Finance Observability - what is it and how is it revolutionizing Finance teams

Whenever I talk to Finance leaders about “Finance Observability” they get excited. The questions range from – How Observability is different from the KPI reporting to how Finance teams can benefit from it.

So, here I am, trying to clarify the confusion around the buzzword – “Finance Observability” – what it is and how Finance teams can leverage this capability. In this article I will decrypt this often talked about but poorly understood buzzword.

What has changed?

Before we dive deep into what Finance observability is, it is helpful to understand the context - the evolution of the Finance paradigm. While the last few decades were all about periodic monitoring, and reporting, the future belongs to cross-function problem-solving and continuous improvement.

The one factor driving this changing role is the Availability of Data in the right format at the right time. With tons of data produced by multiple systems, it is only natural for leaders to exploit this resource.

With a constantly changing business environment Business leaders to turn to their Finance departments to differentiate the noise from the signal.

The role of the CFO is becoming critical in having data on-demand, anytime, anywhere. The role of the CFO is to be the architect of where you should put all the enterprise data for management and operational decisions. – Big4 Partner

Glenn Hopper shares how this can be done in his article, The Digitization of the Finance Function

What is Finance Observability

Imagine having a crystal ball that tells you what has happened, what is happening, and what might happen simultaneously. Or picture a Quentin Tarantino movie – where multiple individual storylines somehow connect into a single grand narrative.

Finance Observability is precisely that – and more.

Finance observability is all about ‘context-awareness’. The Finance organization serves as the organization’s brain, receiving data from multiple nerve-like functional tools and turning it rapidly into actionable insights through advanced analytics.

Information is handled in real-time, and cross-functional data is stitched together seamlessly.

Based on an analysis conducted by Gartner, only 3% of companies have strategic, operational, and financial planning processes that are fully aligned and integrated.

In short, Finance Observability does the following:

- Methodically crunching data to decision cycles

- Actionable insights to drive outcomes

- Continuously monitor to uncover & prevent risks

The 3 Pillars of Financial Observability

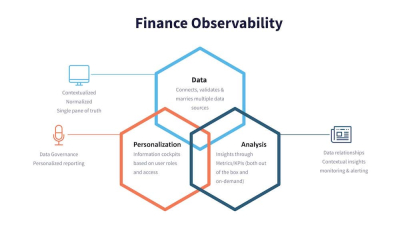

Finance observability focuses on 3 broad pillars to transform how organizations use data. These are:

1. Data - At its very core, Observability connects, validates & marries multiple data sources. As a first principle, Observability requires centralized data to access and leverage data across systems. Data focuses on the following:

- Contextualized data availability

- Data normalization & standardization

- Single source of truth

2. Analysis - Finance observability focuses on delivering insights through Metrics/KPIs (both out of the box and on-demand ad hoc). Metric-based reporting ensures the standardization of metadata structures and rules. Here the focus is on the following:

- Data logic and data relationships

- Contextual insights/reports

- Continuous monitoring & alerting

3. Personalization – Information is only helpful in the right hands. Observability focuses on building information cockpits based on user roles and access. This pillar focuses on the following:

- Data Governance (role-based & need-based access)

- Personalized reporting cockpits

What’s in it for Finance?

1. Finance turns Storyteller- Let’s face it, as Finance leaders, you are expected to understand and solve business problems requiring collaboration from other departments. With Finance Observability, you get a 360-degree view of the organization through data from all systems. You are not just equipped with the “what”, but also the “why”. This lets Finance tell the “entire story” about business performance and events.

Based on a CFO study conducted by Everest in 2022, 62% of CFOs agreed that “improving data management, including data maintenance and organization-wide visibility” is a high-priority item.

Olga Rudakova shares how dashboards can be used to help us become better storytellers, Why Dashboards are a Powerful Tool in FP&A

2. Outcome-oriented business partners – Automating rule-based KPI computations and reports allows Finance teams to focus on what is needed to do the most – becoming the Decision Experts. Advanced analytics help decode the root cause faster and drive business action. Access to operational data brings Finance closer to business – helping make the right decisions at the right time.

3. Democratized insights, Centralized controls – Gone are the days when data was not available or erroneous. Observability aims at putting information in all hands, with adequate security guardrails. The metadata structures and definitions are all controlled centrally, making Finance teams the Data steward for the organization.

Based on a Study conducted by Gartner, “73% of finance functions favor a centralized tightly governed source for data.”

4. Faster time to value – Finance folks are ROI driven and need solutions that are faster and simpler to adopt. The right observability solution should have a plug-and-play approach for that reason.

Read, Time Is Of The Essence: Financial Forecasting To Make Better Decisions to firm up your arguments to invest in solutions and your team.

Conclusion

I hope this short summary of hours of conversations with Finance leaders helps you understand the nuances of this revolutionary concept. Finance Observability, when combined with the right business partnering mindset, will be transformative.

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!