Is Planning Dead?

Finance leaders all over the globe are struggling to amend their corporate planning process in the midst of a world that has turned upside down.

Operations and finance teams are debating how to effectively plan under today’s uncertainty, ambiguity and generally murky economic variables.

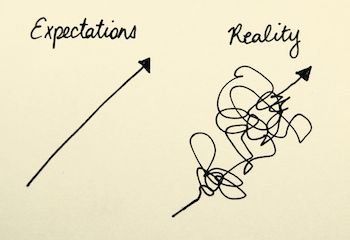

Is planning dead? was the provocative title of a panel I joined recently. In the lead-up, I had the opportunity to talk to a number of leaders to get their thoughts on the topic. The visceral reaction from most was an emphatic “no” -but then a pause. Most realize that in a world with such uncertainty, reality is unlikely to align with our plans. There is also a realization that there are major flaws in how businesses currently plan, which need to be ironed out quickly.

So, is planning dead? We should start off with asking ourselves why we plan in the first place.

If you fail to plan you are planning to fail

Benjamin Franklin

Planning seems simple – until it isn’t.

Planning at its heart is a decision-making activity. Plans are simply the articulation of the actions you intend to undertake to hit your desired goals, best summarised by these three activities.

1. Gathering intelligence.

The first part of planning is to step back and understand in detail the current state of play. It sets the scene for any decisions the company or individual can then take.

2. Assessing the alternatives to choose an optimal path.

The next stage is to evaluate the actions you can take based on current information, with consideration to the strategy of the organization and it’s existing resources. This is a balancing of the benefits against the risks of those alternatives to come to a conclusive decision on how to act.

3. Coordinating teams and resources.

Aligning, resourcing, and motivating teams to act, but also understanding and overcoming resistance, anxiety, and limitations.

Done best, this is a continuous process where new learnings get built in to adapt the plan.

This description of planning and its benefits is uncontroversial, but the value is in the understanding of where it breaks down.

Planning can create harmful frictions in your business.

The list below is unlikely to be exhaustive but outlines some of the key frictions we have seen to successful planning.

1. Poor intelligence: Believing your intuition over the data.

Intelligence gathering in organizations is mostly poor. For instance, the median cycle time for the annual budget cycle is 32 days. Even during less volatile times, the data is automatically out of date when it’s collected. The result is often that any data is ignored and, as many a senior executive has said to me, “decisions get made from the back of an envelope calculation.”

2. Poor communication: Lacking specificity and simplicity.

Most people believe that planning is a purely financial activity. It is also often communicated that way and planning and analysis teams mostly sit within finance teams. Plans are often communicated as “increasing revenues by 5%”, “reduce costs by 10%”, or “improve margin by 2 points”. Not only is the way finance-speak is conveyed non-understandable to the majority of people without an accounting degree, it is also ridiculously unactionable. “How do I do that?” is the exasperated demand of most operators when they see such a plan.

3. Expecting certainty: If I say so, so shall it be.

The world has a wonderful ability to tear up even the most thorough and well-presented models from business analysts. Despite this, when plans and budgets don’t hit the model’s expectations, people start getting blamed. This situation is only worsened due to plans being in 12 month or quarterly cycles. Especially now, the situation can often change within weeks.

Rather than sit down and learn what happened and iterate, people just either get performance managed out of the business or go to great pains to explain their performance.

4. Politics: If you align a bonus to a plan, what do you expect?

With incentive compensation often aligned to plans and budgets, it provides the strongest of incentives to distort a plan. Planning becomes a game of power and negotiation rather than seeking value and the truth. It also doesn’t help the planning process when the teams actioning and formulating them are divorced from each other in separate functions.

5. Lacking ownership: Planning is something someone else does.

It is rare to meet an organization where employees take ownership of plans. They feel neither ownership nor purpose around them. Planning needs to be aligned and collaborative, but people also need to know how their plans fit the overall objectives of the company.

These planning frictions can be overcome by becoming agile and adaptive.

These frictions are mostly not hard to remove. Organizations with the right mindset can remediate them quickly. Here are some recommended remedies.

Step 1: Get your management information and metrics in order.

I might be a broken record on this, but getting your data structured in a way that gives you a clear picture of what is going on in your business will be a key differentiator for companies. Refer to this series on Data Lineage for more details

Step 2: Become operational and simple in your language.

Get rid of all financial acronyms. Use the language that operators use day in day out. Get granular.

For example, rather than requesting a 10% reduction in employee cost, break it down into operational language. Language like “limit overtime to no more than 2 hours on a Thursday” is more direct and actionable.

Step 3: Plan shorter, and build in follow-ups and learning.

Quorso data shows that when a specific plan is actioned for three weeks, 85% of the resulting benefit remains for the next nine months. Planning needs to become an adaptive learning process, where companies adjust as they learn what is going right, and what is going wrong.

Step 4: Rethink organizational structure and incentive plans.

Firstly, planning and analysis should not sit within finance. As it’s core to business operations, it should sit with the business decision-makers. Its place in a separate team creates negative dynamics. Secondly, align any incentives to overall business goals and be flexible to changing them if they do not support the business at this time.

Step 5: Remember culture eats strategy for breakfast.

This will be the hardest thing to get right: creating an environment where people feel a joint sense of purpose to get the business achieving its goals. Although difficult, it is perhaps the most necessary component to transform planning into something that allows adaptation and success in the new normal. Here is a timeless article on how the framework we use to communicate can improve our culture, Communication That Can Change a Culture

So, planning isn’t dead after all. If anything, it’s vital lifeblood to a successful organization and ensures the best operational decisions are being made. Too often it is seen as a routine activity divorced from the true needs of the business, but fix its frictions and it can be incredibly beneficial – even in a world as uncertain as this one.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!