The CFO’s Guide to Financial Statement Analysis

Among the primary tasks of an analyst is to do a substantial evaluation of financial statements. In this overview, we will break down one of the most important approaches, types, as well as approaches to financial analysis.

This guide is developed to be useful for both inexperienced and seasoned financing professionals, with the main topics covering:

(1) the income statement,

(2) the balance sheet,

(3) the cash flow statement,

and (4) rates of return.

Income Statement Analysis

The majority of experts start their financial statement analysis with the earnings declaration. Intuitively, this is normally the first thing we consider with a business ... we usually ask concerns such as, “How much revenue does it have?” “Is it profitable?” as well as “What are the margins like?”

In order to respond to these concerns, and a lot more, we will study the income statement to get going.

There are 2 primary kinds of evaluation we will certainly do: vertical analysis as well as horizontal evaluation.

Vertical Analysis

With this technique of evaluation, we will look up and down the income declaration (for this reason, “upright” evaluation) to see just how every line thing compares to revenue, as a percentage.

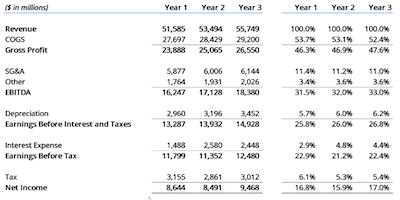

For instance, in the income declaration revealed listed below, we have the total dollar amounts and also the portions, which make up the upright analysis.

As you see in the above instance, we do a comprehensive analysis of the income statement by seeing each line item as a percentage of income.

The vital metrics we consider are:

- Cost of Goods Sold (COGS) as a percent of revenue

- Gross profit as a percent of revenue

- Depreciation as a percent of revenue

- Selling General & Administrative (SG&A) as a percent of revenue

- Interest as a percent of revenue

- Earnings Before Tax (EBT) as a percent of revenue

- Tax as a percent of revenue

- Net earnings as a percent of revenue

Horizontal Analysis

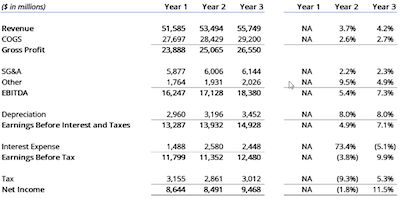

Currently, it’s time to consider various means to evaluate the income declaration. With horizontal analysis, we look at the year-over-year (YoY) modification in each line thing.

In order to execute this workout, you need to take the worth in Period N and also separate it by the value in Period N-1 and then subtract 1 from that number to obtain the percent modification.

For the example below, earnings in Year 3 were $55,749, as well as in Year 2, it was $53,494. The YoY adjustment in income is equal to $55,749/ $53,494 minus one, which equates to 4.2%.

Balance Sheet and Leverage Ratios

Let’s proceed to the balance sheet. In this area of monetary statement evaluation, we will certainly evaluate the operational performance of a business. We will take numerous products on the income declaration and also compare them to accounts on the balance sheet.

The balance sheet metrics can be split right into a number of classifications, consisting of liquidity, leverage, as well as operational effectiveness.

The primary liquidity proportions for a business are:

- Quick ratio

- Current ratio

- Net working capital

The main leverage ratios are:

- Debt to equity

- Debt to capital

- Debt to EBITDA

- Interest coverage

- Fixed charge coverage ratio

The main operating efficiency ratios are:

- Inventory turnover

- Accounts receivable days

- Accounts payable days

- Total asset turnover

- Net asset turnover

The Related Article: The 10 Most Important Profitability Ratios Every Business Needs To Understand

Making use of the above economic proportions, we can determine how successfully a firm is producing revenue and also how rapidly it’s marketing the stock.

Utilizing the financial proportions derived from the balance sheet as well as comparing them historically versus market averages or competitors will certainly aid you to analyze the solvency as well as leverage of a business.

Cash Flow Statement Analysis

With the income statement as well as the balance sheet under our belt, let’s look at the cash flow statement and also all the insights it gives us into the business.

The cash flow statement will certainly assist us to recognize the inflows and also outflows of cash over the time duration we’re looking at. Cash flow declaration summary

The cash flow declaration consists of 3 parts:

- Cash from operations

- Cash used in investing

- Cash from financing

Each of these 3 sections tells us a one-of-a-kind as well as an important part of the firm’s sources and uses of money over a particular amount of time.

Lots of investors think about the cash flow statement is one of the most essential signs of a firm’s performance.

Today, capitalists promptly turn to this area to see if the company is in fact earning money or otherwise and what its financing needs are.

It’s important to comprehend how various ratios can be utilized to correctly analyze the procedure of a company from a cash administration standpoint.

Connecting the 3 statements with each other in Excel is the building block of economic modeling.

Rates of Return and Profitability Analysis

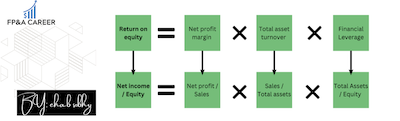

In this part of our evaluation of financial statements, we unlock the chauffeurs of economic efficiency. By utilizing a “pyramid” of ratios, we are able to show how you can figure out the earnings, and performance, as well as utilize motorists for any company.

The key insights to be derived from the pyramid of ratios include:

- Return on equity ratio (ROE)

- Profitability, efficiency, and leverage ratios

- Primary, secondary, and tertiary ratios

- Dupont analysis

By constructing the pyramid of proportions, you will obtain an incredibly solid understanding of business as well as its economic declarations.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!