Can we really “Stop using Excel”?

An article from the Wall Street Journal recently stirred up a commotion in the Finance world. The article, Stop Using Excel, Finance Chiefs Tell Staff, is about Microsoft Excel.

A few days after, the astonished author wrote another article, Finance Pros Say You’ll Have to Pry Excel Out of Their Cold, Dead Hands, based on all the responses the first article got.

The title says it all – Indeed, if you want to get any CFO’s blood racing – with excitement or anger, that is subjective, talk about Excel. Everyone has an opinion about it.

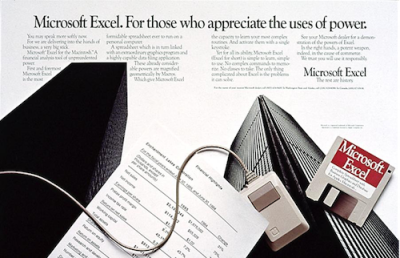

Microsoft must have seen it coming.

When Microsoft first launched Excel, the ads they released predicted just how massive it would be.

“Microsoft Excel. For those who appreciate the use of power. A financial analysis tool of unprecedented power.”

Another ad read:

“Microsoft Excel. The soul of the new machines. And the heart of a business solution that will make as much sense five years from now as it does today.”

Fast forward 30 years, Microsoft Excel is still the undisputed leader in spreadsheets with more than 750 million users, and remains a staple in most offices. Honestly, who doesn’t use Excel? Its accessibility, ease of use, and flexibility just makes Excel the first choice for crunching numbers.

Facing today’s challenges with Excel

However, to quote another Excel ad from the 80’s – ”The computer world was a very different place five years ago. Chances are, your business was too.”

How far has Excel come to address the current needs of business users?

Here are some of the challenges CFOs and their teams face when using Excel as a budgeting and planning tool :

- Data Consolidation

- Scalability

- Collaboration

- Accuracy

- Flexibility

- Security

- Control

Microsoft continually works with active Excel users through online communities such as UserVoice, to really listen to what they are saying and respond to them with new features.

The question is, are those new features powerful enough? While they may be sufficient for some level of business needs, there are still risks, especially when Excel is the primary tool for budgeting and planning.

“Excel just wasn’t designed to do some of the heavy lifting that companies need to do in finance,” said Paul Hammerman, a business applications analyst at Forrester Research Inc.

Replacing Excel

Some organizations believe that Excel needs to be eliminated from primary business processes. Realistically, that’s easier said than done. Circling back to that Wall Street Journal article, some end-users, even top executives, will not let their spreadsheets go without a fight.

Nevertheless, more and more organizations are implementing new finance systems to mitigate risks and to streamline processes. Some are choosing to implement innovative cloud solutions, while others turn to “tried-and-true” systems from SAP, IBM, Microsoft, etc. In both cases, these new solutions respond to very specific business requirements – planning, forecasting, reporting, KPI, dashboards, etc.

Organizations need to be aware that most proprietary solutions are closed and have limited ability to communicate with other systems. This could present some challenges in data consolidation and consequently, data integrity.

Despite “successful” implementations, end-users typically still turn to Microsoft Excel to provide them the flexibility to manipulate and transform data exported from those new systems. End-users still turn to Excel to get their job done and to meet the needs of management. This begs the question, is the new system successful when at the end of the day, your business process still leads back to Excel?

Finding the sweet spot between Excel and finance solutions

The best solutions are practical solutions – in the sense of implementation, control, flexibility, and user adoption.

Excel is a great tool for finance, when used with systems that provide control and that buffer Excel’s limitations. Leveraging an end-user’s existing knowledge about Excel ensures quick and successful user adoption, and maintains required flexibility that is needed for complex business requirements.

Look for solutions that strengthen the whole system. Other technologies allow you to build finance solutions (cloud or on-premise) based on data models that are completely open to connect to and from Excel, or any other 3rd party solutions.

Some technology automatically consolidates and aggregates data which is then accessible through Excel spreadsheets, reporting systems, as well as visualization tools such as PowerBI, Tableau or Qlik. These solutions achieve an open, live collaborative system that allows end-users and management to work together from a single-source of truth.

End-users who choose Excel as their main interface to planning and forecasting solutions are able to enjoy the flexibility they need. However, instead of spending countless hours administering and reconciling versions upon versions of spreadsheets and formulas, users spend their time analyzing and making valuable and informed decisions.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!