Which Pillar Will Be Most Critical to CFO Success in 2025?

As we enter our fourth year of running this poll, the gap between the pillars continues to widen. For the fourth consecutive year, we surveyed the global finance community to uncover whether there have been shifts in the importance of each Pillar of CFO Success. The results tell a compelling story.

The Four Pillars of CFO Success

At CFO.University, we have identified four primary proficiencies that drive the success of Chief Financial Officers—what we call the Four Pillars. Here’s a brief overview:

- Leadership: The cornerstone of inspiring teams to achieve goals. It starts with self-awareness, builds through teamwork skills, and culminates in strategic leadership.

- Treasury: The discipline for managing and growing a company’s capital base. Key areas include cash management, capital raising, and risk management.

- Finance: The forward-looking pillar that transforms accounting discipline into strategic insights. Core competencies include planning, budgeting, forecasting, and investment analysis.

- Accounting: The bedrock on which the other pillars stand. With roots in double-entry bookkeeping, it is both an art and a science, emphasizing controls, governance, and reporting.

For more details on each Pillar and the competencies that define great CFOs study our eBook: The Four Pillars of CFO Success.

The Poll Summary

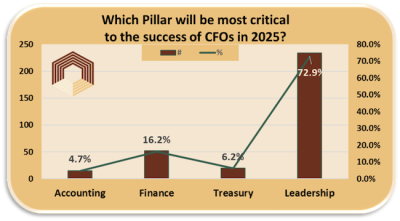

This year’s poll asked: “Which Pillar will be most critical to the success of CFOs in 2025?”

Poll Results

- Leadership: Dominates with 73% of the votes—the highest percentage since we began this poll.

- Finance: Surged by 33%, to 16% of the total, solidifying its place as the second most critical Pillar.

- Treasury: Dropped to just over 6%, following a turbulent year of financial instability in 2023 - a banking crisis that upset the capital markets, higher interest rates and inflationary pressure - that settled down over the course of 2024.

- Accounting: Slipped to its lowest level ever at under 5%, reflecting its taken-for-granted foundational role.

Leadership: The Unstoppable Force

Leadership has never been more critical to CFO success. As technical skills become table stakes, the ability to inspire, guide, and influence others is now the differentiator. Defined as the ability of an individual, group, or organization to “lead”, influence, or guide other individuals, teams, or entire organizations, this pillar dwarfs all others. Technical competency may still be valuable in small and medium sized companies but success in any CFO role is now dependent on leadership capabilities.

“With leadership the company can have SMART objectives, and more realistic forecasts, because of the leadership the accounting becomes more sincere, and the accounts more regular. The leadership leads us to a neutral vision, unbiased analyzes and more rational risk management.” – Fatah Sahel

Leadership Resources

- The Expanding Role of the CFO: Learn how your role is growing and why leadership is key.

- Leadership Courses: Develop self-awareness, team-building, and strategic skills.

- Coaching Program: Partner with an experienced finance leader to elevate your impact.

- Search for “Leadership” in ‘Keywords’ in the CFO.University Library for more on Leadership.

Treasury: The Wild Card

After spiking last year, Treasury’s importance dipped. CFOs seem to have settled in after the mayhem caused by the banking jitters caused by the failures of Silicon Valley Bank and Credit Suisse in early 2023 Managing cash, raising capital and risk management appear to causing less stress as business leaders experience lower interest rates, less inflationary pressure and reduced supply chain woes. The economy seems to be recovering from these pressures which is reflected in the poll results.

Counter to this trend and in a bold call out to finance leaders,

“…Leadership is a given, but functional knowledge—specifically Treasury—is critical.” – Matthew Harlan

Treasury Resources

- Counterparty Risk Primer: Broaden your risk management perspective.

- Cash Velocity Calculator: Free up capital tied in working capital accounts.

- Capital Planning and Financing Series: Equip your team for growth.

- Treasury Courses: Improve your cash management, funding and risk management skills.

Finance: Rising Star

As we shift from reactive to proactive strategies, the Finance Pillar is making a comeback, driven by the integration of AI and data analytics.

With an emphasis on the forward-looking focus CFOs are expected to center their attention on, this Pillar solidified its rank as the 2nd most critical Pillar to CFO Success. As we come out of hunkering down from the 2023 economic scare and return to growth minded strategies, CFOs expect the Finance Pillar to grow in importance. The promise of AI seems especially strong in the planning and forecasting areas of the CFO suite, likely giving the Finance Pillar an added boost in importance for year. This Pillar rose by 33% from last year’s poll.

Finance Resources

- Unlocking the Power of AI in Finance: Insights from Prashanth H Southekal, PhD, MBA, ICD.D l and Tariq Munir.

- Finance Courses: Hone your planning, forecasting, and investment analysis skills.

- CFO Talk Series on Pricing: Learn strategies to drive top-line growth.

...CFO Talk: Pricing Excellence and the CFO with Lynn Guinn

...CFO Talk: The CFO Pricing Pyramid with Anne Warren

...CFO TALK - The Role of Finance in Pricing with Paul Barnhurst

Accounting: The Overlooked Foundation

The foundational role of the Accounting Pillar gets less and less relevant in the results of our poll over the past four years, finishing at its lowest level ever, 4.7%, this year. As a profession, we take this key pillar for granted. Somewhat like the baker, who takes their flour for granted. Beware, the long term quality of your product will suffer if you don’t properly care for the key ingredients.

Without a strong Accounting Pillar the other Pillars are built on sand, or in the case of the analogy above, your dough won’t rise.

We believe the Accounting Pillar gets its bad reputation, primarily from these three reasons:

- A historical (backward looking) perspective,

- A control-oriented nature and,

- The perception of the masses that “Everything in accounting can be automated”

Contrary to these arguments against accounting, strong historical reporting provides business leaders the confidence to invest in finance, the forward looking aspect of the CFO role.

Similarly, controls provide the infrastructure that allows businesses to grow.

“Like breaks on a car, they allow you to go fast, but with confidence you can stop in time to avoid a collision. ” - Steve Rosvold

Many roles in accounting can be augmented with automation and improved with AI. However, technology can not compensate for the complexity and ambiguity found in the activities of control, governance, recording and reporting that a well trained accountant delivers.

Accounting Resources

- Process Redesign Workbook: Streamline and modernize your accounting functions.

- Tools like the General Ledger Analysis Tool, the Financial Close Assessment and Managerial Reporting Scorecard.

- Accounting Courses: Reinforce your foundation in controls, governance, and reporting.

- This fun training video will help build the accounting acumen of your non accounting teammates, Accounting and Finance for Non Accounting and Finance Professionals.

Key Takeaway

Leadership may take the spotlight, but CFOs cannot succeed without the support of Treasury, Finance, and Accounting. The pillars work in harmony to build a resilient and effective CFO function.

We extend our gratitude to everyone who participated in this year’s poll and shared their insights.

What leads the way? Leadership. Who leads the way? Leaders.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!