The New Frontier – Talent as the Central Theme to Resource Management

Talent acquisition, development and retention have always been an ingredient for business success. Since the 1970s a transition has taken place. Talent has universally become the essential ingredient responsible for corporate success.

As the world has evolved from the age of industry to the age of information, human capital (talent) is becoming the benchmark of corporate success. Jobs and businesses based on human intelligence are continuing to grow. Over the last 45 years business value has shifted from assets and products based to intellectual and service based.

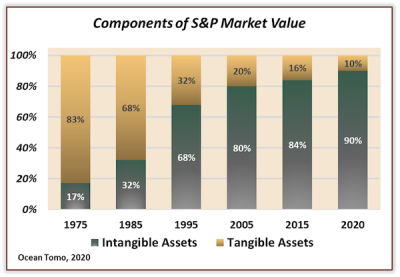

The information in the graph below is from Ocean Tomo. It divides corporate market value on the S&P 500 between tangible (brick and mortar) and intangible (human/Intellectual capital) assets.

The graph highlights a major shift that has occurred over the past 45 years. The market value ratio between tangible and intangible assets, which was nearly 5:1 in 1975 has more than reversed and now sits at 1:9, tangible:intangible.

This shift has driven management’s focus from physical assets to human talent. The long term success of our businesses in the future won’t rely on making the best widget or having the best process. It will be having access to the talent we need to continually innovate the way we solve problems for our customers. New ideas and disruptions are decaying the value of our widgets and processes at a faster pace than ever before. This is still an accelerating trend. People are our most valuable resource and they are becoming a larger portion of business value every year.

This is why building a strategy and culture around talent has never been more critical. How well businesses focus on the recruitment, development and retention of human capital will be the difference between success and failure. The culture we build for our talent to thrive…or dive… in, is the main component in employee engagement. As every study shows, employee engagement increases the contributions from individuals, improves the performance of the team and the bottom line of the company.

Generally, CFOs know the treatment of talent in our financial statements is inadequate. It doesn’t show up on the balance sheet and gets expensed on the income statement. That almost seems backwards.

Talent as an asset doesn’t readily conform to our traditional accounting framework. The practice of expensing, rather than capitalizing, most talent compensation (salaries, labor) hides the value being created from human capital in our conventional GAAP financial statements.

To make matters worse look at this. The graph below highlights a dramatic change in the growth of the U.S. working population.

The graph highlights that working age population growth in the United States has plummeted since 2002. The notional additions to the labor force will be the smallest in the last 150 years! Not only is our talent becoming more valuable, its availability is becoming more scarce. A gut punch for those companies still managing their plant and equipment ahead of their talent. The data included in the graph is based on the United States, but I have a hunch it also describes the situation in quite a few developed countries.

This message, combined with the struggle many company’s and employees are having with remote professional development – a key to employee engagement and retention - underscores the importance of getting our remote development systems and processes right. This article, Professional Development for Accounting and Finance Leaders in a Post Covid-19 World, addresses this issue for CFOs, accounting/finance leaders and their teams.

So, human capital, our most valuable resource is getting more difficult to acquire, develop and retain. Plus, we don’t have any good ways to measure our talent’s impact on corporate success. In some parts of the world the accounting for a large portion of our talent costs are treated as a variable expenses, like a spigot to be turned off and on at will. Is that any way to treat our most valuable resource?

These major accounting flaws combined with the demographic and remote work challenges facing us are causing finance chiefs to re-evaluate the practices, assumptions, models in order to better capture intangible value derived from our talent.

Here is an example of how financial statements are being supplemented with related information on human capital.

The Human Capital Management Institute has developed statements to report on human capital in formats similar to traditional financial statements. They have a taken a page out of the book Luca Pacioli wrote in 1494 about double-entry bookkeeping, to come up with the following:

Human Capital Statements

Human Capital Impact Statement

- Supplementing the Income Statement, this statement measures the human capital impact on financial performance over a period of time.

Human Capital Asset Statement

- Comparable to the Balance Sheet, this quantifies the total value of the workforce. It also breaks down the value contributions by job category or by key roles.

Human Capital Flow Statement

- Comparable to the Cash Flow Statement, this statement quantifies and tracks the changes in the workforce by job class and the key steps along the talent management life cycle:

Human Capital Disclosures

- The Society for Human Resource Management has recommended that all public companies voluntarily disclose information related to their human capital management.

Summary

A better understanding of how the talent in our businesses creates value is an important step in developing a high performing workforce. This understanding will guide us in our recruiting, development and retention efforts and create an engaged talent force.

With a highly subjective value, human capital can be difficult to measure. However, the concept continues to develop and the insights being uncovered give CFOs, CEOs and top executives a fresh perspective on how to develop talent. Using this framework with your executive team as part of resource planning will put the “human” back in your capital planning process.

I can really use your help finding answers to this dilemma. Please share the steps you are taking to address these concerns. I’ll commit to sharing that feedback with all who participate. Together we can make some great headway on one of the biggest challenges facing CFOs and their companies in the coming decade.

I would enjoy learning how you manage and report on the value and cost of your talent.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!