When Searching for Merger Candidates - Substitutes and Complements Make All the Difference

When 1 plus 1 equals 3 it’s time to consider a merger.

What’s driving your main initiatives? If you’re like many executives, it’s competitive pressure. To ensure short-term survival or profitable growth, leaders are searching for ways to reduce costs and increase distribution channels. How? Frequently, the answer lies with those same competitors, especially in industries with margin pressure or slow sales growth.

What competitors will make a worthy partner for your business? This post focuses on how to assess the benefits of merging, acquiring, or entering into other mutually beneficial arrangements with a competitor. Please feel welcome to add your comments on merging with competitors.

Which Competitors Could Become Good Partners?

Go to your note-taking app or take it old school and grab a pen and a piece of paper. List three to five of your top competitors and answer the following questions:

1. Do we serve the same customers or markets?

List your top 10 customers and estimate the top 10 customers of the competitors you listed. Significant customer overlap can dilute the value of a partnership. If a partner doesn’t bring along a new customer base, make sure it delivers significant technological advances or production efficiencies. Also, be prepared to pass along some of these benefits to your customers—or you’ll find yourself in a bigger company with fewer customers.

2. Are our products (or services) substitutes or complementary?

List your top products and the top products of your competitors. Substitute products with the same customer base may spell disaster for a partnership. For instance, if you sell Brand X shampoo, partnering with Brand Y shampoo may not return the benefits you expected.

On the other hand, complementary products with different customers offer excellent potential for growth. If you produce frozen waffles, forming a partnership with a syrup manufacturer makes practical sense. In this situation, the partnership can leverage the relationship each company has with its current customers to create another distribution outlet for its partner company.

The value of different products to a merged entity is highly dependent upon the synergies that can be created in manufacturing, distribution and sales in a new entity. If the synergies are small, the value of each partner’s customers to the other partner must be high to create value for the new venture.

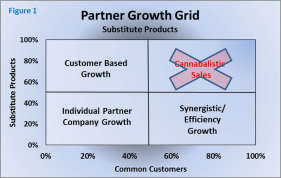

Figure 1 plots the percentage of same products and common customers for potential partners. The quadrants are labeled to describe where growth in the new venture will come from. It’s a common mistake for companies with similar products and common customers to conclude the synergies from a merger will improve profitability. It’s more likely the loss of sales will dwarf the impact of cost savings or manufacturing and distribution improvements.

In other words, Brand X and Y shampoo companies, newly formed into Brand Z, may save manufacturing and distribution costs. Those savings may not be enough to counter the loss of sales.

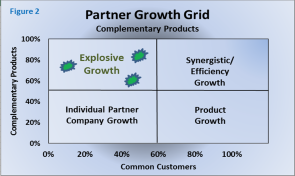

Figure 2 does the same for complementary products. If you have potential partners that fall into the upper left quadrant of Figure 2, you have identified a partnership in which each entity brings a tested distribution network for the other party’s product.

Partnerships that fall into this quadrant have great potential but are often difficult to find. You may have to expand your search beyond your current competitors.

Learning about the other top suppliers for your top customers may help identify other good partnership candidates.

A few years ago I advised on the merger of two agriculture companies. The companies had similar but differentiated products and different customer bases. The bonus in this deal was the facilities to handle and process their products had high fixed costs and weren’t at capacity. The product mix, customer access and costs of the merged company all improved, resulting in a very successful merger.

3. How do our cost structures compare?

Don’t let the fact a company is private get in the way of good analysis. You can piece together valuable information by knowing their organizational structure, labor situation, where their plants are, their product mix and who their customers are. Normally this information is readily available; often through people in your company. Frequently companies assume a cost structure similar to their own and miss opportunities to take advantage of wide cost disparities.

In answering these three questions, you will have a wealth of knowledge with which to evaluate partnership opportunities. You’ll know who your top candidates are, the potential of sales growth, and efficiencies or synergies that can be realized. Armed with this information, you can model the financial potential of a partnership and determine the value to your business. You’ll be able to answer the ultimate question: Is this the best move for my company?

Identify your path to CFO success by taking our CFO Readiness Assessmentᵀᴹ.

Become a Member today and get 30% off on-demand courses and tools!

For the most up to date and relevant accounting, finance, treasury and leadership headlines all in one place subscribe to The Balanced Digest.

Follow us on Linkedin!