Creating Resilience In Finance - Part I

Introduction

Well, inflation started out as “temporary” transitioned to “transitory” and now has become “sticky”. Even with the recent declines, relatively high inflation is expected to be around for some time . That said, action must be taken to address the negative effects of inflation and, what some predict will be stress on many businesses. Today, executives must balance the needs of the business against the needs of employees who are being impacted by inflation as well.

- The annual inflation rate achieved 9.1% earlier in 2022 then retracted to 8.5% for the 12 months ended in July 2022 hovered around the number until recently when come decline has taken place.

- Inflation rates are well above 20% for many items we purchase on a daily basis.

In response to current economic challenges, Price Waterhouse Coopers (PWC) – and echoed by other firms – recently reported that:

- 50% of major companies will reduce staffing

- 52% have implemented hiring freezes

- 46% dropping or reducing sign-on bonuses

- 44% are rescinding job offers

How prepared is your organization to address the challenges of today’s economic environment?

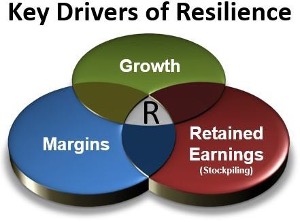

McKinsey & Company published an informative white paper “The emerging resilients: Achieving ‘escape velocity’,” October 2020, by Cindy Levy, Mihir Mysore, Kevin Sneader, and Bob Sternfels which was accompanied by an equally informative webinar entitled “Finding Tomorrow’s Resilients.” The white paper chronicled the authors’ research based on those organizations that successfully weathered through the 2008-2009 recession, identifying the characteristics that defined resilience and the learnings that would apply to the current economic downturn. Rather than reiterating their findings, which can be found on the McKinsey & Company website, what is presented here are the challenges and opportunities associated with the principal drivers that make companies resilient.

- Margin Protection – protecting EBITDA margins through divestitures of low-margin offerings – pruning under-performing products and services while identifying acquisitions that bring higher margins and cost management.

- Revenue Growth – achieving revenue growth during the downturn by focusing on strategic pricing and high-margin offerings. Focusing effort on those products and services that address unmet needs by competitors that would justify price increases — this focus ensures that margin protection is obtained through revenue growth rather than cost reduction.

- Stockpiling Retained Earnings – building a war chest of retained earnings in support of reinvestment opportunities in high-margin acquisitions.

Given that accumulating retained earnings may be driven by both policy as well as success with the other two key drivers, this paper will cover both the challenges and opportunities associated with margin protection as well as growth.

Margin Protection

A primary strategy of the resilients as related to margin protection are both divestitures, shedding low profit margin outputs in favor of maintaining higher profitable products and services, and acquisitions that hold the promise of additional profitable revenues. That said, there are significant challenges associated with identifying which outputs may be less profitable and specifically which cost elements can be removed, or redeployed, without negatively impacting the remaining lines of business (LOBs) by depressing profitability.

Although many in the organization are obligated to optimizing costs and to ensure maximum profitability, a primary responsibility for identifying which outputs should be targeted for divestiture falls within the Finance organization, and more specifically the Chief Financial Officer (CFO). The CFO is responsible for leadership and partnership along with other C-Level peers for the financial and operational well-being of the organization. The CFO has been specifically chartered with the responsibility for identifying, from a financial perspective, where the organization is performing well along with identifying areas where enhancements are required to meet financial and other organizational objectives. To carry out their responsibilities, this role includes supporting performance improvement efforts within the organization. The role of the CFO is getting more attention these days due to more global competition, economic upturns (opportunities), and downturns (crisismanagement).

Identifying Low-Margin Divestiture Targets

One of the first steps taken by CFOs, and their Financial Planning & Analysis (FP&A) staff, to understand the financial well-being of the enterprise is to determine the costs and profitability in for-profit or spending in public-sector and non-profit organizations.

Oftentimes, the first place to seek understanding of the financial well-being of the organization is to examine the organization’s financial statements. However, GAAP accounting, supported by General Ledger systems, is designed to capture costs at the functional/department level and although they can be structured for P&L data at a granular level (e.g., office or branch), they may not deal with indirect/overhead costs, overlap/duplication, value creation, or activity fragmentation. Therefore, GAAP accounting provides little, if any, managerial insights that can be used to identify improvement opportunities or divestiture targets. To support this strategy, more detailed managerial cost accounting systems are required. (See Why Most Cost Accounting Systems Fail for a description and the faults of the most commonly applied cost-accounting systems).

Read Part II

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!