Strategic Pricing: Mastering Pricing in the Dynamic Professional Services Market

Achieving effective pricing strategies for professional services (PS) firms is a balancing act between ensuring profitability and nurturing client satisfaction. This journey not only requires a deep dive into the firm’s own operational costs but also demands a keen understanding of the market’s dynamics and the value delivered to clients. Our experience working with different firms helped us make this practical guide, aiming to demystify the complexities surrounding pricing models. There are numerous insights into various strategies, from the foundational cost-plus model to the more nuanced value-based pricing; we aim to enlighten and guide firms towards sustainable growth and deeper client relationships.

Understanding Firms Costs

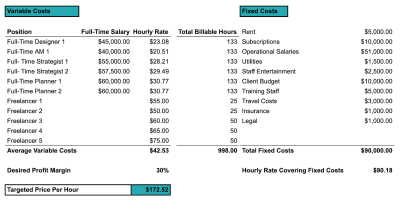

At the heart of every firm’s pricing strategy lies a thorough understanding of its operational costs. This foundational knowledge serves not just as a ledger of expenses but as a strategic tool for crafting a pricing model that aligns with both the firm’s sustainability and its clients. Variable costs, such as salaries and freelancers, and fixed costs, including rent and software subscriptions, constitute the baseline for firms to begin to shape their pricing. By allocating these costs across billable hours, firms can determine a base hourly rate. However, the real artistry comes in adding a desired profit margin, a decision that hinges not just on covering costs but on positioning the firms competitively in the market.

Example:

The personnel cost-to-revenue ratio offers a lens through which firms can assess the efficiency of their pricing model. Keeping this ratio at 60% or below strongly indicates a healthy balance between personnel costs and revenue. This suggests that the firm is not just keeping operational efficiency but is also on a path to growth and profitability. This metric is more than a number; it’s a reflection of how well an firm manages its resources and maximises its billable hours. In this context, understanding and managing firm costs becomes a dynamic process of strategic planning that supports the firm’s journey from merely surviving to actively thriving in the competitive landscape of the creative industry.

Learn more about flat rates vs hourly rates in this article by Mark Stiving, Pricing: Flat Rates vs. Hourly Rates: Which One Should You Use?

From Hourly to Value: Pricing Models

Transitioning from traditional hourly billing to more contemporary pricing models like value-based and performance-based pricing signifies an evolution in the way firms align their services with client expectations and market demands. Hourly billing, while straightforward, often places the focus on the quantity of time spent rather than the quality of outcomes achieved. This model can inadvertently set the stage for a misalignment of firms-client goals, as clients are more interested in results than how long it takes to achieve them. On the other hand, value-based pricing shifts this dynamic, emphasising the firms’s ability to impact the client’s business significantly. By anchoring the price to the perceived value of the services rendered, firms can foster a more collaborative and goal-oriented relationship with their clients.

Value-based pricing, while incentivising firms to drive tangible results, carries its own set of risks. This model can place firms at the mercy of factors beyond their control, such as market fluctuations or changes in the client’s internal priorities, which can significantly affect the firm’s compensation. Furthermore, a heavy reliance on performance metrics might encourage short-term thinking, potentially sacrificing long-term brand building or more strategic decision making for immediate results. Firms must also consider the administrative burden of tracking and validating performance metrics, which can add complexity and cost to client relationships.

Both models require a delicate balance between risk and reward, and firms must navigate these waters carefully to ensure that the shift from hourly billing does not jeopardise their financial stability. Implementing safeguards, such as minimum retainer fees or caps on performance fees, and maintaining an open, ongoing dialogue with clients can help mitigate these risks, ensuring that the firms-client relationship remains mutually beneficial.

Performance-Based Pricing: A Double-Edged Sword

With performance-based pricing, firms venture into a model that directly links their compensation to the results they deliver for their clients. This approach can be advantageous, fostering a deep alignment between firms efforts and client outcomes. A well-crafted performance-based pricing model incentivises firms to push the boundaries of creativity and effectiveness, as their financial success becomes intrinsically tied to their clients’ success. For instance, setting up tiered incentives based on specific performance milestones, such as the number of new accounts opened or the percentage increase in online engagement, can motivate firms to aim higher and think more strategically about their campaigns.

However, the allure of potentially higher rewards comes with its pitfalls. The volatility of relying solely on performance-based income can place firms in a precarious financial position. A dramatic example can be seen when a client decides to slash their marketing, consulting or advisory budgeta, significantly affecting the firm’s revenue overnight. Such scenarios underscore the risk of having all your eggs in the performance-based basket. Firms must navigate these waters with caution, implementing safeguards like minimum retainer fees that offer some income stability. Balancing the risk and reward of performance-based pricing requires a keen understanding of both your firm’s resilience and the client’s market dynamics. By marrying the promise of higher rewards with the security of a stable base income, firms can harness the benefits of performance-based pricing while mitigating its inherent risks.

Learn how to use the pricing pyramid to develop optimal pricing strategies from pricing expert Ann Warren, CFO Talk: The CFO Pricing Pyramid with Anne Warren

Tailoring Pricing to Client Needs

The essence of a successful firm lies not just in its creative output or strategic advice but in its ability to adapt its pricing strategy to meet the diverse needs of its client base. Recognising that each client is unique, with varying budgets, goals, and levels of market maturity, requires a flexible approach to pricing. For startups or businesses in growth phases, for example, traditional retainer models may not always be feasible. In these cases, firms might consider equity-based arrangements or performance incentives that align more closely with the client’s financial realities and growth aspirations. Such tailored pricing strategies facilitate a partnership approach to client relationships and underscore the firm’s commitment to shared success.

Similarly, when working with startups, especially those eyeing an exit, another innovative pricing strategy involved attaching a percentage of the exit profit to the standard retainer fee. We implemented this approach with a client of ours, and we not only aligned the firm’s efforts with the client’s long-term goals but also demonstrated a vested interest in the client’s ultimate success. These examples highlight the importance of understanding each client’s unique position and goals. By moving beyond a one-size-fits-all pricing model to embrace more customised arrangements, firms can better serve their clients’ needs while incentivising outstanding performance. Tailoring pricing strategies in this manner requires not just a deep understanding of the client’s business but also a flexible approach to contract structure, ensuring that both parties are invested in the success of their partnership.

Understanding your clients needs and aligning with them if further highlighted in this CFO Talk with Lynn Guinn, a pricing leaders in Cargill’s Center of Excellence, CFO Talk: Pricing Excellence and the CFO with Lynn Guinn

Transitioning Between Pricing Models

The decision to shift from one pricing model to another is monumental and can significantly impact both firms operations and client relationships. Such a transition requires careful planning, clear communication, and a nuanced understanding of the implications for all stakeholders involved. Drawing from experience, a strategic approach to this transition is first pinpointing the rationale behind the move. For example, a firm might find its unit economics unsustainable under the current model, prompting a shift towards a more profitable structure. This was the case when transitioning to a retainer-based model due to the inefficiencies and financial strain of hourly billing, which often needed to account for the value delivered accurately.

Successfully navigating this transition involves a phased approach, starting with introducing the new model to new clients while maintaining existing arrangements until a suitable time for renegotiation. This gradual shift allows the firm to test and refine the latest model in real-world scenarios, ensuring it meets operational needs and market expectations. Once many new clients are onboard with the new pricing structure, the firm can begin conversations with longstanding clients, outlining the benefits and addressing any concerns. It’s essential to manage this process with sensitivity and transparency, reinforcing this changes value to the client-firm relationship. Ultimately, the goal is to achieve a seamless transition that supports the firm’s long-term sustainability and enhances the quality and scope of client services.

Final Thoughts

As we conclude our exploration of firms pricing strategies, it’s clear that the journey towards finding a suitable model is complex and deeply individualised. Each strategy offers unique advantages and challenges, from hourly billing to value-based and performance-based models. The key to success lies not in choosing the “best” model in absolute terms but in selecting and adapting a strategy that aligns with your firm’s values, capabilities, and goals, as well as the needs and expectations of your clients.

The transition between pricing models, adapting to client needs, and implementing innovative pricing strategies underscore a fundamental truth: mutual trust and shared objectives are the heart of any successful firm-client relationship. As firms continue to navigate the an evolving landscape, flexibility and pricing transparency will become increasingly vital. This journey is not about pursuing perfection but the continuous adaptation and growth towards mutually beneficial partnerships.

In sharing these insights and experiences, we aim to illuminate the path for firms seeking to refine their pricing strategies. Firms can confidently navigate pricing complexities by embracing a mindset of openness, curiosity, and resilience, ensuring their longevity and prosperity in a competitive marketplace. Remember, the goal is to sell and build lasting relationships that thrive on shared success and collective achievement.

Yiannis is the founder of growthCFO,Learn more about him here, Yiannis Papadopoulos

*Thumbnail image from Storyset

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!