The CFO’s Role in Performance Management

Welcome to Contributor Brian Higgins, Principal at the Management Resources Technologies, Ltd. We are happy welcome him to CFO.University.

Today, many organizations – both private and public alike – are under pressure from owners, executive management, and activist investors to improve financial/operational performance necessary to either maintain their competitive leadership or to address financial challenges posed by today’s economy. When any of the following occur, the organization can benefit from a prescriptive review of their operations:

- Changes in the business environment due to economic downturns, loss of market share, product/service maturity, mergers and acquisitions, deregulation, etc., that impact performance.

- Growing costs without a similar growth in revenues.

- Increased demands for performance accompanied by budgetary constraints.

- Revisions to strategies that require redeployment of effort towards more mission-critical practices.

- Lack of knowledge regarding the true cost and profitability of products, services, and market channels.

- Declines in employee engagement and/or customer loyalty affecting competitive performance.

- Overlap, duplication, and non-mission-critical effort expended on activities across functional boundaries, generating excessive and avoidable costs.

- When you need to grow the business but cannot afford to do so.

- Desire to establish or maintain a leadership position in a highly competitive market.

When organizations are faced with financial and operational challenges an shortfalls noted above, the CFO is often looked upon as the “go-to” person expected to provide leadership that will navigate the organization through troubled waters. Unfortunately, many executives having this responsibility may not have the wherewithal, tools, or systems to succeed during economic challenges and they in turn reach out to others for assistance such as Lean, Six-Sigma, Continuous Improvement, etc. As such, the CFO and the Finance team often have a symbiotic relationship with others engaged in improvement initiatives that depend on, and trust in, Finance to provide timely and accurate financial information. Yet, according to the Chief Financial Officer Insights from the 2017 IBM C-Suite Study…

Only 16% of the CFOs believe the finance organization is effectively combining information from different parts of the enterprise – of vital importance.

A critical component to effective financial and operational performance management is accurate data by which informed management decisions can be based. To that end, organizations rely mostly on financially-based costing systems which are void of the necessary information to make such decisions and, as such, the wrong conclusions usually result in the wrong solutions. For example, an important component missing in most managerial cost-accounting systems is the inclusion of non-financial stakeholder information – critical to the determination of value. That said, most financially based performance methodologies omit, or fail to connect, critical information that plays a key role in enhancing financial and operational excellence. Information, including perceptual and experiential data, is often missing and is most critical in the identification of value or the lack thereof.

In addition to understanding critical financial and operational information, executives need tools to gain a more accurate and truer picture of the costs and profitability of their products and services. However, financial information alone is not enough to identify breakthrough opportunities in performance. Tools necessary to improve financial and operational performance should include, but are not limited to, the means to lower costs, improve quality, enhanced revenues, engaged employees, and not just create satisfied customers but a growing legion of loyal customers as well.

Activity Value Management® (AVM®), the topic of this course, provides the linkages necessary to achieve outstanding, and oftentimes breakthrough, improvements in financial and operational performance by linking data elements that until previously have not been fused for the purpose of improving performance. Unique features of AVM include, but are not limited to, a revolutionary method of accurately and precisely costing organizational outputs while assessing the financial performance of products and services that includes cost and effort; inclusion of stakeholder experiential data seamlessly linked to the work processes for the purpose of defining value; and an assemblage of specifically designed tools that can be applied to produce significant performance improvements accompanied by enhanced customer satisfaction and loyalty.

In addition to the CFO’s role in performance management, today’s Finance team also has responsibilities and a support role associated with, but not limited to:

- Forecasting and budgeting. AVM recognizes the fixed and variable components contained in activities and drivers. As such, projections of future spending are not treated as linear costs, but reflect the cost behavior of resource components included in each activity. This feature allows for more predictable spending under conditions of change and uncertainty.

- Strategic and tactical planning. Each organizational activity identified through AVM can be assessed as to whether it contributes to, or detracts from, the strategic direction of the organization. Oftentimes, there is a gap between the strategic plan and the operational response to that plan – AVM closes that gap by measuring the alignment of activities to goals and objectives.

- Wage and salary administration. Since unique resource job profiles are created in AVM, the administration of wage and salary information can be more precise and individually tailored. AVM can identify mismatches between individual employee expense and preferred activity compensation levels – identifying where highly-compensated employees are performing tasks that could be performed by lesser-compensated staff.

- Quantification of “soft areas.” Negative drivers can be assigned “hard costs” by linking activities to such areas as poor communications, inadequate training, lack of information, poor planning, inadequate employee engagement, etc., bringing to light the costs associated with events and circumstances that hamper performance that previously could not be measured.

- Improvement diagnosis. The prescriptive diagnostic capabilities of AVM will identify the most opportune areas of concentration for other improvement methodologies such as Lean management, Six-Sigma and Lean Six-Sigma, that ensures the highest possible ROI.

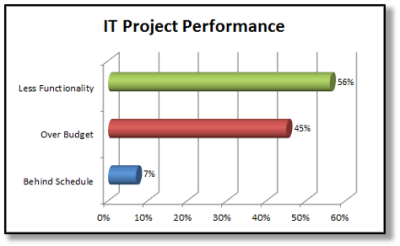

- Investment analysis. Analyzing project investments necessary to understand the ROI is oftentimes difficult, if not impossible, to perform. IT projects for example, have a poor

success rate (Bloch, M., Blumberg, S. & Laartz, J. Delivering Large-Scale IT Projects On Time, On Budget, and On Value, McKinsey & Company [October 2012], pg. 1.). Project benefits and ROI can be easily determined using AVM by examining the impact that the project will have on activity costs, efforts, and performance. For each activity potentially affected by the project, the necessary changes to the activity that must be incorporated in the project can be identified. Also, if the project performs as required, the change to the activity cost can be estimated, forming the foundation for the ROI computation. Given the financial size of IT projects – major ERP investments entail tens of millions of dollars – require a thorough analysis of both the costs and benefits. Such analysis can be performed in short order after an AVM diagnostic study is performed.

- Strategic pricing. Oftentimes, prices for many products and services are set without a complete understanding of costs or competitive positioning. Qualitative information captured from customers can confirm the expected value proposition and the gaps that exist with respect to the customers’ experience and the delivery of products and services. Through the understanding gained through an AVM study that links customer experiential data with organizational outputs, prices can be established that maximizes profitability, competitiveness, and market share. Prices should be established based on price elasticity, product utility (ability to address unmet needs by competitive offerings), customer alternatives, and a thorough understanding of costs as provided through an AVM analysis.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!