From Vision to Execution: Initiating the Finance Transformation Journey

The term “Finance transformation” gets more and more attention these days. This is a very complex subject and requires a clear definition. Finance transformation is a strategic initiative through which a CFO reimagines, restructures, and optimizes its financial operations, systems, and processes to achieve higher levels of efficiency and effectiveness. This definition itself is very inclusive and result-based but also presents another question, where does Finance Transformation start? Finance Transformation is a process that begins with a visionary outlook and well-defined short and medium-term objectives. At its inception, the Chief Financial Officer (CFO) plays a significant role in shaping this vision. They chart the course for a comprehensive overhaul of financial operations that aligns with the organization’s evolving goals. This process demands a thorough evaluation of existing financial processes, systems, and methodologies to identify areas that require improvement and innovation.

Identify Roadblocks – the starting point.

Process efficiencies are often hindered by manual processes, legacy systems, and a lack of collaborative environment.

At the beginning of the transformation journey, the CFO is responsible for identifying generic roadblocks that hinder the realization of the envisioned objectives. These obstacles may encompass a range of challenges, from operational inefficiencies linked to routine manual processes, legacy technology systems, lack of collaborative platforms, etc. These inefficiencies prevent the ability to meet the ever-growing demands of stakeholders. Recognizing these impediments is integral to formulating effective strategies for finance transformation. The solution to eliminate these roadblocks often entails a multi-faceted approach.

Optimization of Costs

Cost reduction initiatives to optimize efficiency and resource allocation are crucial pillars. Organizations can consolidate certain finance functions into shared services centers or outsource non-core financial activities. This approach can lead to economies of scale, reduced headcount, and cost savings while maintaining the quality of service. Cost optimization often involves identifying and eliminating redundant or manual processes. By automating routine tasks such as data entry, reconciliation, and reporting, the finance department can streamline the team by eliminating excessive effort, thereby cutting labor costs. Solutions can also span from rationalizing overhead costs to reengineering workflow procedures to unlocking financial resources that can be redirected toward strategic initiatives.

Technology Evolution

We must reengineer our processes, upgrade our ERP system, and advance our data analytics capabilities.

Advancing the current state of technology is another cornerstone in the finance transformation journey. Leveraging robust financial systems, automation tools, and data analytics not only accelerates decision-making but also elevates the accuracy and understanding of financial information. This includes modernizing the existing technology platforms that empower organizations to navigate complex financial landscapes with agility and real-time insights. For instance, modernizing financial planning and budgeting processes allows for better allocation of funds. Accurate forecasting and efficient budgeting can prevent overallocation and wasteful spending. Leveraging digital tools and data analytics can help finance departments gain insights into financial performance and trends.

Being more efficient

A holistic view of finance transformation extends beyond cost reduction and technological upgrades and encompasses process optimization, data governance, and standardization efforts. The finance team can ensure consistency and clarity and enhance collaboration by streamlining processes across geographies and business units. Bringing efficiencies to the finance team is another area of finance transformation. It promotes the adoption of standardized processes and systems across the organization. This reduces the complexity of operations and makes it easier to manage and reducing the need for specialized roles or redundant efforts.

Assessing the Opportunity

However, evaluating the finance process with the self-assessment approach has limitations but can still be overcome by forming a separate internal finance transformation team. This standalone formation is necessary due to daily involvement in business-as-usual activities. At the same time, the finance team possesses insights into known problems but may inadvertently overlook issues that have yet to surface. Moreover, the team’s day-to-day obligations can impede their ability to allocate adequate time and resources to assess thoroughly. This constraint could hinder the achievement of desired outcomes from the assessment process. To overcome these challenges, a separate finance transformation team should consist of key members from each finance function, such as one person for each process R2R, AP, FP&A, etc. Approaching finance-related complexities with this team is often considered the most effective strategy for addressing them. These team members should possess a wealth of domain knowledge and an in-depth understanding of financial processes.

Despite its own limitation self-assessment of financial processes internally, increases accountability and provides sustained benefits.

In the journey, the resolution of complex financial challenges and elevating them to the next level necessitates a thorough assessment of the issues at hand. One approach which is often employed is the self-assessment that is conducted internally by the finance team. This method has its own benefits, primarily stemming from the team’s familiarity with existing finance processes. This core understanding allows the team to identify areas of concern and suggest improvements based on their own experience. Moreover, self-assessment can establish a sense of ownership and accountability among team members as they actively engage in the process and problem-solving. When self-assessment results indicate that more extensive actions are needed, they are grouped as individual transformation initiatives.

Hiring external Finance Consultants

|

Transform With Data and Analysis

You can employ various practices to gather issues and develop solutions comprehensively. These practices ensure a robust and well-informed approach to finance transformation. One important method involves in-depth interviews with key persons critical to the financial processes. These individuals, designated by the CFO, have hands-on experience that can provide invaluable insights into the finance department’s current state (AS-IS situation). Interviews prove particularly effective when only a few team members can cover the subprocesses, or the finance team is relatively small, as they facilitate detailed discussions and the exchange of relevant information. During these interviews, they articulate the issues in existing processes and share details and challenges faced in day-to-day operations. These insights, drawn from firsthand experience, offer a comprehensive understanding of the current AS-IS process and serve as a foundation for further solutions.

In cases where the finance team is larger and is spread across geographies, surveys emerge as a powerful tool. Surveys capture a broader perspective that elicits targeted viewpoints from diverse team members. Surveys are designed for ease of comprehension and efficiency that enables

For gaining insight into the current state of financial processes, surveys, interviews, and tools-based diagnosis are a few methods that can be used.

participants to quicknput on various aspects of the finance and accounting processes. These surveys encompass multiple levels of the management hierarchy, ensuring a comprehensive representa perspective.

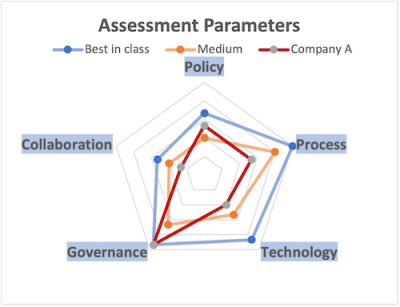

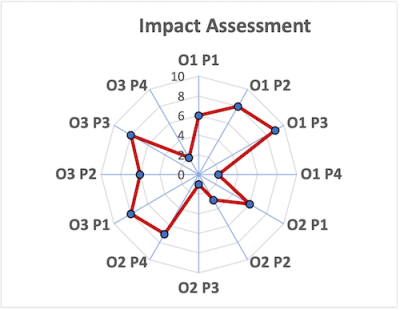

The diagnostic tool’s results are quantified through scores assigned to processes, sub-processes, and functions. It provides a quantifiable measurement of the existing state and areas for improvement. These scores also serve as a benchmark for assessing the finance team’s maturity across industry best-in-class. The insights derived from the diagnostic tool

Finance Transformation, a Journey

In essence, Finance Transformation is a journey and may take years to accomplish. The involvement of dedicated finance transformation teams will result in a comprehensive and actionable strategy. Finance transformation is a collaborative project led by the finance team, making them an integral part of the organization’s progress. This collaborative approach enhances the accuracy of problem identification, facilitates the exploration of hidden issues, and culminates in developing a well-informed, strategic transformation roadmap. Accordingly, organizations can confidently navigate the intricacies of finance transformation and ensure that solutions are reliable and poised for long-term success.

Don’t miss Vineet’s CFO Talk: The CFO and Finance Transformation. Steve Rosvold and Vineet discuss finance transformation and what CFOs and their teams can expect from it. It’s not just about overhauling systems, but also optimizing current investments and leveraging legacy systems that still have a return on investment. Enjoy this episode of CFO Talk, The CFO and Finance Transformation with Vineet Jain

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!