculated on their own.

In this article, we’ll explain how to use the multiple of EBITDA formula more accurately. This article is not a substitute for engaging a valuation professional, but it should help to make those rule-of-thumb calculations more realistic.

Part 1 - Understanding the difference between the EBITDA on your financial statements and the “Adjusted EBITDA” that is used in valuation.

Part 2 - What’s the right multiple for your company?

Part 3 - How does “business value” translate into a sale price.

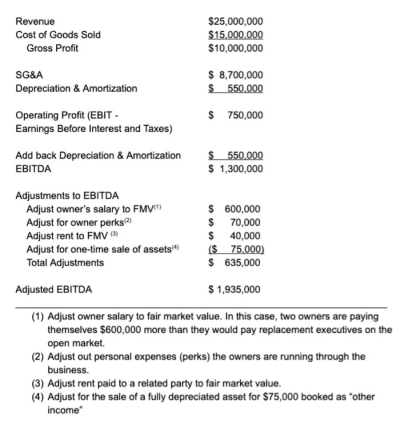

Throughout this article, we’ll use a fictional company named ACME Manufacturing to illustrate our points. We’ll assume that ACME Manufacturing is operated by two founders. In the last twelve months, it had $25 million in annual revenue and $1.3 million in EBITDA. We’ll learn more details about ACME’s business as we work through this formula.

PART 1: UNDERSTANDING THE DIFFERENCE BETWEEN EBITDA AND ADJUSTED EBITDA.

(EBITDA) Earnings Before Interest, Taxes, Depreciation, and Amortization is a common way to evaluate the operating cash flow of a company. When valuing a business, it’s customary to use trailing 12 month EBITDA. In cases where a company has seen unusual increases or decreases in EBITDA over the past few years, it may be more appropriate to use an average of EBITDA over that time period. It’s important not to cherry-pick the time period if you want a realistic valuation. Regardless of which period is used, there’s an important step in valuation calculations that’s often overlooked: “normalizing” or “adjusting” EBITDA.

Adjustments to EBITDA are designed to help a would-be buyer evaluate the company’s cash flow potential under their ownership.

The most important adjustments to EBITDA center around the compensation paid to owners. If the owners are drawing higher than market salaries, the difference between actual and market salaries would be added back to EBITDA (e.g. The company would show higher profit if owners drew lower, market-level salaries). Similarly, if the owners are drawing below market salaries, EBITDA would be adjusted lower to reflect what it would really cost to pay the management team at market salaries. Remember, the objective here is to help a would-be buyer understand the cash flow of the company under their new ownership.

Owner compensation includes all owner “perks” as well. For example, owners often run personal expenses (e.g. car, country club, personal travel, etc.) through the company to reduce taxes. EBITDA needs to be adjusted (increased) for these expenses, as the new owner may choose to manage these items differently.

Another common area of adjustment occurs when the business is renting real estate from a separate but related company. For example, if there is a separate entity with overlapping ownership that owns the factory or office building the company occupies, the rent charged by that separate entity may be above or below market value. If the company being valued is paying above-market rent (the most common scenario) then the difference between market rent and the actual rent paid is added back to EBITDA. (e.g. the company would show higher profits if it were paying market rent). The reverse is true if the company is paying below market rent.

Other adjustments to EBITDA include non-recurring revenues or expenses (e.g. one-time changes to accounting methods, relocating the business, unusual litigation expenses or gains, the sale of assets, etc.). The full range of these potential adjustments is beyond the scope of this article, but the example below should illustrate the EBITDA adjustment process:

In the example above, the Adjusted EBITDA for the year is $635,000 higher than the EBITDA reported on an income statement. Companies ACME’s size often trade at multiples of between 4 and 8 which means, adjusting the EBITDA added between $2,540,000 ($635,000 x 4) and $5,080,000 ($635,000 x 8) to the valuation - a pretty big difference!

PART 2: WHAT MULTIPLE OF EBITDA APPLIES TO YOUR BUSINESS?

In part one we described the difference between the EBITDA reported on your accounting statements and the Adjusted EBITDA used in valuation. In this part, we talk about the factors that influence the multiple that is applied to adjusted EBITDA to determine company value.

The table of median multiples, below, represents a reasonable starting point for determining the multiple for any company based on its size and industry. As a manufacturing company with adjusted EBITDA of $1,935,000, the median valuation for a company like ACME Manufacturing would be 6.

Extracted from the 2022 Private Capital Markets Report produced by the Pepperdine Private Capital Markets Project.

Extracted from the 2022 Private Capital Markets Report produced by the Pepperdine Private Capital Markets Project.Having a median value for your industry and company size is useful, but it’s important to recognize that the actual multiple applied to your company by a potential buyer can vary widely based on their perception of the risks versus rewards of buying your company.

Buyers will evaluate a variety of factors to determine the multiple that will serve as the basis for their purchase offer. Here are some of the most important factors:

Size matters

It is a fact that companies with higher revenue and earnings trade at higher multiples than smaller companies. When it comes to business valuation, bigger is better, all else being equal, and that is reflected in the median multiples table above.

Competitive Advantage

Acquirers generally buy what they cannot easily create themselves, so expect a higher multiple if you have a distinct competitive advantage in the marketplace. This often comes from intellectual property in the form of patents, know-how, and/or exclusive rights to a specific product or service in your market. These competitive advantages generally translate to higher profits and thus higher values in the Adjusted EBITDA portion of your valuation, but they will also impact your multiple if a potential acquirer believes these advantages can be exploited on a larger scale under their management. Innovation and intellectual property, more than any other criteria, have the ability to drive outsized multiples and valuations.

Trends

Revenue and earnings trends are almost as important as the numbers themselves. For example, we’ve shown that ACME Manufacturing has $25 million in revenue and $1,935,000 in adjusted EBITDA, but we haven’t looked at trends. If ACME has been growing at 20% per year to arrive at the current performance, the multiple is likely to be adjusted up. On the other hand, if revenue and earnings have been stagnant, the multiple might be adjusted down. Buyers will pay for momentum and the likelihood of future growth. Declining businesses are viewed as especially risky and they will be discounted, sometimes heavily.

Recurring Revenue

The stability of recurring revenue streams reduces the buyer’s risk, and their annuity-like value may help the buyer to obtain acquisition financing. Whether your customers are locked in via long-term contracts or they have simply established a long history of choosing your products or services over others, recurring revenue translates into higher multiples.

Industry and geography

Valuation multiples vary by industry (as demonstrated by the table above) and also by geography. Companies in fast growing industries and/or fast-growing regional economies command higher multiples than those in stagnant or declining industries and/or economies. Similarly, companies near major metropolitan areas with access to larger markets and more talent, tend to have higher multiples than similar companies in rural areas.

Business Dependence

How dependent is your business on a small number of customers, vendors or employees? In the eyes of a buyer, dependence equals risk. If one customer is responsible for 20% or more of your business or if you have a sole-source supplier for a critical part, a buyer is going to discount their valuation of your company. In cases of extreme customer concentration (e.g. more than 50% of revenue from just three customers) it may be difficult to attract serious buyers no matter how profitable the company is.

Management Depth

One of the most common barriers to selling a smaller company is excessive dependence on the owner(s). Successful founders tend to be smart, demanding and very hard-working. The traits that allow a founder to power through the many obstacles to building a company can make it difficult to delegate, and to develop an empowered management team. Buyers view over-dependence on the owner as a risk. A sale transaction will probably provide the seller with a “life-changing” sum of money. Will he or she stick around and be able to check their ego sufficiently to work with the new owners? Buyers worry about these things and they will pay more for a company if it’s not overly dependent on the owner(s), if it has a solid management team, a trained staff and well-established business processes.

Accounting Practices

Accounting is the language of business. If your accounting systems are well-organized and consistent, then everything from calculating Adjusted EBITDA to measuring recurring revenue will inspire buyer confidence. Quality accounting is expected. Sloppy accounting introduces uncertainty and risk, and lowers multiples.

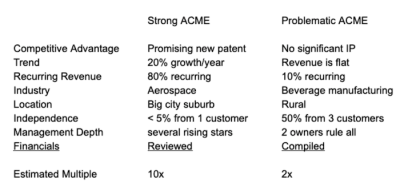

Applying risk factors to ACME Manufacturing

In our example company, ACME Manufacturing, we would analyze each of these categories to identify risks and advantages, to determine whether an appropriate multiple would be higher or lower than the median multiple of 6x. The examples below demonstrate how different a final multiple might be depending on how well ACME scores in the categories we’ve outlined.

Determining a reasonable multiple is always a subjective process. Indeed, each prospective buyer may arrive at a very different answer. It’s human nature to be optimistic about your company’s value, but it’s dangerous to build an exit plan based on optimism.

As we move forward with our ACME Manufacturing example, we’ll assume that the company has some challenges that reduce their multiple from the industry median of 6 to 4.5.

PART 3: THE DIFFERENCE BETWEEN “VALUE” AND SALE PRICE.

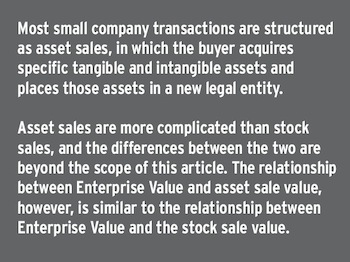

By now, you may have noticed a problem with our valuation formula - it doesn’t take company debt into consideration. That’s because the multiple of EBITDA formula is used to estimate a company’s Enterprise Value.

Enterprise Value represents the total value of a company, including its value to shareholders and debt holders. It reflects the value of the entire capital structure. Enterprise Value is helpful in comparing companies with varying debt levels, but companies aren’t sold based on their enterprise value.

Imagine two companies with the same Adjusted EBITDA and multiple, but one has significant long term debt and the other has none. Using our formula, both would have the same Business Value or Enterprise Value, but would you expect both companies to have the same sale price? Of course not.

For simplicity, let’s assume that ACME Manufacturing is sold in stock sale - a full transfer of the legal corporate entity including all balance sheet account balances.

To estimate the shareholder value in a stock sale, we need to subtract long term debt from the Enterprise Value we calculated using our multiple of EBITDA formula.

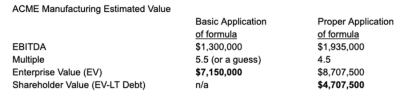

In our ACME Manufacturing example, we established the company’s adjusted EBITDA as $1,935,000 and its multiple as 4.5. ACME’s Enterprise Value would be $8,707,500 (adjusted EBITDA X 4.5).

Let’s also assume that the company has long term debt of $4 million. The purchase price in a stock sale would be adjusted to about $4,642,500. ($8,707,500 in Enterprise Value - $4 million in long-term debt). Even though a buyer acquires all assets and liabilities in a stock sale, the value of that stock will be established based, in part, on the amount of long term debt being assumed.

Working through these steps will lead you to a reasonable approximation of your actual business value. Let’s review how our process impacted ACME Manufacturing’s valuation.

For most business owners, their companies represent their largest asset by far. Developing a realistic estimate of that asset’s value requires the proper use of valuation techniques. Imagine how different the ACME owner’s exit plans might be if they based them on an assumed sale value of $7,150,00 instead of the more realistic value of $4,707,500.

We hope this three-part series has given you a better understanding of one of the most common methods for estimating business value - the multiple of EBITDA. Even with this new understanding, there are two very important things that business owners need to keep in mind:

1) Producing an accurate business valuation requires an objective assessment of the company and an understanding of the broader merger and acquisition market. There is no substitute for professional, objective valuation assistance when making important exit planning decisions.

2) Professionals can provide accurate valuation ranges, but even professional valuations are merely estimates of value based on historical information and professional judgement. The ONLY way to know the actual value of a business is to offer it to potential buyers with proper planning, effective marketing and experienced guidance. Ultimately a business is worth what a buyer will actually pay for it.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!