5 Indicators That Your Company Needs A Finance Transformation – Growth Of Finance Function Expenses Exceeds Revenue Growth (Part 1 Of 5)

This is the first in a 5-part series of articles that will help you identify if your company is a prime target for Finance Transformation.

The first key indicator: The percentage growth of Finance Function expenses exceeds percentage revenue growth.

As a component of fixed cost, a Company should strive to have Finance Function expenses grow at a slower rate than revenue. Although fixed in the short-term, Finance Function expenses typically have significant variable components. This causes Finance Function expenses to be fixed in the short-term as the same resources can manage large changes in volumes (both revenue and transactions) but will require investment to meet long-term requirements if a company continues to grow in scale and depth (many business units, divisions, subsidiaries, etc…).

During times of steady growth, the spend on the Finance Function should increase at a slower rate than revenue. For example, if a company increased sales from $10 million to $12 million (20% increase) while accounting and finance spend during the same time period increased from $200 thousand to $220 thousand (10% increase) the lower accounting and finance expense growth (10% compared to 20% for sales) will drop to the bottom line, increasing net operating profit.

Comparing the Growth of Finance Expenses to Growth in Revenue

The first in the series of potential indicators that your Company may be in need of a Finance Transformation is to look at the cost to perform the Finance function as a percentage of revenue over time. Preferably, it should be looked at on a historical basis on a 3, 6 and 12-month basis. When the 3-month average exceeds the 6-month average, a company should begin to investigate causes. If the trend continues and the 3 and 6-month trend exceeds the 12-month average, a full Finance assessment should be performed to determine if the increases are justified.

Many times, strategic investment in the Finance function is required to meet the long-term objectives of the Company justifying the increases, but not always. Frequently, and especially in smaller organizations, the headcount/cost of the Finance Function will outpace revenue in the short-term. This may be reasonable and justified over short periods of time if it is in preparation for expected revenue growth, integration of new acquisitions, new IT systems implementation, creation of new business lines or service offerings or balance sheet recapitalizations such as a debt issuance, or an initial public offering (IPO). Over the intermediate term (9-12 months) those fluctuations should even out.

When using the cost to perform the Finance function as a percentage of revenue as a benchmark to peers, remember to only look at Companies in the same industry. For example, a retailer’s cost to perform the Finance function as a percentage of revenue over time will be significantly different than an energy or capital goods manufacturer. Many times, it is best to benchmark your Company against its historical average to avoid this type of distortion.

A similar metric can be to take total General and Administrative expenses as a percentage of revenue to determine operational leverage. Which metric will be best for your Company will depend on your needs and access to data.

If the analysis indicates your organization’s Finance function expenses are growing faster than revenue, you have a strong signal your organization needs a Finance Transformation.

For tips on calibraing business and finance growth read CFO Success Series: For Best Results, Business Development Should Be Symmetrical

Microsoft’s Finance Transformation

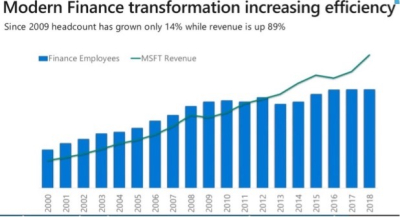

A Company that has done exceptionally well in its execution of a Finance Transformation is Microsoft. On slide 13 of the below SlideShare presentation, you can see that Microsoft has been able to grow revenue by 89% over the designated period, but Finance headcount has grown only 14%.

Modern Finance at Microsoft US from Microsoft

What may be most amazing about the above chart is that people think Finance Transformation means headcount reductions. Over the designated period Microsoft had a significant increase of 14% more people from the base period. That is net new Finance positions.

https://www.slideshare.net/Microsoft/modern-finance-at-microsoft-us

Through leveraging technology, Microsoft has been able to shift its Finance people’s time from task management, transaction and operational execution to deep analytical and strategic thinking, influencing, negotiating and project management. Instead of focusing on boring, mundane, transaction-level work Microsoft’s Finance personnel became business partners, supporting the growth and profitability of the company so it could achieve such record-breaking revenue growth.

Conclusion

Analyze your Finance Function’s expense growth relative to revenue growth. If the function’s growth is near or exceeds revenue growth, it is a strong indicator your Finance Function is an excellent candidate for Finance Transformation.

If you determine you organization is ripe for Finance Transformation, contact me or Steve to help you through your journey.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!